Table of Contents

Scammers use guaranteed high returns, unsolicited messages, trust-building, pressure tactics, and requests for personal information. Dive in to know more and safeguard your investments.

Nowadays, WhatsApp and Telegram are commonly used tools for communication that join millions of people with a few touches. By April 2024, WhatsApp Messenger had recorded two billion regular users. However, their exponential growth has made these platforms fertile ground for another kind of connection- investment scams.

Investment scams on WhatsApp and Telegram have been soaring at an astonishing rate taking advantage of the trust and familiarity people have towards these sites. These scams are frequently highly persuasive as they apply tactics similar to those employed in genuine investment options. Supported by many stories in the media, there are several situations where victims experienced massive financial damages worth millions of rupees.

This article will attempt to demystify WhatsApp and Telegram investment scams in the stock market in India, provide practical advice on how to protect your finances against them and outline what should be done if you suspect scamming attempts via them.

Understanding the nature of WhatsApp and Telegram scams

Scammers on WhatsApp and Telegram employ a range of ploys to con potential investors in the stock market. These schemes are intended to exploit trust, create urgency, and nudge individuals into making snap financial decisions. Below are some common strategies employed by these scammers.

- Promises of guaranteed high returns: Scammers often falsely promise very high returns with really no risk at all. They may pretend to possess insider information or an infallible approach that is going to make their profits in the stock market.

- Unsolicited messages: These con artists send unsolicited messages to potential victims, sometimes pretending to be financial advisers or representatives of reputable investment companies. Such messages can have attractive stock tips or exclusive investment opportunities.

- Building trust: Tricksters develop trust by sharing fake documents, & testimonials, and maintaining a constant conversation. They can use official-looking logos, expert language, and invented success stories to become credible.

- Pressure tactics: Urgency creation is a very common tactic. Scammers hurry victims up, saying that the time to buy the stocks will soon elapse since it is a sensitive tip.

- Requests for personal information: There may be requests for personal and financial details from scammers disguised as opening an account or processing an investment. This kind of information could be utilised in identity theft or other fraudulent activities.

- Influencer impersonation: Influencer impersonation has emerged as a prevalent tactic used by scammers to exploit the trust and influence of well-known figures in the financial world, often referred to as “finfluencers.” This deceptive strategy typically unfolds through various online platforms, including social media giants like Telegram and WhatsApp.

In the recent past, one of the notable cases involved two investors who lost more than ₹3 crore in a Telegram scam. Victims were induced by fraudsters with high stock market returns which were backed by bogus testimonials and counterfeit certificates. The investors were convinced to transfer huge amounts of money thinking they were investment in a profitable venture. But as soon as the funds were transferred, the fraudsters disappeared leaving the investors at a great loss.

In another recent incident, a 71-year-old retired financial expert from Mumbai lost about ₹20 crores to a WhatsApp stock market scam. The fraudster impersonated an investment advisor by using a fake mobile app alongside WhatsApp group messaging to deceive the elderly man into believing he would make profits from his investments. The victim suspected it was an act of fraud when he was asked for more money upon attempting to withdraw his funds. The police have launched investigations into the matter.

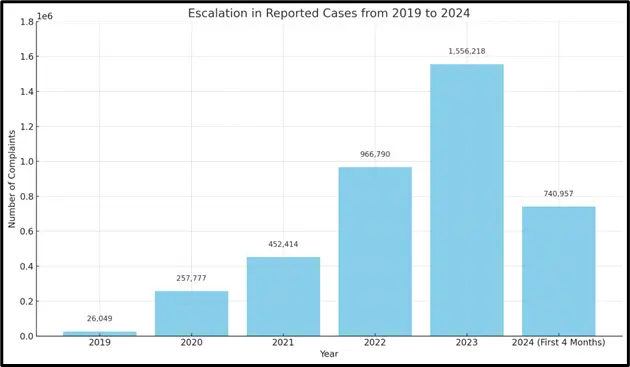

Based on data available on the National Cybercrime Reporting Portal, between January and April 2024, there were over 740 thousand complaints lodged about cybercrime activities which led to a monetary loss worth over ₹1750 crore.

