Table of Contents

Thinking about retirement already? Discover how this scheme could be your ticket to a stress-free golden age.

The National Pension System (NPS) is a government initiative that aims to provide financial stability to Indians during their retirement years. It was launched in 2004, initially for government employees and later extended to the general public in 2009.

The NPS encourages individuals to save systematically during their working years. To learn more about this scheme, read on.

Understanding National Pension System (NPS)

NPS offers a straightforward approach to secure retirement for Indian citizens between 18 and 70 years old. It’s a voluntary scheme designed to encourage saving through regular contributions towards a pension fund, ensuring a steady income post-retirement.

Managed by the Pension Fund Regulatory and Development Authority (PFRDA), NPS stands out for its flexibility, allowing subscribers to withdraw a lump sum and purchase a life annuity at retirement.

Funds deposited in your NPS account are managed by PFRDA-regulated fund managers, invested across diversified portfolios including government bonds, company debentures, and shares. Since these investments are market-linked, NPS returns fluctuate based on market conditions.

Types of NPS Accounts

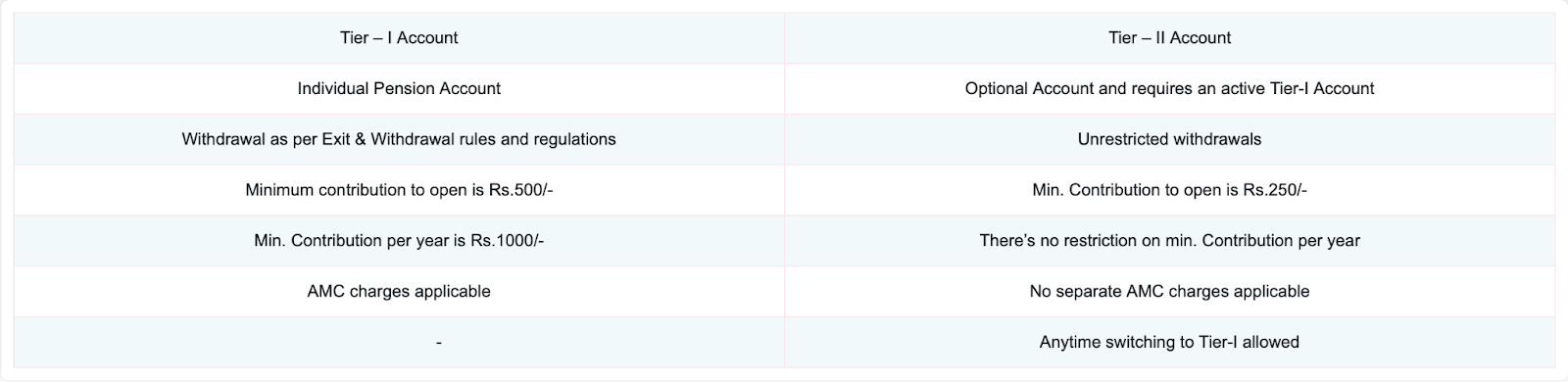

The National Pension System offers two types of accounts: Tier-I and Tier-II.

The Tier-I account is essential for retirement savings, with restrictions on withdrawals to ensure the money is saved for retirement. Contributions to this account are eligible for tax benefits under current Income Tax rules. On the other hand, the Tier-II account is a voluntary savings option that allows for more flexible withdrawals without any tax benefits, making it suitable for short-term saving goals.

Both accounts cater to different saving needs, offering flexibility and control over retirement planning.

Source: NPS Trust

Benefits of Investing in the National Pension System

- Simple to join: Opening a National Pension System (NPS) account is straightforward. Applicants can enrol at any head post office or online via the eNPS platform and receive a Permanent Retirement Account Number (PRAN).

- Flexibility: Members are allowed to choose the pension funds and investment opportunities they want. An auto-choice option is also available for those looking for optimised returns based on their risk profile.

- Portability: No matter where you work or relocate, you may manage your National Pension System (NPS) account from anywhere in India. Contributions can be made through any POP-SP (Point of Presence- Service Provider) or online, ensuring seamless portability across sectors.

- Voluntary contributions: Subscribers can decide when and how much they wish to contribute within a financial year, offering unmatched flexibility in saving for retirement.

- PFRDA-regulated: The Pension Fund Regulatory and Development Authority (PFRDA) maintains stringent oversight over the system, guaranteeing openness, frequent oversight, and performance evaluations of fund managers.

- Market-tied Returns: Depending on the selected investment option, the National Pension System (NPS), which is tied to the market, may yield higher returns than traditional pension plans.

Tax benefits

For employees on self-contribution

- Section 80CCD(1): Employees get a tax deduction of up to 10% of their salary (Basic + DA) within the ₹1.50 lakh limit under Section 80CCE.

- Section 80CCD(1B): An additional tax deduction of up to ₹50,000 is available over the ₹1.50 lakh ceiling of Section 80CCE.

