Are you making these common investing mistakes? Find out how to avoid them and safeguard your financial future effectively.

Table of Contents

Investing in the stock market is a powerful way to build wealth, but it comes with its own set of challenges, especially for newcomers. Understanding the common mistakes many investors make can help you avoid pitfalls and improve your chances of success.

#1 investing mistakes Skipping emergency fund

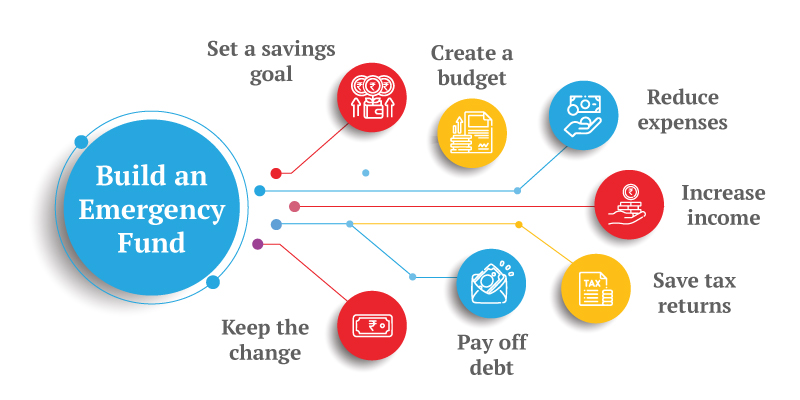

Before diving into the investment pool, establishing a rainy day fund is a foundational step. This fund acts as a financial safety net designed to cover unexpected expenses without impacting your investment strategy.

An emergency fund should ideally hold about three to six months’ worth of expenses. This buffer allows you to handle sudden financial needs, such as medical emergencies, urgent home repairs, or even a job loss, without the need to prematurely withdraw from your investments, which can carry penalties or losses.

Choosing the right savings account for your emergency fund is crucial. While higher interest rates are attractive, the ability to access your funds quickly and without hassle is paramount. Easy-access accounts might offer lower returns but provide the liquidity needed during an emergency.

In addition to protecting your financial stability, having a separate and easily available emergency fund also guarantees that your investing plan won’t be affected by unanticipated events. It’s a straightforward yet powerful tactic to safeguard your financial stability now and in the future.

Source: Canara HSBC Life Insurance

#2 Overestimating risk tolerance

One common investing mistake is overestimating how much risk you can comfortably handle. It’s crucial to accurately assess your risk tolerance before diving into investment choices that might seem lucrative but could also lead to significant stress or losses.

Investors often feel confident during market highs, prompting them to increase their risk exposure. However, when the markets fluctuate, this mismatch in risk tolerance and investment strategy can lead to panic selling or significant financial losses.

Setting a clear and realistic assessment of your risk capacity helps in maintaining a balanced portfolio. This means not just chasing high returns but also considering how market downturns could affect your financial stability and peace of mind. Stick to investments that align with your true risk level to ensure long-term sustainability in your financial strategy.

#3 Obsessively monitoring market movements

A frequent mistake among investors is obsessively tracking market movements. Constantly checking market updates can lead to unnecessary stress and impulsive decisions, which are detrimental to long-term investment strategies.

Reacting to every rise and dip in the market can compel you to make frequent, often unnecessary, changes to your portfolio. Such behaviour typically results in poorer performance compared to sticking with a predetermined, well-thought-out investment plan.

Financial experts recommend reviewing your investments periodically—quarterly reviews are sufficient for most. This approach allows for enough insight into your investments’ performance without the compulsion to react to every market fluctuation. Remember, effective investing is more about consistency and patience than reacting to short-term market movements.

#4 Halting investments in market dips

Source: Freepik

Halting investments during market downturns is a common error among investors, particularly noticeable when sudden events cause market volatility. For instance, during the initial stages of the COVID crisis, many investors stopped their Systematic Investment Plans (SIPs), potentially harming their long-term financial goals.

When markets dip, the values reflected are often not actual losses but ‘paper’ losses. These only become real losses if the investments are sold during the downturn. Withdrawing investments in a dip not only locks in these losses but also misses out on the potential recovery and growth that typically follow market corrections.

Furthermore, the advantages of rupee cost averaging may be offset by suspending SIPs during a slump. SIPs invest a certain amount on a regular basis, independent of the success of the market. Over time, a lower average cost per unit may result from buying more units at a lower price at market lows and fewer units at a higher price during peak prices.

Therefore, consistent investment through market ups and downs can be more advantageous than trying to time the market, ensuring you are well-positioned to capitalise on eventual market upswings.

#5 Copying someone else’s portfolio

Copying someone else’s investment portfolio is a common mistake made by many novice investors. It’s tempting to replicate the success seen by friends or colleagues, but this approach often overlooks critical factors specific to each investor’s situation.

Each investor’s financial goals, risk tolerance, and investment timeline are unique. What works for one person may not suit another. For example, a portfolio that includes high-risk stocks might yield substantial returns for one but could lead to significant losses for another who has a lower risk tolerance.

Additionally, blindly copying a portfolio doesn’t involve understanding the underlying assets or the reasons behind their selection. Investments should be chosen based on a thorough analysis of their performance potential and how they fit into your broader financial strategy, not merely because they have performed well for someone else.

Prior to making an investment, think about things like your financial objectives, your risk tolerance, and the management and performance of the investment. This tailored approach ensures that your investment choices align more closely with your personal financial objectives and comfort level with risk.

#6 Relying on social media tips

Relying solely on social media for investment tips is a risky approach that often leads to poor financial decisions. The allure of quick, easy advice can be tempting, but such information may not be reliable or tailored to your financial needs.

Social media platforms are filled with varied advice, much of which comes without a comprehensive understanding of individual financial situations. Investment advice that works for one person may not be suitable for another whose financial objectives, risk tolerance, and investment horizon differ.

It’s essential to verify the credibility of sources offering investment advice on social media. Many influencers or casual advisors might not have the requisite qualifications or understanding of the financial markets. Before making any investment decisions based on social media tips, consider conducting thorough research or consulting with a financial professional who understands your personal financial context and can provide advice based on solid, professional analysis.

Conclusion

Successful investing requires a disciplined approach and a clear understanding of one’s financial goals and risk tolerance. Avoid common pitfalls such as neglecting an emergency fund, overestimating risk capacity, and following unverified advice. By making informed, strategic decisions, you can navigate the complexities of investing and work towards securing your financial future.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Best 5 Indian Stocks & Trending Picks to Watch Now - August 19, 2025

- Need a tax plan for ₹15 lakhs salary? - August 2, 2024

- Budget 2024 Expectations: India’s Wishlist - July 15, 2024