Table of Contents

Taxes don’t have to be scary! This basics of taxation guide breaks down key concepts for stress-free filing.

In FY24 – India earned about $235 billion from income taxes (including corporate and personal taxes), an increase of 17.7%, reflecting an increased income.

But with one of the most complex tax systems in the Asia Pacific region, filing a tax return can be a complicated exercise as far as Indian citizens are concerned.

Irrespective of its source:

- Salary,

- Property,

- Capital gains

- Business/profession,

The one constant thing is taxes are always on you.

Here, let us give you a simple introduction to the Indian tax system.

What is tax?

Taxes are fees that the government imposes on individuals and business entities. These funds are meant for the government spending on things such as:

- Roads,

- Schools,

- Infrastructure,

- Projects regarding social issues and

- National defence.

Who collects them

Taxes are collected by government entities – local, state, or central.

Who pays them

Taxes are paid by both individuals and businesses. You have to pay what the government decides based on your income.

How they are used

ax money collected from the individuals/businesses is utilised to finance government programs and services. Most of these programs include such ones we directly make use of, i.e. infrastructure (roads, bridges) or public services (fire departments, libraries) or social programs (Social Security, medicare).

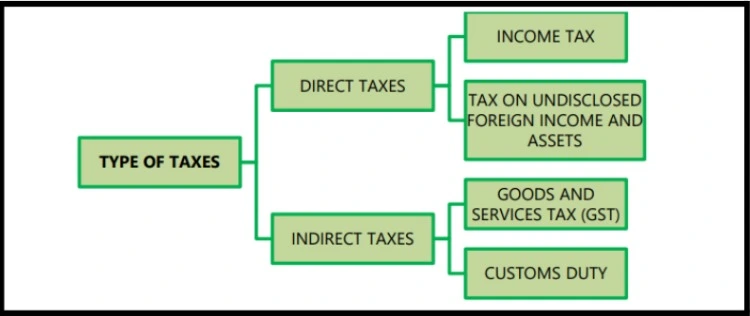

Types of taxes

Two main types of taxes are:

- Direct taxes and

- Indirect taxes

First is direct taxes

These are the taxes that you pay directly to the government based on your income or wealth. For example, income tax. You cannot pass on the burden of these taxes to anyone else. You have to pay them yourself.

Source: ICAI

Indirect taxes:

These are the taxes that you pay indirectly when you buy a good or service. For example:

- GST or Goods or Services Tax or

- Customs duty.

Here, the seller of the good or service adds the tax to the price and collects it from you. Then, they pay it to the government.

Let’s say you buy a biscuit. If you see its MRP you’ll notice it’s written inclusive of all taxes.

Yes, so the seller of the biscuit has passed on the tax burden to you. And ultimately, you are the one who is paying taxes to the government.

How are taxes calculated?

Let us talk about direct taxes!

Direct tax, say income tax, is charged on a person’s previous year’s total income.

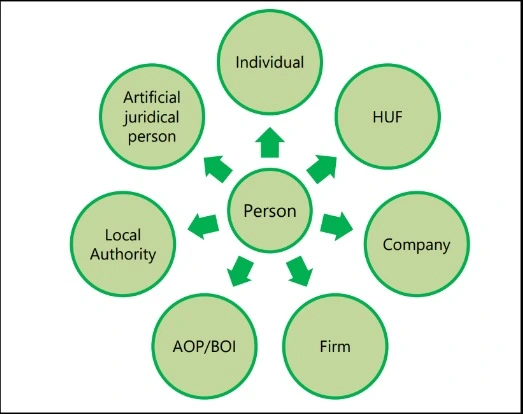

Who is a person?

- An individual,

- A firm,

- A company,

- A Hindu Undivided Family (HUF),

- A Body of Individuals (BOI),

- An Association of Persons (AOP), etc.

Source: ICAI

What is the previous year?

Think of it like this: The previous year is when you actually make your money, like your salary during the year. In India, our financial year works a little differently. The tax year in India runs from April 1st in one year to March 31st of the following year.

