India’s IPO market is experiencing a resurgence fueled by strong investor confidence. Let’s see the three key factors!

Table of Contents

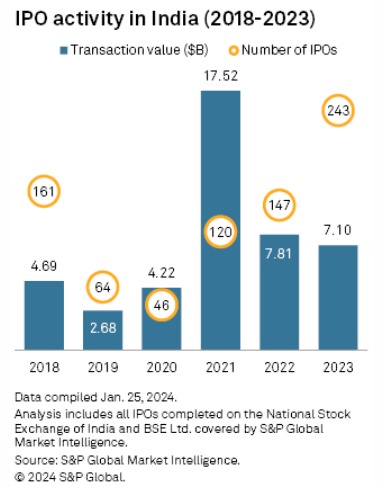

India’s IPO market has been on a robust trajectory, helping to fuel renewed investor confidence. Following a 65% jump in the number of listings in 2023, it is expected that the strong momentum in India’s IPO space will continue unabated in 2024.

This anticipated boom underscores the burgeoning investor confidence and the thriving state of the Indian financial landscape. This expected surge in IPOs can be attributed to three main factors: the country’s vigorous economic growth, the government’s intensified focus on digitization and a youthful and dynamic population.

According to S&P Global Market Intelligence data, 243 companies were listed on Indian bourses last year – the highest yearly count since 2016.

Source: S&P Global

These developments have seen India rank third for IPO proceeds globally, signifying a move towards domestic sources of capital and maturing market dynamics.

As of June 17 2024, around 24 companies are about to storm into the primary market and will collectively raise approx ₹30,000 crores from IPOs within the coming few months.

India’s IPO market are back? Latest IPOs in India

Here are some of the upcoming IPOs:

| Company Name | Issue Open Date | Issue Close Date | Issue Size (Cr) | Price Band (₹) |

| DEE Development Engineers | June 19, 2024 | June 21, 2024 | 418.01 | 193 – 203 |

| Akme Fintrade India (Aasaan Loans) | June 19, 2024 | June 21, 2024 | 132.00 | 114 – 120 |

| Stanley Lifestyles | June 21, 2024 | June 25, 2024 | 537.02 | 351 – 369 |

| GEM Enviro | June 19, 2024 | June 21, 2024 | 44.93 | 71 – 75 |

| Durlax Top Surface | June 19, 2024 | June 21, 2024 | 40.80 | 65 – 68 |

| Falcon Technoprojects India | June 19, 2024 | June 21, 2024 | 13.69 | 92 |

| EnNutrica | June 20, 2024 | June 24, 2024 | 34.83 | 51 – 54 |

| Medicamen Organics | June 21, 2024 | June 25, 2024 | 10.54 | 32 – 34 |

Source: Mint

Apart from these, some of the other companies likely to launch IPOs in the next one to two months are:

- Afcons Infrastructure,

- Allied Blenders and Distillers,

- Emcure Pharmaceuticals,

- Waaree Energies,

- Asirvad Microfinance,

- Shiva Pharmachem,

- CJ Darcl Logistics,

- Premier Energies,

- One MobiKwik Systems, and

- Bansal Wire Industries.

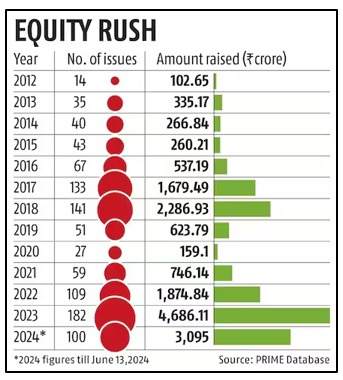

Why are SME IPOs attracting investors?

SME IPOs are hot in India now for multiple reasons.

Source: Business Standard

Here are some:

- High returns: Small and medium enterprise (SME) IPOs have been offering better results than conventional investment options. BSE’s SME platform rose by 96% in 2023 and 79.6% in 2024. Thus, high returns are attracting investors to the SME IPO.

- The underlying strength of SMEs: The Indian economy is driven by SMEs. These firms contribute a significant proportion to the GDP (around 29%). Investors who take part in an SME IPO are essentially taking part in the future of the Indian industry.

However, some challenges must be acknowledged, such as limited allotment for retail investors and risk associated with smaller companies. However, overall, this market is one of the fastest-growing, supported by its high returns and these companies’ potential.

3 key factors boosting investor confidence

Analysts predict a bullish trend in the Indian secondary market due to political stability and positive economic indicators. This optimism is expected to spill over to the primary market as well.

Investors hope for stable governance and policies

Investors are flocking to more IPOs following the recent appointment of our Prime Minister, driven by a wave of optimism regarding the anticipated positive changes in governance and policy-making.

This has restored faith in business continuity and transformation, prerequisites for any entrepreneurial society to flourish. This improved confidence that the government will be stable and forward-looking has created an enabling environment for business innovation and expansion with subsequent attention from investors who now want to participate in such markets.

The prospects for a robust economic structure and coherent policy framework by the new regime are propelling investor confidence.

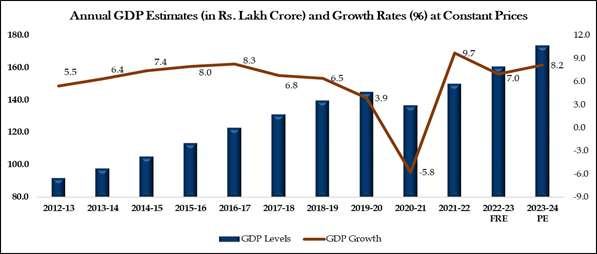

Great corporate earnings and the country’s steady economic growth

Another compelling reason for increasing investor confidence is the strong corporate earnings and the country’s steady economic growth.

The real GDP of India is projected to grow by 8.2% in FY 2023-24, which is quite robust for investors who view it as a significant boost in confidence.

Source: PIB

Such an excellent economic performance shows the strength and potentiality of the Indian market, making it attractive for investment purposes. Further, robust corporate earnings validate that businesses in this vibrant economy are profitable and stable. Thus, further consolidating the notion that India’s economic policies and its growth path are on the right track. So, investors are looking forward to capitalizing on these prospects through investing in IPOs with the hope of making tremendous gains from a booming market.

Liquidity in domestic markets

The last and the most essential factor driving investor confidence is domestic liquidity, as seen through the huge sums of money that flow into mutual funds.

Conclusion

In conclusion, while the Indian stock market thrives on positive economic indicators, remember, that IPO investing is a different ball game. Don’t get swept away by overall market optimism.

Focus on the fundamentals of the company going public – its financials, growth potential, and most importantly, the IPO valuation. Even a promising company can become a risky investment if its shares are priced too high. Do your own research, understand the company’s true value, and only then decide if the IPO price offers a good entry point.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024