September 1st, Friday,

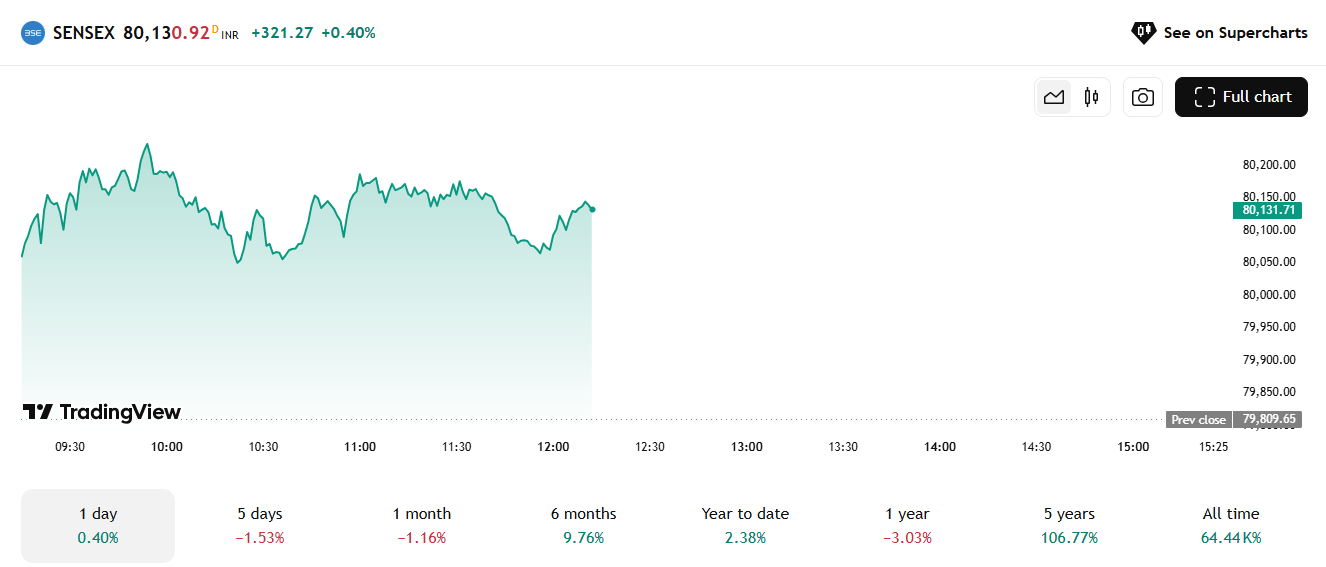

The Indian stock market opened on a strong note on Monday, September 1, 2025, reflecting investor optimism fueled by robust macroeconomic data and positive sector performances. At the market opening, the BSE Sensex registered a significant gain of over 300 points, opening above the 80,000 mark and starting at approximately 80,113 points.

