Afraid of making mistakes in your beginner investor journey? Here’s my first-year experience that shows how to avoid the common traps.

The value of money doesn’t stay still, it quietly erodes over time. In December 2024, annual inflation rate spiked to 5.22% overall, with food inflation at a striking 8.39%. With the cost of living expenses becoming costlier with each day, I realized that simply saving wasn’t enough, I knew I had to take action. I’m Rohan Mehta, a 27-year-old marketing professional from New Delhi, and about a year ago, I took my first steps into the world of investing. That’s when I began my beginner investor journey, a path filled with curiosity, caution, and personal growth.

Taking the First Step: Guidance, Not Going Solo

As a true beginner, I knew I needed help. I turned to a SEBI-registered financial advisor, following AMFI’s advice for first-time investors. The advisor explained the basics, what a Demat account is, how the KYC process works, and why diversification matters. I learned that emotional investing letting fear or excitement drive decisions was a common trap for new investors, and that having a plan would help me avoid it.

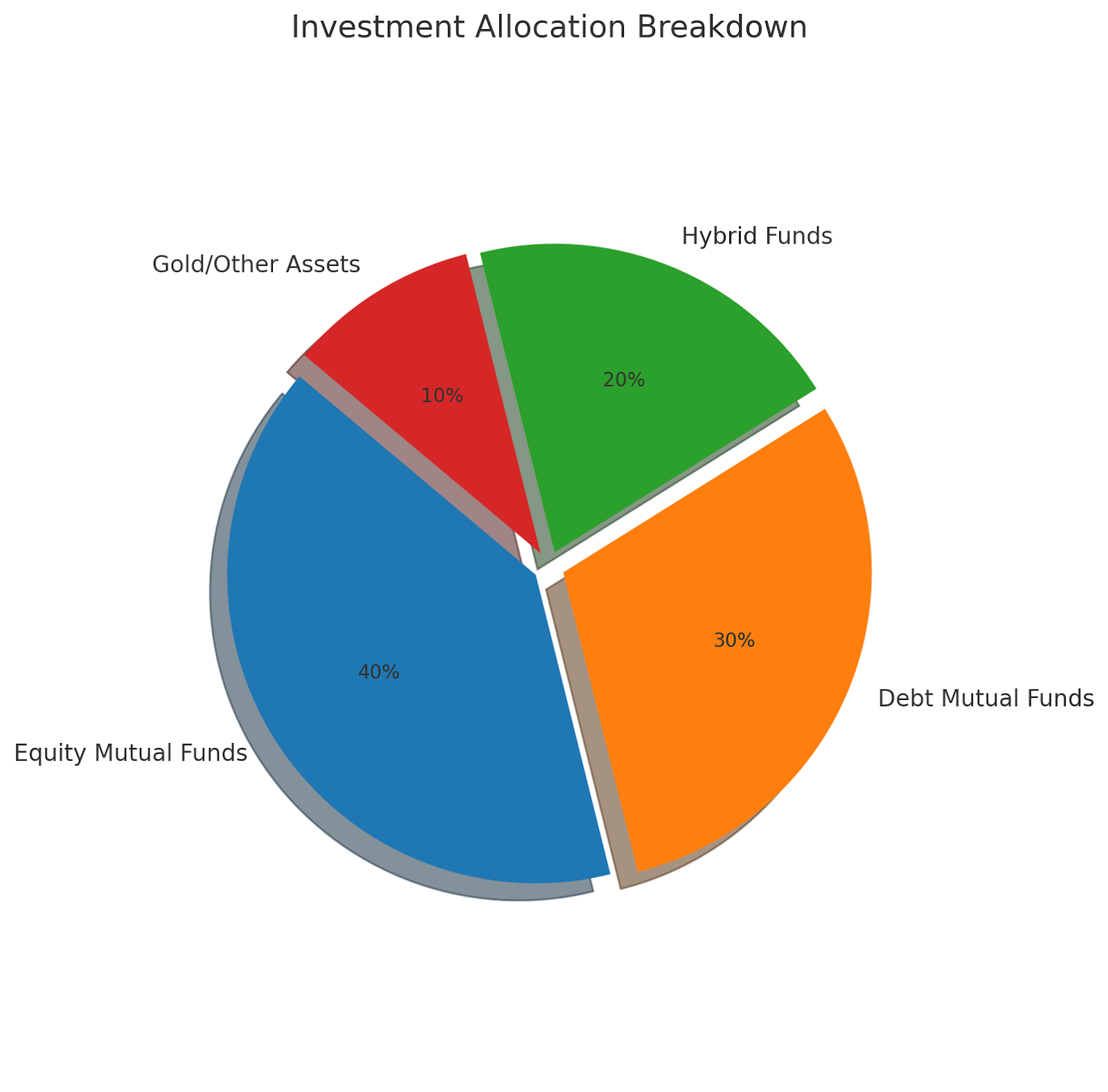

We settled on a Systematic Investment Plan (SIP) of ₹5,000 per month. This approach, widely recommended by AMFI and SEBI, allowed me to invest regularly and avoid the temptation to “time the market.” My portfolio was simple and diversified:

- 40% Equity Mutual Funds

- 30% Debt Mutual Funds

- 20% Hybrid Funds

- 10% Gold/Other Assets

This mix was designed to balance growth and stability, keeping risk in check while giving me a taste of the stock market’s potential.