Source: The States Man

Types of scams in the stock market

Pump and dump scams in stock market

In pump-and-dump schemes, fraudsters create artificial demand for a stock with false or misleading statements to inflate its price. This makes them sell their shares at a high price, thereby causing the prices to fall dramatically, and other investors to incur huge losses.

Example: A group on WhatsApp or Telegram promotes an unknown stock which they claim will shoot up in value due to impending news or inside information. As more people buy the stock, it increases its price while scammers profit from selling their shares. Upon ceasing promotions for this particular stock, the price drops sharply, thus resulting in late entrants suffering big losses.

Signal group scams

Signal Group Scams are characterised by the formation of groups on platforms like Signal where swindlers trade in fabricated achievements to trick victims into adopting wrong investment directions or sending cash. Such groups appear to be genuine, giving accounts of making huge financial gains that would make one believe them and claim urgency.

Example: You are added to a Signal group called “Elite Investment Circle.” The group members (scammers) share stories and screenshots of their recent profits from a new cryptocurrency called “CryptoGem.” They claim they tripled their investment within a month and urge new members to invest quickly before the price soars. Trusting these stories, you invest a significant amount, only to find out later that “CryptoGem” is a worthless asset, and the scammers disappear with your money.

Ponzi schemes

Ponzi schemes involve using new investors’ capital to pay returns earned to initial ones instead of making profits. Such systems fail once there aren’t enough fresh investors who can offer monetary reimbursements for previous participants.

Example: An investment firm promising substantial uniform returns uses money from new investors as return payments for older ones. The moment fresh investments reduce; this plan collapses leading to a loss of funds by most individuals.

Common red flags of investing scams

When it comes to investment scams, here are some warning signs to watch out for:

- Unlicensed investment professionals: Beware of someone who offers financial services without being officially approved to do so. Check the accreditations and licences before you trust anyone’s advice on investments.

- Overly assertive vendors with excessive qualifications: Sometimes, the scammers will brag about their accomplishments or expertise. Do not respond under any circumstances to hard-sell tactics; conduct a thorough investigation into this matter.

- Promises that sound too good to be true: Be cautious of those things which seem unlikely like a free lunch in that any returns promised are unrealistic. Authentic investments seldom offer huge overnight gains.

- Opportunities without risk: No venture has no risk at all. Anyone who claims otherwise should not be trusted.

- Promises of guaranteed wealth and investment returns: They often promise assured profits but one must know that every time a coin is flipped, there is a chance it falls on either side.

- Everyone else is buying it: Never be fooled by assertions that everyone else is investing in something. Conduct independent research and make your analysis.

- Investment pressure from scammers: These swindlers may use this method to force clients into making decisions quickly. Take time and get a consultation from reliable sources.

- Marketing went overboard through false testimonials: Extravagant marketing campaigns can have fake endorsements. Always cross-check information before believing anything reported about any product or service in the media

- Unsolicited requests for personal information or payments: You should be careful while giving your sensitive details or making payments because they may want your credit card numbers, gift cards or wire transfers.

How to protect yourself

To evade these scams, follow the steps below:

- Authenticity check: Always verify who you are speaking to; use official websites and contacts for confirmation. For instance, if someone from a well-known brokerage firm gets in touch with you, contact the company directly using information found on their website.

- Information sharing avoidance: Do not share any of your personal or financial details via messaging apps. Real investment firms do not ask for sensitive data through WhatsApp or Telegram.

- Official channels usage: Take investment decisions through recognised and formal platforms. Be wary of acting on advice received through informal means.

- Self-teaching: Familiarise yourself with genuine investment practices as well as common fraudulent techniques. Make use of resources available on reputable financial education websites and institutions.

- Security software installation: Protect your devices by installing antivirus and anti-malware software that is routinely updated to guard against phishing attacks and other online threats.

Conclusion

Investors can better protect themselves against these ever-changing scamming strategies by remaining aware and careful on digital platforms that are available today; eventually, a well-informed cautious approach is needed to address these emerging threats in WhatsApp and Telegram investment cons occurring in equities markets thus saving your pockets from being emptied by fraudsters all over again.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025