Source: Tradingview

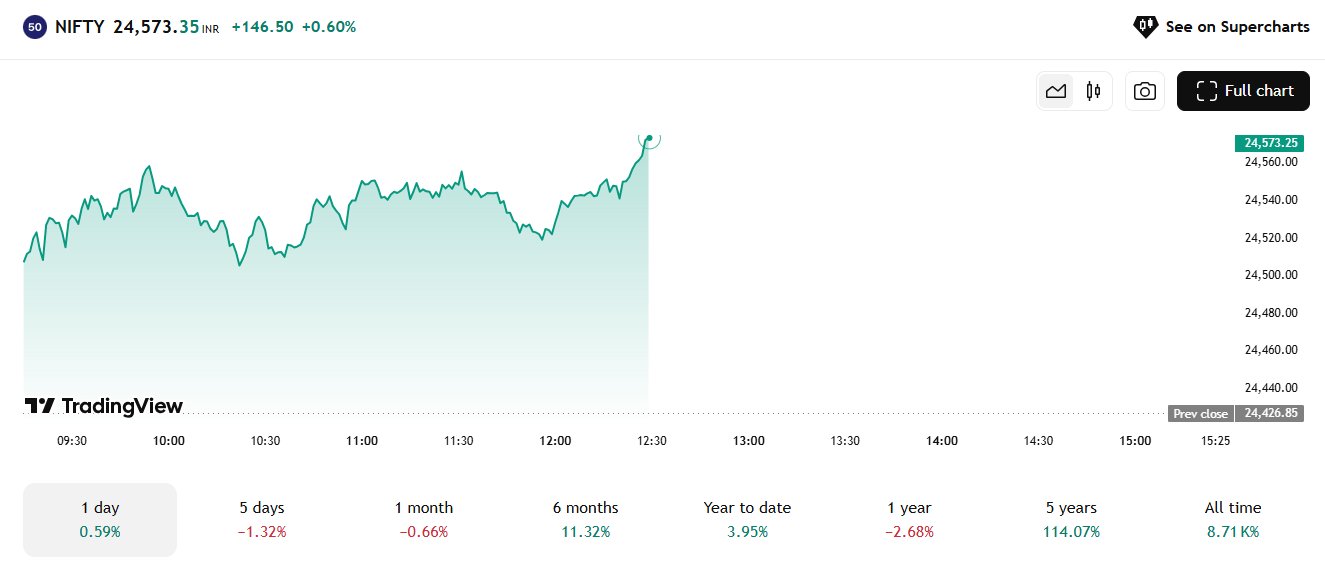

The Nifty50 index opened above the 24,500 mark, standing near 24,518 points, up nearly 0.4% from the previous close. Nifty50 paced up 0.6% by mid-morning.

Source: Tradingview

Sectoral and thematic indices in the Indian stock market showed a generally positive trend with a few exceptions.

The IT sector emerged as the top performer among sectoral indices, rising by about 1.3 to 1.5%. Other sectors such as the auto, consumer durables, and capital goods sectors also recorded gains, supported by strong domestic demand and encouraging macroeconomic data.

But, what are the reasons behind this optimistic start to the month? Let’s find out!

1. Strong Macroeconomic Data

One of the primary catalysts for the bullish sentiment was the better-than-expected Q1 FY26 GDP growth data announced on August 29th, 2025 (the previous trading day). India’s manufacturing growth hit a 17-year high in August, with the HSBC India Manufacturing Purchasing Managers’ Index (PMI) climbing to 59.3 from 59.1 in July. PMI indicators can be a valuable source of information for traders, showing sectoral growth prospects. High PMI numbers can suggest robust industrial activity and investor confidence in the economy.

2.Developments in Trade and Geopolitics

Investors remained attentive to ongoing developments in India-US trade relations, especially in the wake of recent decisions by the US Court of Appeals. The court ruled that former US President Donald Trump had overstepped his authority by imposing broad tariffs on major trading partners under his “liberation day” declaration but kept the tariffs in place, introducing an element of uncertainty and caution in global markets. This legal backdrop comes amid Prime Minister Narendra Modi attending the Shanghai Cooperation Organisation (SCO) Summit in Tianjin, China, indicating potential diplomacy that could influence trade and market sentiment.

3. Sector-Specific and Corporate Announcements

Corporate news further added momentum to the market. Shares of RITES, a state-owned company, jumped nearly 5% after securing a significant contract worth ₹25.3 crore from NTPC, reflecting positive investor sentiment on government-related contracts.

Solar energy company Premier Energies also saw its shares rise by about 3%, following announcements of orders worth ₹2,703 crore across its subsidiaries.

Meanwhile, stock market inflows from domestic institutional investors (DIIs) continued unabated, extending their buying streak to 25 months with ₹11.4 trillion invested since June 2023, indicating strong domestic support.

Now, let’s also have a look at the top 3 gainers and losers for today till 1:00 pm.

Top 3 gainers:

| Stock Full Name | Opening Price (₹) | Previous Close (₹) | Last Traded Price (₹) | % Change |

| JPOLYINVST (Jubilant Poly Investment) | 1,038.70 | 865.60 | 1,038.70 | 20.00% |

| BSL (Bharat Steel Limited) | 171.03 | 163.38 | 196.05 | 20.00% |

| SHYAMCENTA (Shyam Cement) | 7.25 | 7.00 | 8.40 | 20.00% |

Source: NSE

Top 3 losers till 1:00 pm were:

| Stock Full Name | Opening Price (₹) | Previous Close (₹) | Last Traded Price (₹) | % Change |

| ROHLTD (Rohit Ltd) | 534.25 | 536.90 | 498.30 | -7.19% |

| STLTECH (Steel Tech Ltd) | 110.20 | 114.69 | 107.65 | -6.14% |

| COFFEEDAY (Coffee Day Enterprises) | 51.19 | 50.03 | 47.35 | -5.36% |

Source: NSE

Despite a positive start, the market remains cautious, given a traditionally volatile period that September often represents in stock market history, known as the “September Effect.” Historically, September has sometimes been the weakest month for stocks due to profit-taking after summer rallies, portfolio adjustments before the fiscal year-end, and institutional investors locking in gains.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025