Overcoming Emotional Investing

No one warned me how emotional investing could be. The first time my portfolio value dropped, I panicked. Was I making a mistake? Should I stop my SIP? My advisor reminded me of what SEBI and AMFI emphasize: emotional investing is the enemy of wealth creation. Reacting impulsively, out of fear during a correction or greed during a rally almost always leads to poor decisions.

I learned to:

- Check my portfolio only once a month, not every day.

- Focus on my long-term goals, not short-term fluctuations.

- Celebrate discipline, not just returns.

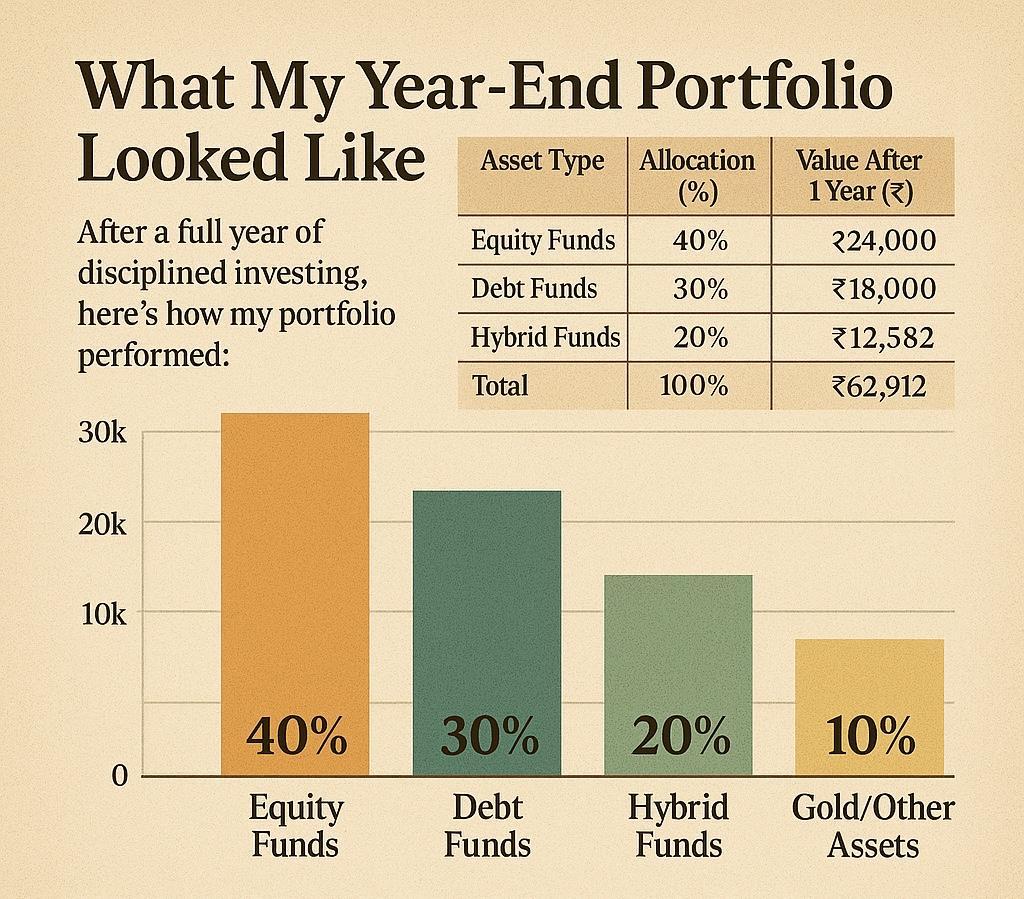

What My Year-End Portfolio Looked Like

After a full year of disciplined investing, here’s how my portfolio performed:

| Asset Type | Allocation (%) | Total Invested (₹) | Value After 1 Year (₹) |

| Equity Funds | 40% | ₹24,000 | ₹25,165 |

| Debt Funds | 30% | ₹18,000 | ₹18,874 |

| Hybrid Funds | 20% | ₹12,000 | ₹12,582 |

| Gold/Other Assets | 10% | ₹6,000 | ₹6,291 |

| Total | 100% | ₹60,000 | ₹62,912 |

Total returns after one year at 9.5%: ₹2,912

Lessons Beginners Should Know Before Investing

Based on my experience, here are the most important lessons from a first-time investor in India, things I wish I had known before I started investing:

- Start with a Plan

Before putting down even a single rupee, ensure to define your goals both short and long term. For me, the short-term goal was building a 3-month emergency fund and the long term was saving for a future home.

