Table of Contents

New investment plans? Assess the old ones first! Find out which factors to consider when reviewing your portfolio.

A well-diversified portfolio is how an investor can achieve his or her long-term financial objectives. You need to be proactive, review your investments often, and be able to adjust to new situations if you want to succeed at long-term investing. Performing routine evaluations of your investment portfolio is crucial to this process.

If you want to maximize your profits rather than merely get by, a vital discipline is needed to evaluate your investment portfolio regularly. Through re-aligning your objectives, managing your risk, and capitalizing on emerging prospects, this review may help you keep your finances working smarter for you.

That said, today we will talk about how to optimize your portfolio by understanding some crucial factors.

Understanding your current portfolio

An investment portfolio evaluation is like an annual health check-up for your investments. It involves looking closely at the different types of assets you own, how they are divided (asset allocation), and how they have performed compared to benchmarks.

Asset allocation and diversification are pivotal concepts in portfolio assessment. Asset allocation determines how your money is spread across different asset classes like stocks, bonds, real estate etc. Diversification means not putting all your eggs in one basket by investing in various sectors and regions.

During the evaluation, you’ll assess if your current mix of investments is still appropriate for your goals and risk tolerance.

- Cash flow requirements

Major life events and changing circumstances can significantly impact your need for investment income or cash from your portfolio. An evaluation allows you to ensure your portfolio’s asset mix and income stream properly align with any new cash flow needs that arise.

For example, purchasing a new home or undertaking a renovation project may require having more liquid investments available to cover a large upcoming expense. Alternatively, if you are approaching retirement, you’ll likely need to shift your portfolio towards generating more income to supplement your living expenses once you stop receiving employment income.

Without a periodic evaluation of your investment portfolio, your asset allocation could become misaligned with your evolving liquidity needs and income requirements.

- Making sure no asset allocation overlaps

Your current investment collection might contain assets that overlap with new acquisitions, leading to an excessive focus on a specific industry within your portfolio. It’s common for investors to accidentally hold the same types of investments through different funds or securities. This overlap in asset allocation can lead to improper diversification and excessive risk exposure.

Such an imbalance could elevate the risk levels—the risk that was neither expected nor accounted for—and potentially hinder your portfolio’s financial objectives and expected returns.

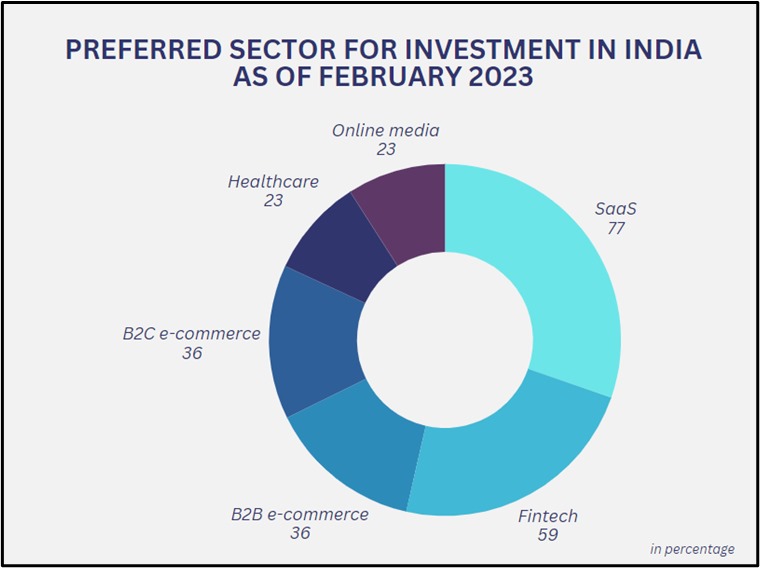

Below, you will find the preferred sectors of today’s Indian investors.

A thorough review can guide you towards achieving the ideal asset allocation that aligns with your financial aspirations and investment timeframe.

