September 4th, Thursday,

The Indian stock market on September 4, 2025, saw a strong rally in the first half of the session, driven by widespread optimism over sweeping GST reforms that boosted sentiment across consumption and auto-related sectors. The Sensex and Nifty50 both opened sharply higher and extended gains till 12:30 pm, while sectoral indices showed robust positive breadth, led by autos, FMCG, and real estate.

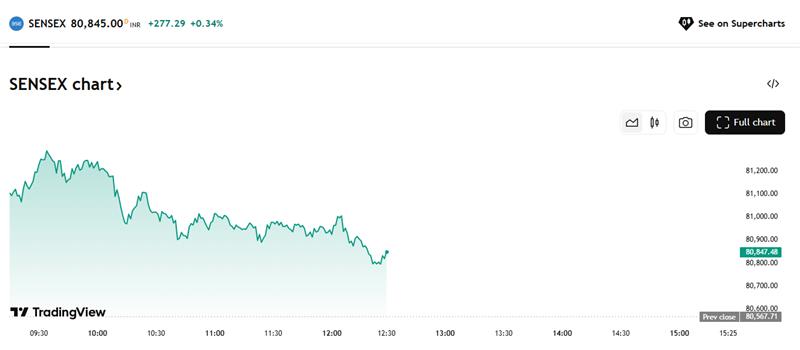

Sensex opened at 81,118, up approximately 550 points or 0.68% from its previous close, and climbed to an intraday high of 81,456.67 during the pre-opening, maintaining levels above 80,845 till 12:30 pm.

Source: Tradingview

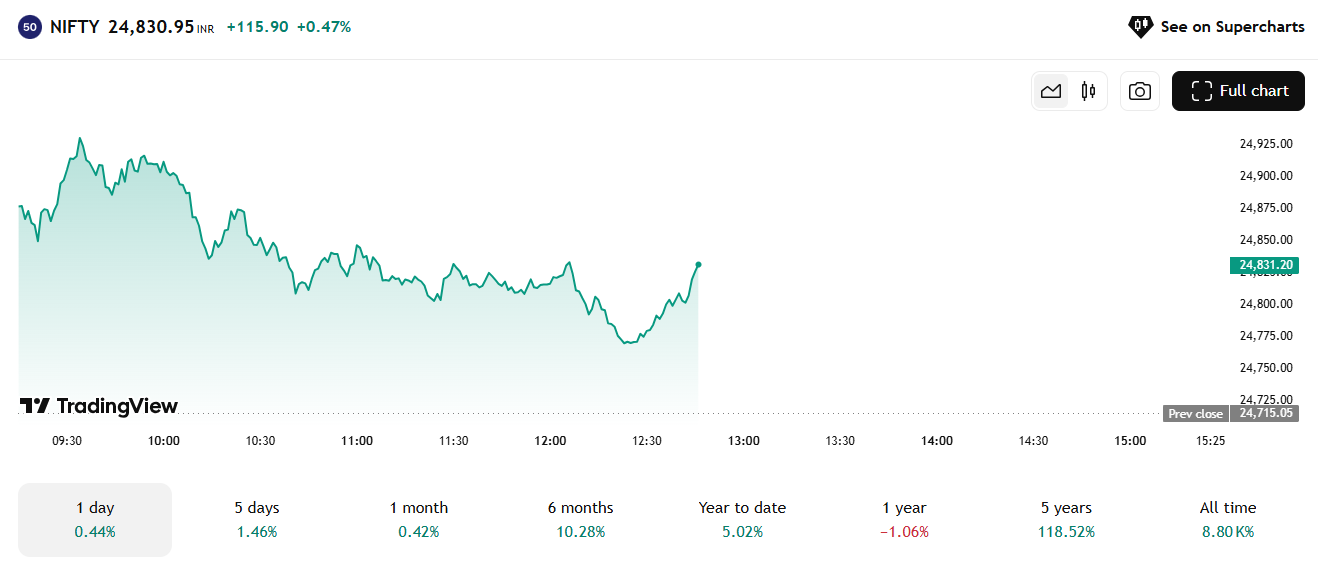

Source: Tradingview

Nifty50 began at 24,877, up 162 points or 0.65%, trading strongly above 24,800 throughout the morning, peaking near 24,980 in early trading.

Source: Tradingview

Nifty Auto jumped 2.3–2.4%, thanks to GST rate cuts that directly benefit auto manufacturers and ancillary firms. Mahindra & Mahindra, Maruti Suzuki, Eicher Motors, and Tata Motors saw notable surges.

Nifty FMCG rose about 1.7%, buoyed by expectations of higher rural and urban consumption due to lower GST on several daily-use goods. Britannia, Dabur, Colgate Palmolive, Emami, and ITC were standout gainers.

Nifty Realty gained 1.3%, as lower construction and related input costs are set to increase margins and spur demand.

But what are the reasons for this high optimism?

Three Major Reasons for Market Direction

1. GST Reforms and Rate Cuts

The market rally was driven primarily by the GST Council’s decision to rationalize slab rates, eliminate the 12% and 28% slabs, and cut taxes across essential items, auto, and FMCG products.

Lower indirect taxes on mass consumption goods and automobiles are expected to boost discretionary demand, spur sectoral margins, and enhance consumer sentiment. Analysts described the reform as “revolutionary” with broad positive implications for the Indian economy.

2. Anticipation of Higher Economic Growth

Projections that GST changes will accelerate GDP growth to 6.5–7% in FY26–27 fueled buying in cyclical sectors. Market strategists highlighted that reforms could trigger a virtuous “consumption upcycle” and support corporate earnings growth, creating a positive earnings and sentiment loop. The effect of recent strong GDP numbers continues to support bullish momentum in equities.

3. Technical Momentum and Market Sentiment

The Nifty and Sensex broke through previous resistance levels and formed bullish candle patterns on daily charts, encouraging further buying and short covering by traders. Support for Nifty was pegged at 24,600–24,750, with upward targets of 24,900 to 25,000 now opening up. Market mood remained optimistic as benchmarks recouped prior losses with broad-based participation

Let’s have a look at the top 3 gainers and losers till 12:50 pm.

Top 3 gainers are:

| Stock Name (Full) | Previous Close (₹) | Opening Price (₹) | Last Traded Price (₹) | % Change |

| Greencrest Financial Services Ltd (GCSL) | 271.00 | 280.00 | 322.05 | 18.84% |

| Moschip Technologies Ltd (MOSCHIP) | 192.69 | 195.10 | 224.90 | 16.72% |

| MIC Electronics Ltd (MICEL) | 51.48 | 52.00 | 59.15 | 14.90% |

Source: NSE

And top 3 losers:

| Stock Name (Full) | Previous Close (₹) | Opening Price (₹) | Last Traded Price (₹) | % Change |

| Sarveshwar Foods Ltd – Rights Entitlement (SARVES-RE) | 0.63 | 0.63 | 0.45 | -28.57% |

| Delta Corp Ltd (DELTACORP) | 95.22 | 94.35 | 89.30 | -6.22% |

| Force Motors Ltd (FORCEMOT) | 19,785.00 | 20,240.00 | 18,698.00 | -5.49% |

Source: NSE

Summary:

The Indian stock market surged on September 4, 2025, fueled by sweeping GST reforms, bullish sentiment, and technical momentum. Auto, FMCG, and realty sectors led the rally, signaling optimism for growth.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025