September 8th, Monday,

Indian equities began the week starting 8th September 2025 on a positive note, buoyed by investor optimism surrounding recent GST Council tax reforms and dovish US macroeconomic data. At the opening bell, both benchmark indices surged.

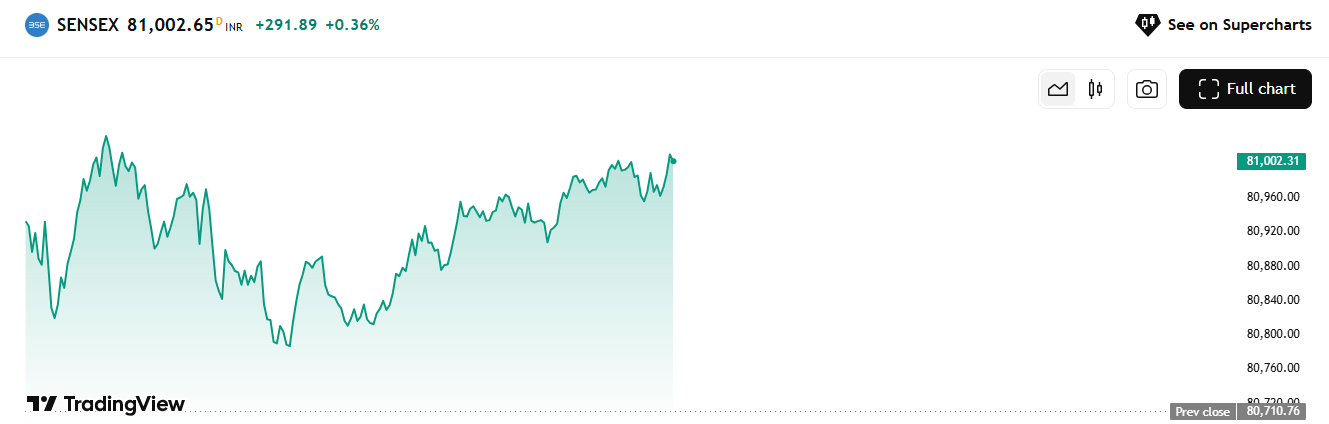

Sensex has opened nearly 200 points higher at 80,905.32, up 0.24% from the previous close of 80,710.76. By mid-morning, Sensex was seen trading at 81,002.65.

Source: Tradingview

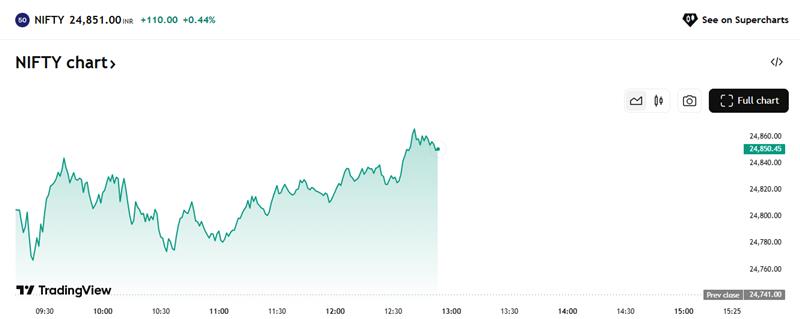

Nifty50 started at 24,804.50, gaining 64 points or 0.26% from the Friday close of 24,741.

Source: Tradingview

Through the morning session, both indices maintained a firm stance, with the Sensex rising over 250 points and Nifty scaling above the 24,800 mark by midday, reflecting continued momentum following last week’s positive GDP numbers and tax policy changes.

The auto indices led gains courtesy of upbeat GST expectations and anticipation of stronger festival-season demand. Key performers included Tata Motors and Eicher Motors, with both showing robust upmoves throughout the morning.

IT Index has underperformed due to persistent concerns about US trade relations and the specter of increased scrutiny on IT exports. Tech majors such as HCL Tech and TCS witnessed mild selling pressure.

Three Major Reasons for Today’s Market Direction

1. GST Council Reforms and Robust Domestic Macros

Recent GST rate cuts and a streamlined tax structure provided a direct boost at the start of the week. Investors expect these reforms to improve corporate earnings, especially in autos and consumer durables, thus driving initial optimism. Additionally, strong domestic GDP numbers and several leading indicators reinforced confidence in India’s economic recovery.

2. Global Market Tailwinds

US job data released over the weekend pointed to weak labor market growth, which increased hopes of a near-term interest rate cut by the Federal Reserve. Asian equities and global indices largely traded in the green, with Japanese and Hong Kong markets up, lending a supportive backdrop to Indian equities. Additionally, crude oil prices moved higher due to OPEC+ supply discipline, but the rupee remained steady, reflecting stable foreign exchange sentiments.

3. Stock- and Sector-Specific Trends

While the overall market was positive, movements were defined by sector-specific triggers. The auto sector outperformed on upbeat demand prospects, while metals found favor as infrastructure news and global cues turned supportive. Conversely, IT and FMCG stocks witnessed selective profit-taking. Broader market indecisiveness was notable as participants evaluated the sustainability of the rally and weighed near-term resistance levels around 24,900–25,000 for Nifty.

Let’s have a look at the top 3 gainers and the top 3 losers in the stock market up till 1 pm.

| Stock Name (Full) | Previous Close (₹) | Opening Price (₹) | Last Traded Price (₹) | % Change |

| Mangalam Fertilizers & Minerals Ltd (MFML) | 26.75 | 28.75 | 32.10 | 20.00% |

| Centum Electronics Ltd (CENTEXT) | 21.77 | 21.90 | 26.12 | 19.98% |

| S.A.L Steel Ltd (SALSTEEL) | 22.17 | 26.60 | 26.60 | 19.98% |

Source: NSE

And top 3 losers are:

| Stock Name (Full) | Previous Close (₹) | Opening Price (₹) | % Change |

| Asian Energy Services Ltd (ASIANENE) | 386.00 | 388.00 | -9.20% |

| Paradeep Phosphates Ltd (PARADEEP) | 200.99 | 201.99 | -8.59% |

| Mask Investments Ltd (MASKINVEST) | 153.51 | 150.45 | -8.51% |

Source: NSE

Conclusion:

In summary, Indian equities opened firmly higher on September 8, 2025, driven by optimism around tax policy reforms, favorable global cues, and sector-specific momentum in autos and metals. Major indices remained resilient above key support levels till 12:40 pm despite selective profit-booking in IT and FMCG. Sustained domestic inflows and robust economic indicators are expected to support the market, though global uncertainties and resistance near record highs may dictate the next move.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025