3. Risk management

Every investment carries some risk, but it’s crucial to understand the level of risk you’re comfortable taking on. A portfolio evaluation shines a light on your current risk exposure stemming from the assets you hold.

Your portfolio may have a higher risk profile than anticipated due to your past investing choices. On the other hand, you might get better results that match your goals if you take more measured risks. To achieve a suitable risk-return tradeoff, you can rebalance using the evaluation.

Source: Freepik

Therefore, it’s crucial to periodically reassess your portfolio to ensure that it continues to mitigate these risks effectively, especially when introducing new investments that could potentially disrupt the balance and impact your returns.

4. Investment goals alignment

When considering adding a new investment to your portfolio, it’s essential to reflect on how it fits your current financial situation and objectives. Life changes, such as shifts in your personal life, might prompt you to expand your investment horizons.

It’s important to remember that the returns on your portfolio might not always meet expectations due to the natural ups and downs of the market. A new investment might seem promising based on current market performance, but it’s crucial to consider whether it matches your existing investment strategy.

Sometimes, what looks like a high-performing asset may have already reached its peak, suggesting limited growth potential moving forward.

By reviewing your portfolio, you can determine if your present investments are still on track to meet your goals and if the new investment will complement these changes.

5. Market changes and opportunities

By regularly assessing your portfolio, you can capitalize on market trends. For instance, if you anticipate a bullish phase in the stock market you may adjust your portfolio to favor equities.

On the flip side, if a downturn seems imminent, shifting your focus to debt funds might be a prudent move. This strategic rebalancing allows you to navigate market cycles effectively, seizing opportunities as they arise while maintaining a disciplined investment approach.

6. Consider how portfolio rebalancing affects taxes

Before making a new investment, think about how it may affect your tax situation. Some investments include hidden taxes that you won’t see until much later. Additionally, you should carefully consider the tax consequences of rebalancing your portfolio to incorporate the new investment. This is because you could have to pay taxes on your capital gains.

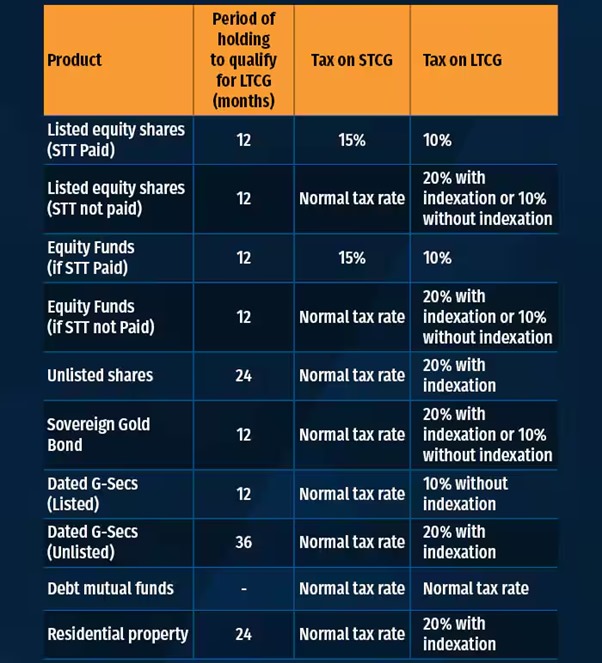

It’s essential to consider the tax consequences associated with capital gains. To avoid the higher taxes on short-term capital gains, you can retain your equity investments for more than a year.

Source: Moneycontrol

When it comes to debt funds, any short-term gains are taxable at rates corresponding to your income tax bracket. As for long-term gains, they are taxed at a rate of 20% but benefit from indexation.

If you decide to reduce your investments, prioritize disposing of assets in accounts that are not subject to capital gains tax. This strategy can help minimize your tax liabilities on capital gains.

Conclusion

By making investment portfolio evaluations on a regular discipline, you adopt a proactive approach that empowers you to make informed decisions and navigate the investment landscape confidently. Make this a fundamental part of your financial plan to maximize your profits and ensure the success of your investments in the long run.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025