September 3rd, Wednesday,

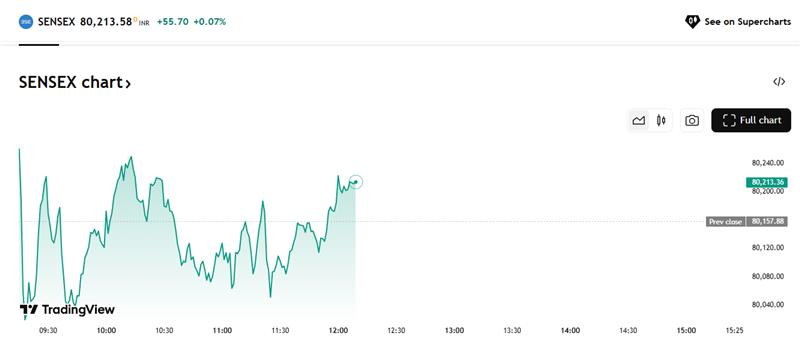

Both the Sensex and Nifty50 opened slightly higher compared to the previous close. Sensex opened at 80,214.67, up 57 points or about 0.07% from its previous close. By 12:20 pm, it had only marginally gained to 80,213.58.

Source: Tradingview

Source: Tradingview

Nifty50 started at 24,592.05, up 12 points or 0.05% over the previous close. As of 12:20 pm, it was at 24,641.60.

Source: Tradingview

The benchmarks initially reflected a positive opening but quickly turned rangebound due to lack of strong triggers and investor indecisiveness.

Nifty Metal index was the standout gainer, rallying approximately 1.95% on the back of a weaker dollar and expectations that China would cut steel production, boosting global prices and sentiment in Indian metal stocks.

Nifty Pharma and Nifty PSU Bank also rose, gaining 1.02% and 0.63% respectively by midday.

Here are the key reasons for this market movement:

1. Anticipation Ahead of the GST Council Meeting

- Investors were hesitant to take major positions at the open and through midday as they awaited outcomes from the two-day GST Council meeting, which could bring about significant policy or tax changes.

- Market participants expect the GST meeting to address rate rationalisation and potentially introduce sector-specific reforms, influencing near-term market sentiment and sectoral moves.

2. Global Cues and Volatility

- Asian equity markets opened lower, mirroring overnight losses on Wall Street, as rising global bond yields and renewed international trade tensions dampened risk appetite.

- The weakness in key global indices and continued economic uncertainty, especially from the U.S. and China, contributed to choppy trade in India.

3. Sector-Specific Factors and Thematic Rotation

- The rally in metals was driven by global commodity moves and expectations of production cuts in China, while IT stocks lagged due to weak U.S. economic data.

- Broader participation from mid- and small-caps offset some of the headline weakness, with positive moves in PSU, pharma, and select financials.

Let’s check out the top 3 gainers and losers till 12:30 pm today:

| Full Company Name | Opening Price | Previous Close | Last Traded Price | % Change |

| Hemisphere Properties India Limited | 142.00 | 141.92 | 170.30 | 20.00 |

| JITF Infralogistics Limited | 267.25 | 267.25 | 320.70 | 20.00 |

| D.P. Wires Limited | 221.10 | 218.90 | 262.68 | 20.00 |

Source: NSE

Top 3 losers:

| Full Company Name | Opening Price | Previous Close | Last Traded Price | % Change |

| Sarveshwar Foods Ltd – RE | 0.65 | 1.05 | 0.66 | -37.14 |

| Globus Spirits Limited | 1,200.00 | 1,196.50 | 1,099.00 | -8.15 |

| AVL (AVL India Limited) | 489.60 | 489.60 | 461.85 | -5.67 |

Source: NSE

Conclusion

The Indian stock market, as of midday on September 3, 2025, was flat to mildly positive, reflecting caution due to the impending GST Council meeting, unstable global cues, and active sector rotation. With metal stocks surging and IT under pressure, broader market breadth remained healthy, but headline indices failed to make decisive moves as investors awaited policy clarity.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025