What if your next big financial leap starts with a simple step? Let financial planning services lead the way from dreaming to doing.

Building a strong portfolio isn’t just about picking investments, it’s about having a smart, long-term strategy. This is where financial planning services can be of great assistance to you. With a growing demand for expert financial guidance, India saw a 17.7% year-on-year rise in CFP® professionals, reaching 3,215 in 2024, a clear sign that more people are turning to formal financial planning. This surge displays a growing trust in formalized financial strategies. From managing investments to building a resilient portfolio, financial planning services can help you align today’s choices with tomorrow’s goals, securely and confidently.

Understanding Financial Planning Services in India

In essence, financial planning starts with understanding where you stand today, defining what you want to achieve, making a plan around your income and expenses, picking the right investment options, and tracking your progress regularly. This comprehensive methodology helps individuals chart a path toward their financial aspirations.

When we talk about financial planning services, we mean the professional help you get to create and follow this map. In India, these services are mainly covered by what SEBI calls “investment advice.” According to SEBI rules (SEBI (Investment Advisers) Regulations, 2013, Regulation 2(l)), this advice involves guiding you on buying, selling, or dealing with financial products and building your investment portfolio, even if it’s through a detailed financial plan.

The scope of these services is quite broad. It includes carefully looking at your current income, expenses, assets, and debts. Based on this, financial professionals give you specific recommendations on different investment options and how to put them together in a smart portfolio.

The Regulatory Framework and Professional Guidance

The framework governing investment advisory in India is primarily overseen by the Securities and Exchange Board of India (SEBI), with additional guidelines from the Association of Mutual Funds in India (AMFI). It’s a process that not only protects investors but also raises the bar for transparency and ethics in financial advisory services.

Role and Responsibilities of RIAs

The primary responsibility of an RIA is to offer impartial, client-centric investment advice. Registered Investment Advisors (RIAs) follow a fee-only model, meaning they’re paid by you, not by commissions, so their advice stays unbiased and aligned with your best interests. Its primary responsibilities are as follows:

- Conducting comprehensive risk profiling of clients before making recommendations.

- Aligning investment strategies with each client’s financial goals, risk tolerance, and investment horizon.

- Their core offerings include goal-based financial planning, designing portfolios, allocating assets smartly, and continuously managing your investments.

- They’re also responsible for maintaining thorough records of all client communications as well as transactions.

- Adhering to a strict code of conduct, full fee disclosure, and overall transparency.

- Only SEBI-registered RIAs are permitted to provide comprehensive financial planning and investment advice, while AMFI-registered distributors are limited to product distribution.

- Individual IAs crossing 300 clients or ₹3 crore in fees in a financial year must apply for in-principle registration as a non-individual IA. This registration stays valid for three months for the transition.

- An annual audit must be done within six months after the financial year and submitted to IAASB/SEBI within a month. Any issues found and fixes must be reported and published. A yearly compliance certificate is also required.

- RIAs must reveal if they use AI tools while signing agreements and update this if use changes.

- RIAs must enter into an agreement with clients outlining key terms. They cannot execute trades without specific consent for each one. Consent may be obtained physically or through digital options like DigiLocker.

- Fixed-fee IAs can charge up to ₹1.51 lakh per year per client family. Alternatively, fees can be up to 2.5% of Assets under Advice (AUA), whichever is higher. Fee modes can be changed anytime. These limits apply only to individual and HUF clients.

This regulatory framework ensures that investors receive professional, unbiased wealth management services for their needs, while maintaining high standards of transparency and accountability in the sector.

Personalized Strategies for Portfolio Growth

Setting up a strong, future-ready portfolio demands more than generic advice; it requires smart personal advice tailored to an individual’s unique situation. This is precisely where SEBI-Registered Investment Advisors (RIAs) and the regulated financial planning services in India prove invaluable. They follow clear rules to make sure your investment plan isn’t just effective, but also perfectly matched to you.

Setting Goals and Checking Risk

Financial advisors begin personalised investment planning by helping you clearly define your goals. They work with you to outline your financial dreams, from short-term needs to long-term objectives. This organised goal setting is a core part of SEBI’s push for investor education.

Most importantly, advisors must perform a detailed risk assessment. Here’s how the rules guide them:

- SEBI (Investment Advisers) Regulations, 2013: Regulation 16: “Information to be sought from client”: This rule mandates that RIAs gather specific details from clients. These include:

- Age

- Investment objectives (what you want to achieve)

- Time horizons (how long you plan to invest)

- Risk appetite (how much risk you are willing to take)

- Risk capacity (how much risk you can financially afford to take)

- Income and existing investments. This ensures the advisor understands both your comfort with risk and your ability to handle potential losses.

Strategic Asset Allocation and Diversification

Once your goals are clear and risk is understood, your investment advisor implements strategic asset allocation. They guide you to spread your money across different investment types like stocks (equities), bonds (debt), and gold. Here’s how the rules support their actions:

- SEBI (Investment Advisers) Regulations, 2013: Regulation 17: “Suitability of advice”: This regulation states that investment advice “shall be based on comprehensive and holistic assessment of the client’s risk profile.” This means advisors must ensure that the mix of assets (asset allocation) and the specific investments chosen are appropriate for your individual risk level and goals.

Sustaining Wealth: Ongoing Guidance & Investor Protection

To maintain your portfolio, ongoing guidance and investor protection are non-negotiable. Here’s how seeking financial planning services can help with that:

Continuous Portfolio Monitoring and Behavioral Discipline

Once your investment plan is in place, maintaining and growing your wealth depends on two things: regular monitoring and staying disciplined. Financial advisors help with both, especially when markets get unpredictable

- Proactive Monitoring: RIAs continuously track the performance of your portfolio against your financial goals. This active oversight, inherent in their duty of diligence (as per SEBI (Investment Advisers) Regulations, 2013, Schedule III, Clause 3), ensures that your investments remain aligned with your objectives and risk profile, even as market conditions evolve. They identify when strategic rebalancing is necessary to maintain your desired asset allocation.