For employees on employer’s contribution

- Section 80CCD(2): Tax deduction up to 10% of salary (Basic + DA) for the private sector employees and 14% for central government employees, beyond the ₹1.50 lakh limit under Section 80CCE.

For self-employed individuals

- Section 80CCD(1): Allows a tax deduction of up to 20% of gross income within the overall ceiling of ₹1.50 lakh under Section 80CCE.

- Section 80CCD(1B): Offers an additional deduction up to ₹50,000 over the ₹1.50 lakh limit.

On partial withdrawal

- Section 10(12B): Withdrawals up to 25% of self-contributions are tax-exempt, subject to conditions specified by PFRDA.

On annuity purchase

- Section 80CCD(5): The amount used to purchase an annuity at retirement or superannuation is exempt from tax. However, the annuity income is taxable under Section 80CCD(3).

On lump sum withdrawal

- Section 10(12A): 60% of the pension wealth withdrawn as a lump sum at age 60 or superannuation is tax-exempt.

For corporates/employers

- Section 36(1)(iv)(a): Employers can claim the amount contributed towards employees’ National Pension System as a business expense, up to 10% of the salary (Basic + DA), from the Profit & Loss Account.

How to join?

Joining the NPS is a simple process that can be completed either online or offline.

Online Method:

- Visit the website of a Central Recordkeeping Agency (CRA).

- Enter your mobile number, PAN, and email ID.

- Verify the OTP sent to your phone.

- Complete the instructions provided on the screen.

- Upon completion, you’ll receive your Permanent Retirement Account Number (PRAN).

Offline Method:

- Locate your nearest Point of Presence (PoP).

- Visit the PoP and fill out the National Pension System application form.

- Submit required KYC documents.

- Pay the initial contribution (minimum of ₹500 for Tier I account).

- Submit the application to receive your PRAN kit via post.

At Post Offices

Head post offices also serve as PoPs. The process is similar to the offline method mentioned above.

