When you think of Indian banks, surely HDFC Bank must be on your list? This private sector bank holds a phenomenal 15% market share in India. With a 1:1 share bonus, dividend declaration in June, and an optimistic Q1 performance, investors are looking forward to an overall analysis of this stock.

This blog highlights the notable figures from the HDFC Bank Q1 results, their recent share market performance, and their prospects.

HDFC Bank’s Steady Q1 Performance Signals Digital Strength

HDFC Bank Ltd shared an update on their first quarter performance for FY26 on 19th July, 2025. The bank has grown both its loans and deposits compared to the same period last year. It shows that more people and businesses are trusting the bank with their money. Such growth is often considered a positive indicator for any bank.

However, one small change that stands out is a dip in the CASA ratio. This ratio shows how much of the bank’s deposits come from low-interest savings and current accounts.

A drop in this number might mean that more customers are now putting their money into fixed deposits to get better returns. This is common when people expect interest rates to stay high. Let’s take a quick look at HDFC Bank’s latest update for the first quarter of FY26.

Key Financial Highlights

HDFC Bank showed strong financial strength in the first quarter of FY26. The bank’s total advances under management reached ₹27.82 lakh crore as of 30 June 2025, which is an 8% rise compared to the same time last year. Every quarter, growth was steady at 0.3%, showing that lending activity has stayed stable.

The average advances under management stood at ₹25,327 billion, up by 0.8% from the previous quarter. The Net Interest Margin (NIM), which tells how much the bank earns from its lending after interest costs, came in at 3.47%. The cost-to-income ratio stayed at 41.0%, showing that the bank managed its spending well.

The Gross Non-Performing Assets (NPA) ratio was at 1.33%, while excluding agricultural loans, it was even better at 1.16%. The bank’s profit after tax stood at ₹162 billion, with earnings per share (EPS) for the quarter at ₹21.3. The Return on Assets (RoA) was 1.9%, while the capital adequacy ratio stood strong at 19.3%, with the CET1 ratio at 16.8%.

P&L Summary Table

| Particulars | Q1 FY24 (₹ in Billion) | Q4 FY24 (₹ in Billion) | Q1 FY25

(₹ in Billion) |

QoQ Change (₹ in Billion) | YoY Change (₹ in Billion) |

| Net Revenue | 350.6 | 807.0 | 724.2 | -10.3% | 106.6% |

| Operating Expenses | 151.8 | 491.3 | 465.5 | -5.3% | 206.7% |

| Provisions | 32.9 | 138.1 | 31.4 | -77.3% | -4.6% |

| Profit Before Tax | 165.9 | 177.6 | 227.3 | 28.0% | 37.0% |

| Consolidated Profit | 123.7 | 176.2 | 164.7 | -6.5% | 33.1% |

HDFC Bank Sees Strong Growth in Deposits and Loan Assignments

In the first quarter, HDFC Bank’s deposits increased by 16.2% year-on-year, reaching ₹27.64 lakh crore in Q1FY26. Compared to the previous quarter, deposit growth stood at 1.8%. The average deposits during the quarter were ₹26.58 lakh crore, showing a yearly rise of 16.4% and a quarterly growth of 5.1%.

Apart from that, the bank also efficiently managed its balance sheet. It securitised or assigned loans worth ₹3,300 crore, which means it sold or transferred some of its loan assets to other financial entities. This helps the bank manage its financial structure better and create space for fresh lending.

In the latest quarter, HDFC Bank reported a modest yet positive shift in its loan-to-deposit ratio, which declined from 97.3% to 96%, driven by deposits growing at a faster pace than loans.

Significant updates and actions

Let’s check some major updates, actions, and announcements shared recently by HDFC Bank.

- HDFC Bank has recently completed a significant 1:1 bonus share issue, granting all shareholders one extra share for each held as of 27 August 2025.

- In July 2025, HDFC also declared a special interim dividend of ₹5 per share

- The bank also paid the highest final dividend of ₹22 per share in June 2025.

Now, given these updates, let’s analyse HDFC Bank’s stock performance in the last few months.

How is HDFC Bank performing in the stock market?