- Mitigating Behavioral Biases: Market movements can stir emotions, nervousness when prices fall or overconfidence when they rise, making rational decision-making even more essential. Advisors help you stay calm, stick to your long-term plan, and avoid mistakes like panic-selling or chasing risky trends. This guidance builds the discipline needed for long-term success.

Investor Grievance Redressal Mechanisms

Even with careful planning, issues may come up. That’s why SEBI created SCORES, an online platform for filing and tracking complaints against SEBI-regulated companies and advisors

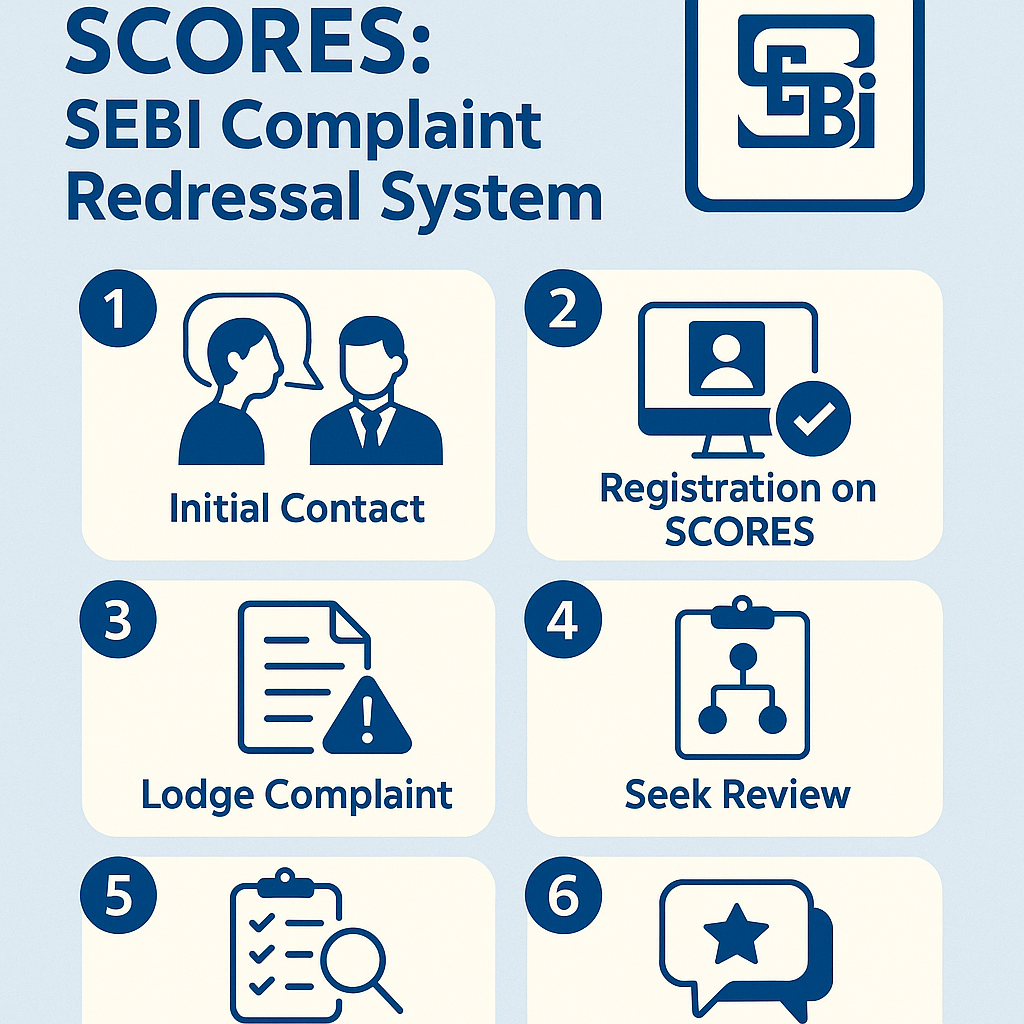

SCORES: SEBI Complaint Redressal System

This is an online platform provided by SEBI (scores.sebi.gov.in) designed to facilitate the lodging and tracking of grievances against SEBI-regulated entities, such as listed companies, registered intermediaries (including Investment Advisors and Mutual Fund Distributors), and market institutions.

How SCORES Works for Investor Protection:

Step 1 – Initial Contact: Investors are encouraged to first raise their concerns directly with the concerned entity’s designated officials.

Step 2 – Registration on SCORES: If the issue remains unresolved, investors can register on the SCORES portal.

Step 3 – Lodge Complaint: A complaint can then be formally lodged on the platform.

Step 4 – Track Status: Complainants can conveniently monitor their grievance status online, while SEBI issues automated reminders to the concerned entities to ensure timely resolution.

Step 5 – Seek Review: A two-level review system is available if dissatisfied with the initial resolution: within 15 days of receiving the ‘Action Taken Report’ (ATR) for the first review, and another 15 days for a second-level review by a Designated Body.

Step 6 – Provide Feedback: After the complaint is closed, investors can provide feedback on the redressal process, helping SEBI continuously improve the system.

Conclusion

Strong portfolios don’t just happen overnight, they take time, just the right amount of effects and the right advice. Financial planning services help you cut through the noise, manage risks, and make choices that fit. For expert insights and sharper moves, talk to a SEBI-registered advisor or a trusted trading platform today.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025