Suppose, you received ₹10 lakh salary from April 1, 2023, to March 31, 2024 – this is your income for the previous year(2023-24) for taxation.

However, it’s not time for you to pay tax yet. The following year after a previous year is known as an assessment year in which any person is supposed to file his/her income and pay taxes on that gross earning.

So, in this case, we would have paid taxes with respect to ₹10 lakh annual revenue during AY 2024-25.The deadline to file your income tax return in India (called ITR) is usually July 31st.

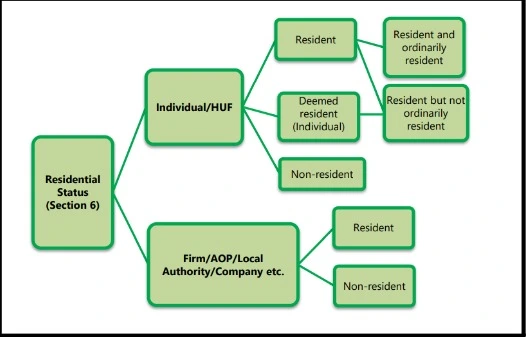

Understanding residential status

Why is residential status important?

It decides which income you pay tax on in India. There are three main categories:

- Resident and ordinarily resident (ROR): You pay tax on all your income, whether in India or abroad.

- Resident but not ordinarily resident (RNOR): You only pay taxes on income that is directly connected to India.

- Non-resident (NRI): You pay taxes on income connected to India (any Indian source).

| Sr. No. | Particulars | ROR | RNOR | NRI |

| 1 | Income received/deemed to be received in India | Taxable | Taxable | Taxable |

| 2 | Income accruing/arising/deemed to accrue or arise in India. | Taxable | Taxable | Taxable |

| 3 | Income accruing/arising outside India from • Business controlled in India or profession set up in India • Other Income | •Taxable •Taxable | • Taxable •Not Taxable | •Not Taxable •Not taxable |

| 4 | Global income | Taxable | Not Taxable | Not Taxable |

| 5 | Foreign Assets Disclosure Requirements under the Act | Required | Not Required | Not Required |

Source: Income Tax Department

Who is a resident or NRI?

Source: ICAI

It all depends on the duration of your stay (how many days you spend in India):

Resident

- 182 days or more in a previous year, OR

- At least 60 days in a year and a total of 365 days in the previous four years.

You are a resident if you satisfy any one of the conditions; otherwise, you are an NRI.

For example:

Let’s say “X” stays in India for the following days:

| Year | Days in India |

| 2023-24 | 100 |

| 2022-23 | 100 |

| 2021-22 | 100 |

| 2020-21 | 100 |

| 2019-20 | 65 |

| Total | 465 |

In this example, X would be considered a resident for tax purposes in India because:

- X was in India for at least 60 days in the previous year (2023-24).

- X spent a total of 365 days or more in India in the four preceding years (100+100+100+65 = 365).

Exceptions

- Citizen/person of Indian origin leaving for work abroad: Needs 182 days only to be considered a resident.

- Indian citizen not taxed elsewhere with income over ₹15 lakh: Deemed resident (always RNOR).

Now, if you are a resident, you can be either:

- Resident and ordinarily resident (ROR) or

- Resident but not ordinarily resident (RNOR).

ROR vs RNOR

You are RNOR if you meet any of these:

- NRI for nine out of ten previous years.

- In India for 729 days or less in the previous seven years.

- Indian citizen/PIO visiting India:

- Lived in India for at least 120 days but less than 182 days in the previous year.

- Income over ₹15 lakh (excluding foreign income).

Conclusion

Understanding the fundamentals of taxes—different types, residential status and computation—gives taxpayers power. This is achieved by simplifying the filing process and raising awareness that will not only ease compliance but also make citizens more knowledgeable about their rights as tax paying individuals.

This is due to the fact that taxation should not be a labyrinth but rather a channel for building the nation.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024