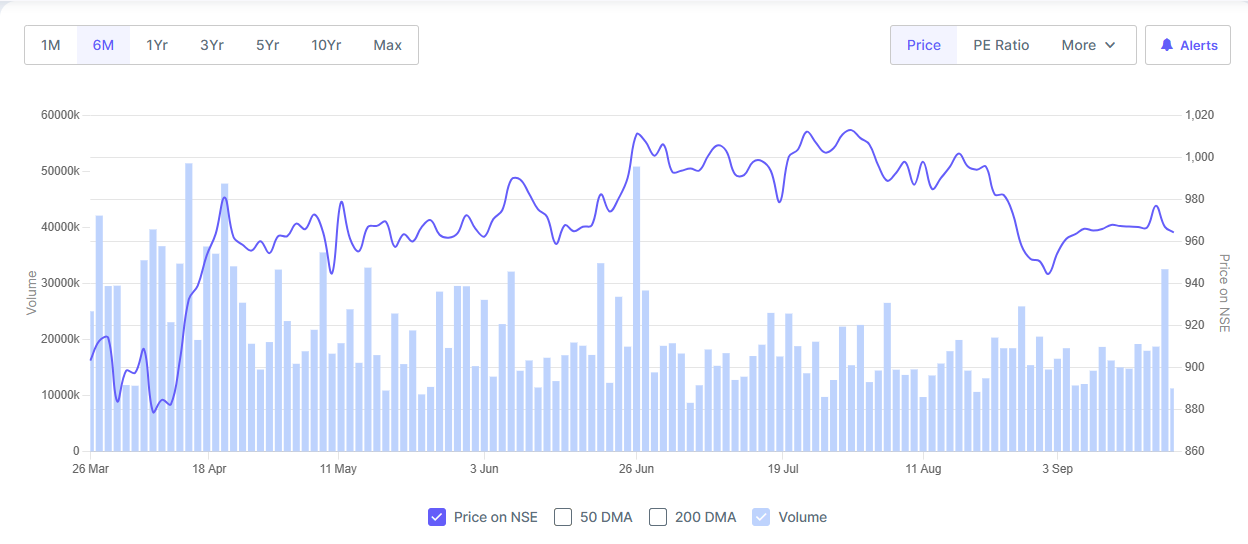

The chart below showcases HDFC Bank’s stock market performance over the last 6 months.

As of 22nd September 2025, HDFC Bank is trading at ₹965.4, up 11% over the last 1 year.

HDFC stock has maintained a generally positive trend. The stock peaked at ₹1,018.85 on July 24th, 2025, a few days after its Q1FY26 result announcement.

Ever since the peak, it has maintained a range of ₹960-₹1000, demonstrating relative stability. The 52-week low is around ₹806, meaning the current price is still up significantly from those lows.

Metric |

HDFC Bank |

ICICI Bank |

Kotak Mahindra Bank |

Axis Bank |

P/E Ratio (forward / recent) |

~ 21× |

~ 19x |

~ 21× |

~ 12.7× |

ROE (Return on Equity) |

~ 13.5 % |

~ 17 % |

~ 12.6 % |

~ 14.9 % |

Last Traded Price |

965.4 |

1401.5 |

2021.7 |

1144.5 |

Market Capitalisation |

14,82,043.2 |

10,02,375.9 |

4,02,153.1 |

3,54,946.6 |

HDFC Bank leads with a 15% market share, a P/E ratio around 21×, and a decent Return on Equity (ROE) of 13.5%.

ICICI Bank has a slightly lower P/E of 19x, but boasts a higher ROE of 17%. Kotak Mahindra Bank has a similar P/E of 21× but lower ROE of 12.6%, while Axis Bank offers a more attractive valuation with a 12.7× P/E but a moderate ROE of ~14.9%.

Future Outlook

HDFC Bank’s future outlook remains positive as it leverages digital innovations and expands its retail and corporate banking services. Its strong capital adequacy, growing advances, and focus on improving the CASA ratio strengthen its financial stability.

The recent 1:1 bonus issue and dividend payouts demonstrate confidence in sustained growth. Strategic initiatives to enhance customer experience, expand branch networks, and integrate technology will help maintain its dominant market position. Despite industry challenges, HDFC Bank’s prudent risk management and strong fundamentals position it well for long-term value creation and returns for investors.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025