Wondering where all your money goes? Values-based budgeting helps you take control without overthinking every purchase.

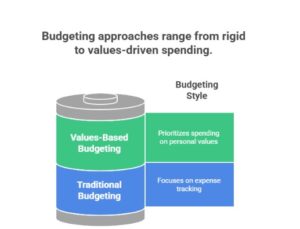

Most people avoid budgeting because traditional methods feel disconnected and rigid. You list expenses, subtract income, and somehow still feel stuck. From a finance industry perspective, this is where values-based budgeting stands out. With opinionated insight, this approach helps you stop reacting to expenses and start choosing where your money goes.

So, how do you put values-based budgeting into action? Let’s walk through it in this guide!

What Is Values-Based Budgeting?

Values-based budgeting is a different way of managing money. Rather than sorting every rupee into categories or tracking every last expense, it starts with what is important to you. It’s about spending in the right way like putting more toward family’s basic needs, clearing debt, or investing in fitness because it keeps you healthy.

While traditional budgets focus on numbers first, values-based budgeting begins with priorities. It’s more about building a spending plan that is meaningful and as per your choice.

Steps to Implement Values-Based Budgeting

If you’re still wondering where half your salary vanished, here are the analyst views on how to start values-based budgeting. Follow these steps to implement it:

Look at Your Expenses

Before changing anything, take a good look at your recent transactions. Look through the last 2–3 months of your bank and credit card statements. Categorise your expenses into common areas like housing, food, subscriptions, shopping, travel, and leisure.

Ask questions like:

- Are these expenses adding real value to my everyday life?

- Am I spending more on things I don’t really care about?

1. Sort your transactions into 3 buckets:

Use three colours: green for meaningful, yellow for neutral, and red for avoidable. This gives you a visual breakdown of your financial behaviour.

2. Match Your Spending

Once your spending is laid out, it’s easier to spot disconnects between where the money goes. Many people find that while their values lean toward health, learning, or community, their expenses tell a different story.

For example:

- It’s worth reevaluating if health is a major priority but most spending leans toward fast food and zero toward wellness like yoga, preventive care, or home-cooked meals.

- If financial independence is important but you keep doing impulse purchases, you must check the expenses in detail.

- If family time matters but your budget doesn’t support weekend outings or travel, small changes can make room for what brings connection.

3. Reconstruct Your Monthly Budget

Now it’s time to rebuild your budget as per values-based budgeting:

- Start with the must-haves such as your rent, electricity, and groceries.

- Then, put money toward your health, learning something new, or setting aside for a future plan.

- Lastly, look at the expenses that don’t add much value anymore. Trim them down or drop them altogether.

If you’re spending ₹3,000/month on shopping but only ₹300 on self-improvement or wellness, this is a chance to balance things out.

4. Smart Spending Habits

If your new budget is already in place, use simple strategies to stay consistent.

Some approaches that work well are:

- Implement a 24–48 hour pause before buying non-essentials. If it still feels worth it later, go ahead.

- Withdraw your weekly discretionary spending and use physical cash.

- Pick one or two days each week where you don’t spend on anything non-essential.

5. Allow Unexpected Costs

Life is unpredictable, and your budget should be ready to adapt. Allocate a small buffer every month like ₹500 to ₹1000, depending on your income.

This way, a medical visit or last-minute expense doesn’t disrupt your long-term plans or increase your reliance on credit.

Benefits of Values-Based Budgeting

Check out the benefits that value-based budgeting has.

1. Allocates Capital Toward Priority Areas

You can use value-based budgeting for spending money on emergencies and basic needs such as utility, gas, and water bills. If this is being followed consistently, you are less likely to feel regret.

2. Increase Psychological Return on Spending

With values-based budgeting, you can start planning beyond just the current month. You may begin putting aside money for something meaningful, like taking care of aging parents or giving back to your hometown, instead of being pulled into short-term wants.

3. Cuts Down On Random Purchases

Impulse buys happen when spending is disconnected from purpose. But if you purchase things if they are truly important, you’re more likely to not go to any sales or close the shopping tab.

4. Contributes to Asset-Building and Liability Reduction

Redirecting funds away from low-impact categories allows for more contributions to asset-generating instruments. This includes SIPs, equity, gold investments or long-term deposits. One can get comprehensive financial planning services to invest the money in these funds. Values-based budgeting also reduces reliance on unsecured debt and improves the personal balance sheet.

Tools and Resources for Values-Based Budgeting

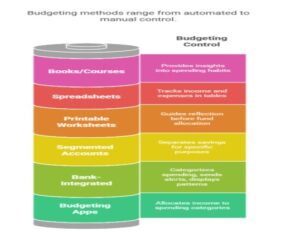

Below are the methods and tools to help put values-based budgeting into practice.

1. Bank-Integrated Budget Trackers

Many banks and credit unions give built-in budgeting features linked to your savings and checking accounts. These can send alerts when you’re nearing limits, categorise your spending, and display patterns over time. It’s a direct way to monitor how your money flows across different areas of importance.

2. Budgeting Apps

Rather than just listing expenses, they help you direct money toward what matters in your financial plan. It can be for healthcare, education costs, or paying off loans.

3. Spreadsheets or Ledger Formats

For those who prefer full control or low-tech solutions, a spreadsheet offers a practical way to track and reassess your income and expenses. Online templates or simple table formats on paper can be used to set categories based on value areas.

4. Books and Courses for Deeper Planning

Structured programs and reading materials can support those who want to take a more comprehensive approach.

Here are the books you can read for budgeting and financial planning:

- “Get Good With Money” by Tiffany Aliche

- Values-Based Financial Planning by Bill Bachrach

- I Will Teach You To Be Rich by Ramit Sethi

Along with this, one can also take help of comprehensive financial planning services from big brands.

Conclusion

For many, budgeting feels like a frustrating cycle with numbers on a spreadsheet. The usual monthly plans often overlook personal priorities, leaving people stressed. That’s where values-based budgeting comes in.

This blog showed the finance industry perspective on how to break that cycle. It covered not just why to use values-based budgeting, but the tools and resources can help you do it. Through reducing impulsive purchases and improving savings, values-based budgeting is a thoughtful way to take control of your finances today.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025