September 9th, Tuesday,

The Indian equity markets opened with firm gains on September 9, 2025, tracking strong global cues and robust sentiment around IT stocks.

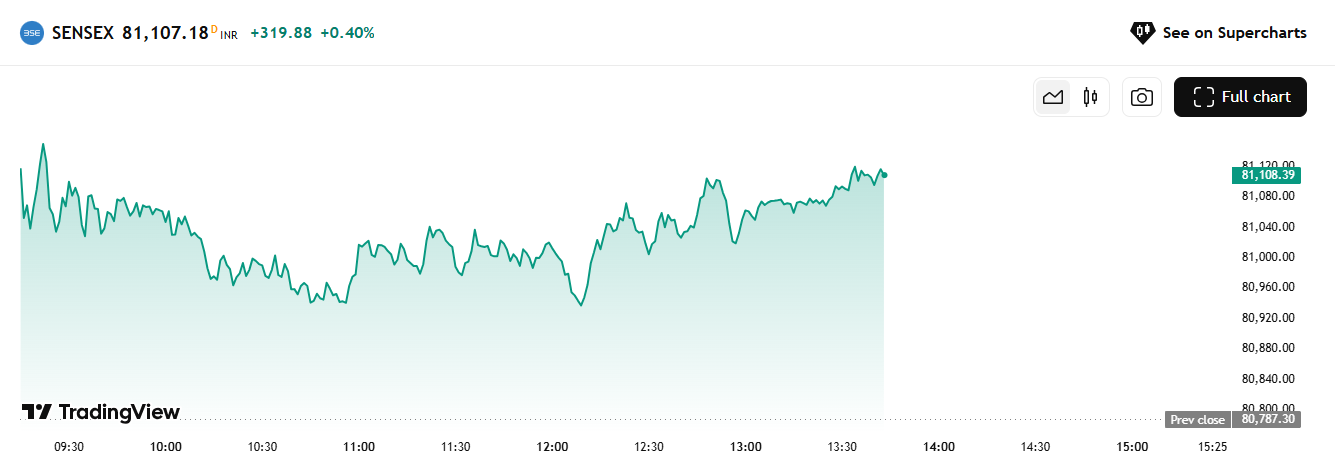

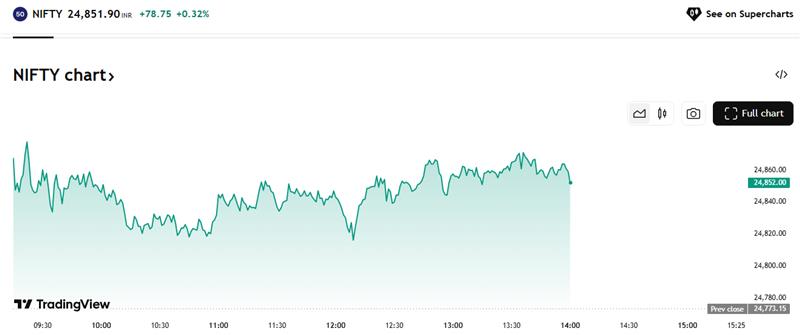

The BSE Sensex surged 323 points higher at the open to 81,102.91, while the Nifty50 advanced 82 points from its previous close, starting the day above 24,855.15. This represented a jump of 0.4% and 0.33%, respectively, reflecting optimism led by hopes of a US Fed rate cut and persistent domestic inflows.

Both indices sustained their strength through the morning, with the Sensex hovering above 81,000 and Nifty50 solidly staying above the 24,850 level into the early afternoon session. The market’s opening buoyancy quickly set the stage for an active trading day, led mainly by gains in IT, Pharma, and select financials.

By 2:00 pm, Sensex reached 81,107.

Source: Tradingview

And, Nifty50 was hovering around 24,851.9. 4

Source: Tradingview

Broader markets also participated, with BSE midcap and smallcap indices modestly in the green.

The IT index emerged as the star performer, surging over +2%. Infosys, Tech Mahindra, and TCS rallied strongly on expectations of improved client spending and a global digital transformation cycle.

Three Major Reasons for Market Direction Today

1. Global Cues & US Rate Cut Hopes

Investor optimism was buoyed by positive global cues—most notably gains in the Nasdaq and Asian indices—resulting from heightened expectations of a US Fed rate cut in September. Matured US jobs data and signals from Fed officials supported the sentiment, driving a risk-on mood across Indian equities.

2. IT Sector Rally and Stock-Specific Action

A strong rebound in IT stocks was a decisive tailwind, with key large-caps like Infosys, Tech Mahindra, and TCS contributing significant points to the index. Improved guidance, optimism on margin recovery, and renewed deal flows underpinned sector outperformance, offsetting profit-taking in Auto and Metal counters.

3. Cautious Trading Ahead of Inflation Data

Despite the upbeat mood, traders exercised some caution ahead of key inflation releases (US and India CPI) later in the week. Market analysts highlighted that signs of rising inflation and upcoming central bank commentary would determine subsequent trend direction, leading to some range-bound and selective activity after the opening burst.

Let’s also look at the top 3 gainers and losers till 2:15 pm.

| Stock Name | Previous Close (₹) | Opening Price (₹) | Last Traded Price (₹) | % Change |

| LASA Supergenerics Ltd | 10.65 | 11.24 | 12.55 | 17.84% |

| India Tourism Development Corporation (ITDC) | 544.70 | 544.70 | 641.20 | 17.72% |

| Ace Integrated Solutions Ltd | 24.10 | 24.10 | 27.95 | 15.98% |

Source: NSE

And top 3 losers:

| Stock Name | Previous Close (₹) | Opening Price (₹) | Last Traded Price (₹) | % Change |

| Sarveshwar Foods Ltd – Rights Entitlement (SARVES-RE) | 0.39 | 0.39 | 0.35 | -10.26% |

| Surana Telecom and Power Ltd (SURANAT&P) | 28.42 | 29.27 | 25.57 | -10.03% |

| MosChip Technologies Ltd (MOSCHIP) | 263.45 | 265.10 | 237.10 | -10.00% |

Source: NSE

Indian markets opened strong and maintained gains till 1:45 pm on September 9, 2025, led by a powerful IT rally and constructive global signals. While momentum persisted in technology and defensives, cyclical sectors like Auto and Metals saw profit taking. The directional bias remains positive, but traders are watching upcoming inflation data and central bank commentary to gauge the next sustained breakout or reversal.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025