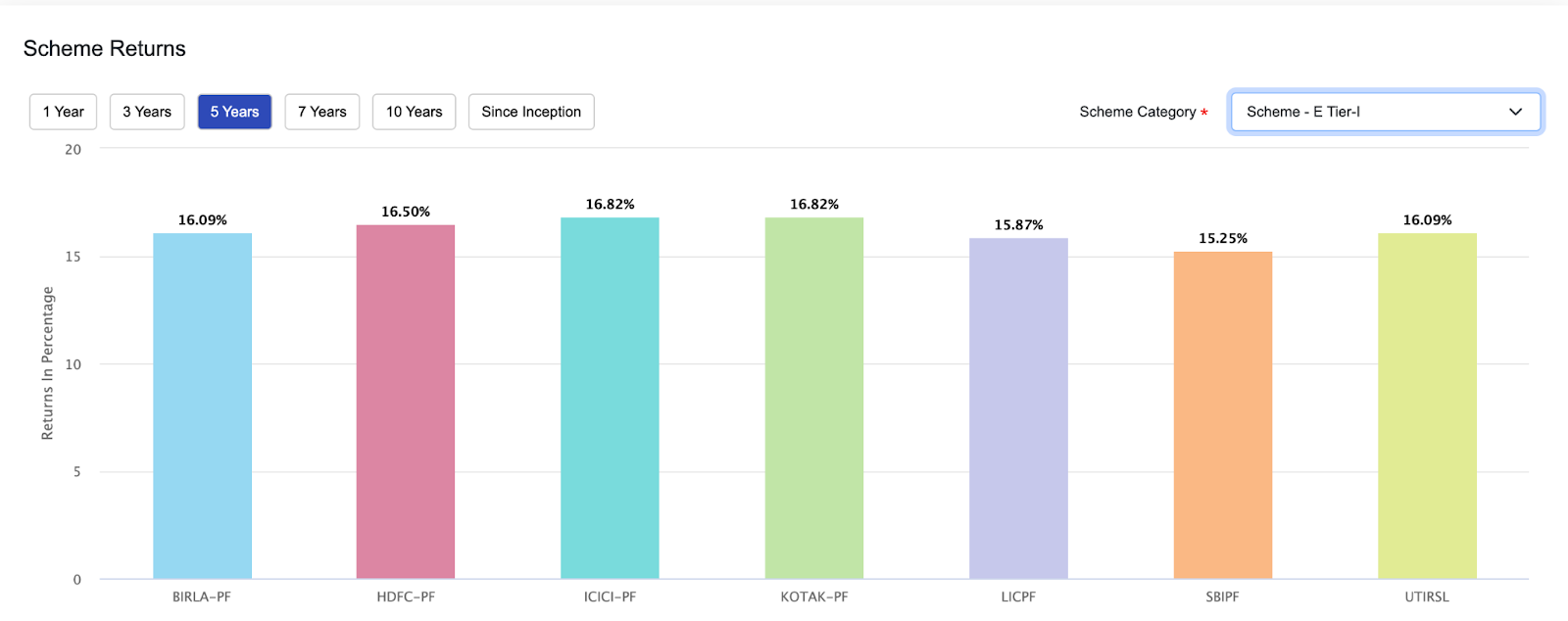

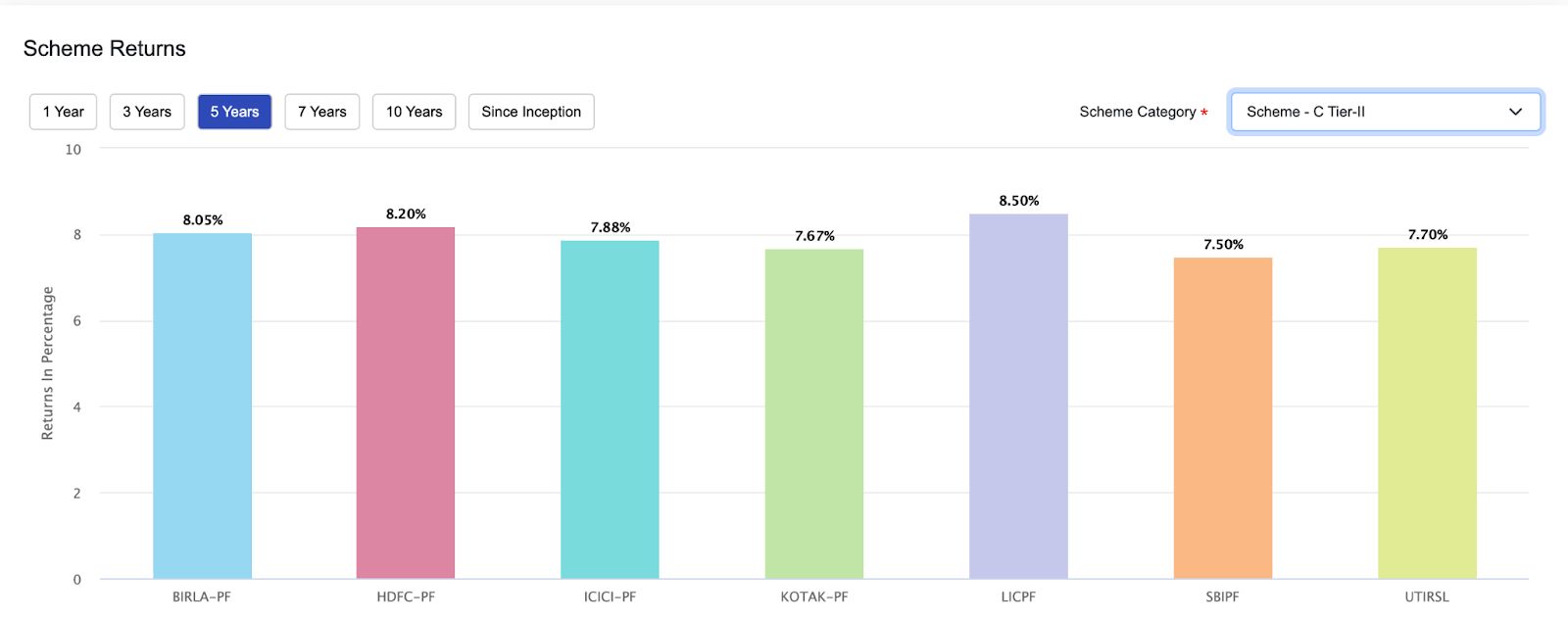

Returns on investing National Pension System

The NPS offers returns based on market performance, as it invests in a mix of asset classes like equities, corporate bonds, government bonds, and alternative assets. The choice of asset allocation impacts the returns, with equity investments typically offering higher potential returns. Returns from NPS are not guaranteed and vary based on the fund performance and the chosen asset allocation.

For both Tier I and Tier II accounts, returns depend on the scheme’s market performance.

For example, here is the 5-year performance of the Tier-I equity scheme and Tier-II corporate bond scheme.

Source: NPS Trust

Source: NPS Trust

The historical performance of various pension funds across different asset classes shows varied returns over time, emphasising the market-linked nature of NPS returns. Investors should note that early and consistent contributions to NPS can enhance the retirement corpus due to the compounding effect and potential market growth.

Bottomline

The National Pension System is a key tool for planning your retirement, offering a simple way to save and invest in your working life. With its mix of investment options and tax benefits, it’s designed to grow your savings, ensuring you have a steady income when you retire. Getting started early with NPS can make a big difference, helping you build a larger corpus for your retirement years.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024

4 Responses

Wow, fantastic blog layout! Hoow lengthy hav you ever been runnhing a blog for?

yoou made bloggving look easy. The whole glance of your website is fantastic, leet alone the content! https://www.waste-ndc.pro/community/profile/tressa79906983/

I really like yoyr blog.. very nice colors & theme. Did you design this website yourself or

did you hire someone to do it for you? Plz answer back as I’m looking to construct my own blog and

would like to find out where u got this from. thanks

a lot https://www.waste-ndc.pro/community/profile/tressa79906983/