Wondering how you can invest in real estate without owning a property? REITs can be your solution.

The investment horizon is growing day by day. More people are realising the significance of investment and are diversifying into various instruments. Moreover, instruments like mutual funds, exchange traded funds (ETFs), and innovative investment vehicles offer an investment opportunity to a larger population.

Real estate is one of the most loved investments. Prices of land and property are hardly ever assumed to decline. However, investing in real estate is not a feasible or regular option for the majority. It demands huge capital.

REITs are a unique investment opportunity which invests money in the real estate sector. The investors do not need a humongous amount to invest in them. Let’s explore more about REITs in this blog.

What are REITs?

REITs are companies operating in the real estate sector that can raise funds from the public by issuing units to them. REITs full form is Real Estate Investment Trusts. These companies earn rent from commercial properties and distribute it as a dividend to the unitholders. The main feature of this instrument is the high dual benefit of earning stable incomes (dividends) and capital appreciation due to the real estate sector.

Usually, the real estate assets (properties) are owned and managed by Special Purpose Vehicles (SPV), which are a Limited Liability Partnership (LLP). However, sometimes the ownership structure is two-tier with a Holding Company (HoldCo). The REITs own these assets by acquiring SPVs or through Holding Companies.

These instruments are valued through different methods like Discounted Cash Flow (DCF), Net Asset Value (NAV), and cap rates (net operating income to total current value). Trusts have to publish half-yearly valuation reports.

There are mainly three parties in REITs:

- Trustee – This person holds the units in the REIT. It is a supervisory role.

- Sponsor(s) – This person is responsible for setting up the REIT. The registration is done by the sponsors.

- Managers – This person is entrusted with total operational responsibility for the trust. All the investment decisions are taken by the manager.

REITs in India

The concept of REITs originated in the United States of America in 1960. In India, the first REIT was issued in 2019 by BRE Mauritius Investments and Embassy Property Development Pvt. Ltd. Over the years, this instrument has gained popularity among investors. As of September 30, 2023, these four REITs are issued in the country:

(msf: million square feet)

| REITs | Total Portfolio | Gross Asset Value (In ₹ Crores) |

| Embassy Office Parks REIT | 45.4 msf (office) | 5,26,514/- |

| Mindspace Business Parks REIT | 33.1 msf (office) | 2,87,707/- |

| Brookfield India Real Estate Trust | 25.4 msf (office) | 2,84,878/- |

| Nexus Select Trust | 9.9 msf (retail)1.3 msf (office) | 2,43,532/- |

| TOTAL | 105.2 msf (office)9.9 msf (retail) | 13,42,631/- |

Source: Indian REITs Association (As of September 23, 2023)

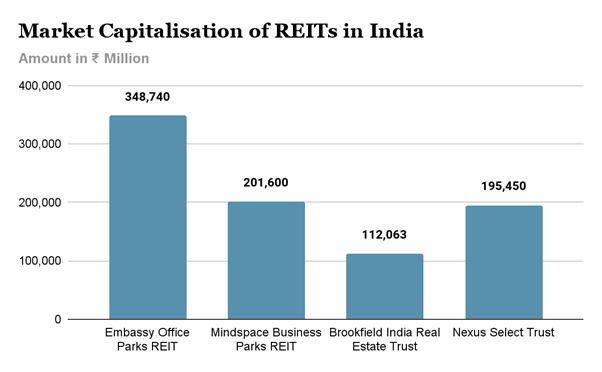

The market capitalisation of the REITs mentioned above in India is as follows:

Source: Indian REITs Association (As of April 16, 2024)

Features of the initial offer of REITs

The REITs raise funds through an initial offer. They are listed on the stock exchange after this initial offer. Later, funds can be again raised by follow-on offer, right issue, preferential issue and institutional issue.

- Listing – Mandatory to trade units.

- Minimum subscription – 10000 to 15000

- Income distribution – Minimum 90% of net distributable cash flows (NDFC), at least every six months

- Investors – Minimum 200

- Lot size – 1 unit

- Leverage – Maximum 49% of REIT assets.

Types of REITs

There are mainly three main types of REIT investments based on mode of investment:

- Equity

They invest mainly in residential properties, offices, industrial estate, etc. Rent and sale of property are the main income in this. It is later distributed as a dividend, which is taxable.

- Mortgage

They provide the facility of debt on the mortgage for the real estate buyers. Due to the nature of debt, interest is the only source of income, and risk is an inherent part of it.

- Hybrid

They have a combination of equity and mortgage REITs. Investors earn dividends and interest.

Pros and cons of investing in REITs

| Pros | Cons |

| Small capital requirement for investment in professionally managed real estate assets. | As traded on the stock market, they are prone to market volatility. |

| Easily tradable in stock markets. | High leverage and refinancing risk. |

| Diversification of investment. | Incomes and cash flows of REITs depend on the performance of Indian commercials and are taxable. |

| Safe due to strong framework and SEBI regulations. |

How to invest in REITs?

Investors should assess the following factors before investing in units of REITs.

- Price-NAV ratio

It indicates whether the units are trading at a premium or discount on the exchange.

- NIFTY REITs and InvITs index

Launched in June 2023, the index was launched. It includes real estate investment trusts (REITs) and infrastructure investment trusts (InvITs). Here, the weights are determined as per the free-float market capitalisation.

- Occupancy rate

It is the number of occupied properties to the total number of properties. A higher rate indicates better rental income.

- Tenant mix

The diverse mix of businesses of tenants and good creditworthiness assures better returns and restricts the risk of concentration into a specific business.

- Lease expiry profile

It accounts for the number of leases expiring in the given year. This should be balanced enough to reduce the risk of vacant property.

- Debt expiry profile

Refinancing risk would be reduced, and cash flow would be maintained with a balanced debt expiry profile.

- Interest cost

If the interest cost (finance cost) on debt capital, paid by the company is less, it leads to better distribution income for the trust. Moreover, a minimum of 90% of net distributable cash flows are distributed among the unitholders.

- Weighted Average Lease Expiry (WALE)

The longer this period, the less the risk of vacancy. However, the risk of negotiation for rent lurks over such investments.

- REIT essentials

The quality and track record of management and the portfolio should be properly analysed before investing in a particular REIT.

Investors can open an account with a brokerage firm to invest or can operate their REITs by themselves. REITs investments are listed on major stock exchanges, such as NSE and BSE. Investors can invest in the following ways:

- Stock – Investors can purchase or sell REITs registered on the stock exchanges. Moreover, NSE also has a NIFTY REITs and InvITs index for benchmarking.

- Mutual funds – Mutual funds invest in REITs like other regular instruments. Currently there are some scheme which invest in REITs throught fund of funds (FoF) category. There is no separate category.

Conclusion

Investing in conventional instruments like bank products, stocks, gold, etc, is affected by the high volume of the asset. However, modern instruments like REITs are in the initial years of their growth and have excellent prospects in countries like India, where population growth leads to more demand for real estate. An investment of ₹10000 holds the potential to earn significant returns in the long run.

Thus, after understanding the instrument and checking the criteria, investors can grab this golden opportunity to invest with a small token in the real estate sector.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025