Also, knowing how much volatility you can handle helps select the right asset mix and prevents impulsive decisions during market swings.

- Learn the Basics

Take time to understand the key investing concepts. I started by learning how mutual funds, SIPs, stocks, and debt instruments work. But equally important things were like:.

- Inflation: Prices rise over time meaning your money loses its value if it just sits in a savings account. That’s why investing is important.

- Interest rates: When RBI hikes rates, debt investments may give better returns, but equity markets often dip.

- Risk vs Returns: Higher returns usually come with higher risk.

- Taxation: Gains from different assets are taxed differently. For example, equity funds held for over a year get LTCG tax benefits, debt funds are taxed as pee on your income slab.

- Set Up Your KYC & Demat

Complete your Know Your Customer (KYC) verification and open a Demat account. Choose a SEBI-registered mutual fund distributor or advisor if you need guidance.

- Trust Official Sources, Not Social Media Hype

Stick to SEBI and AMFI’s investor education resources. They provide reliable, beginner-friendly guidance unlike influencers or viral content pushing unverified tips.

- Emotions Will Try to Interfere

Accept that markets will fluctuate. Your portfolio will go up and down. Panic, greed, or impatience can lead to impulsive decisions. Prepare yourself mentally to stay calm and focused on long-term goals.

- You Don’t Need a Big Amount

You don’t need a big lump sum to start investing. Even ₹500–₹5,000 per month through SIPs can grow significantly over time. Starting small builds confidence and helps form strong financial habits.

- Diversification is Not Optional

Putting all your money into a single fund, stock, or asset is risky. Before you begin, know that diversification across asset classes helps manage risk and smooths out returns during market ups and downs.

- Don’t Try to Time the Market

Trying to invest only when the market is low may seem smart, but it rarely works even for experienced investors. The smartest move for beginners is to start early and stay consistent, instead of waiting for the “perfect” time that rarely comes.

More Beginner-Friendly Investment Options

Apart from the stock learnings I came across in my first year as an investor, if you want look beyond individual stocks, there are several other beginner-friendly investment options I learned about, some of which include:

- Fixed Deposits & Recurring Deposits

Out of everything I explored early on, these stood out as the most easy to understand. Fixed Deposits (FDs) let you invest a lump sum at a fixed interest rate for a specific time. Recurring Deposits (RDs) are similar, but you invest a small amount every month. Both felt like a safe place to park money if I wasn’t ready for market ups and downs yet.

What I learned later is that while FDs and RDs are low-risk, they come with some conditions. Most banks require you to keep your money for at least 7 days in FDs, anything less than that usually earns no interest. And if you take it out early, you may lose 0.5–1% on the promised interest. RDs typically have a lock-in of 5 years, and early closure reduces your returns.

- National Pension System (NPS)

This one is suitable when thinking about retirement. NPS invests in both equity and debt, and the best part, it doesn’t need constant tracking. You also get the benefit of tax deductions under Section 80CCD, an added perk for long-term savers. What stands out is low charges and long-term compounding. It’s a locked-in investment till you turn 60, so it acts more as something for future security rather than instant gain.

- Public Provident Fund and National Savings Scheme

Two names that kept popping up in my research were Public Provident Fund (PPF) and National Savings Certificate (NSC). Both are backed by the government and are known to be very safe.

PPF has a lock-in period of 15 years, but the interest earned is completely tax-free. Many people use it as a steady long-term saving tool. It’s not flashy, but it’s reliable.

NSC is more of a short-to-medium term option with a 5-year lock-in. The interest is taxable but gets reinvested, so it quietly grows in the background. Both options also offer tax deductions under Section 80C, which makes them attractive if you’re looking to save on taxes.

- Index Funds & ETF

These were among the first things I read about while exploring mutual funds. Index funds and ETFs (Exchange-Traded Funds) basically copy the performance of the stock market like Nifty 50 or Sensex. You don’t have to pick individual stocks (which felt overwhelming back then), just have to invest a small amount, and money gets automatically spread across the top companies.

What is the most convincing part is that you can start with as low as ₹500 and exit any time wanted. The returns depend on the market, but they usually beat traditional savings options if you stay invested for a few years. They act as a nice bridge between risk-free investments and full-on stock investing.

Final Thoughts

Looking back, my beginner investor journey was far more about building habits than chasing returns. From SIP to low risk options, there’s something for everyone. If you’re new like I was, take the first step because the best investment you’ll ever make is simply getting started. And if you feel unsure, consider speaking with a trusted trading expert or using a reliable investment platform to guide you through those first steps.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025