Indian Stock Market Shows Signs of Caution Today

August 28, 2025

August 28th, Thursday The Indian stock market opened with caution today, Sensex at 80,337.43 (previous close: 80,786.54), down by 0.56%. The Nifty 50 opened at 24,592.25 (previous close: 24,712 ), dropping 0.48%. By mid-morning, Sensex picked up a bit and reached 80,540. Source: Tradingview Similarly, Nifty50 also climbed up in the early hours to reach […]

A Glance at the Stock Market India Today: Factors that Led to the Downward Movement

August 26, 2025

The Indian stock market faced a weak start this morning, with Sensex opening at 81,377.39 (previous close: 81,635.91) and crashed nearly 700 points to hit an intraday low of 80,940.67. The Nifty 50 opened at 24,899.50 against the previous close of 24,967.75 and dropped by almost 1% to its day’s low of 24,755.60. Source: Tradingview […]

Top ELSS Mutual Funds and Other Tax Saving Investments in India 2025

August 26, 2025

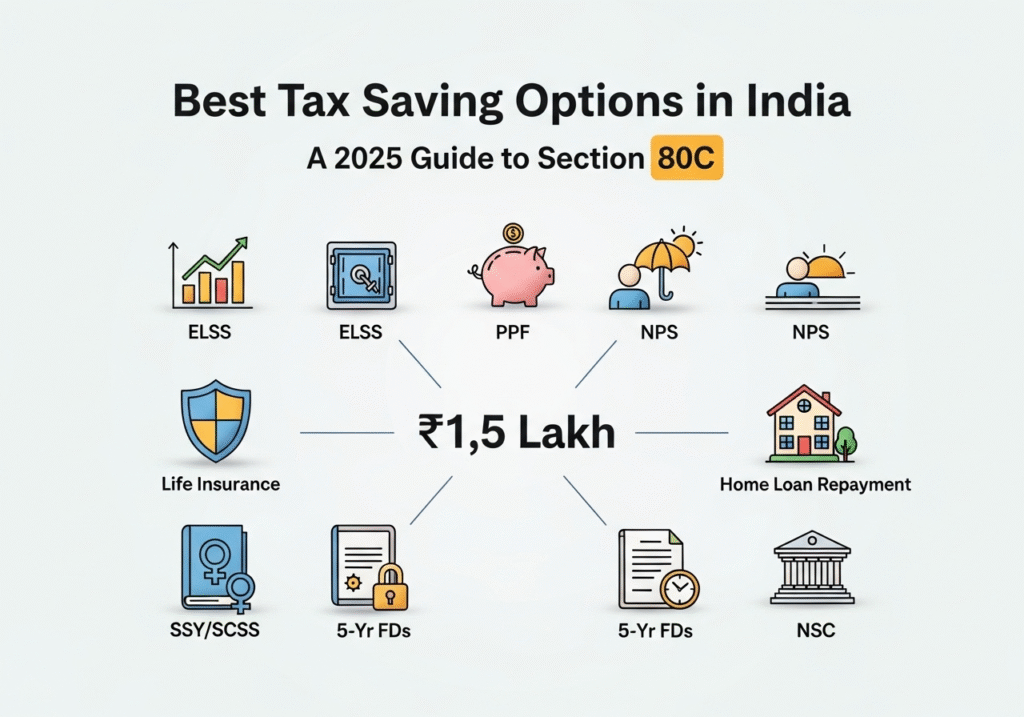

Saving tax is a smart way to manage personal finances, and Section 80C of the Income Tax Act remains one of the most popular avenues for doing so in India. A sum of ₹1.5 lakh is the maximum amount of money on which individuals can claim deductions made from investments and expenses that are eligible […]

Is Ola Electric share price worth tracking? Get insights on price and GMP

August 25, 2025

Ola Electric is a company renowned for its innovative green solutions and has established a strong presence in the electric vehicle market. It is essential to track the company’s share price, as it reflects the market’s perception of the company and its performance in a rapidly evolving industry. This blog has the current updates on […]

Stock Market Today: Signs of Positivity Shine Through the Market!

August 25, 2025

This morning, benchmark indices Nifty and Sensex opened on a positive note, tracking a rally in global markets. While the Sensex opened at 81,501 (Previous Close: 81,306), Nifty50 opened at 24,949 (Previous Close: 24,870). Source: Tradingview Source: Tradingview Even the midcap and small indices showed a positive trajectory. Additionally, some sectoral indices such as Nifty […]

Why is the Nifty 50 and Sensex down today?

August 22, 2025

Friday morning witnessed a weak start with the Sensex down by 400 points and Nifty50 falling below the 24,950 mark. In this mini blog, we uncover why stock market is falling today in India. Source: Tradingview (As of 22nd August, 2025) This sharp decline comes in around the same time as SEBI Chairman’s proposed directive […]

Should You Apply for the Shreeji Shipping IPO? Review with Latest Insights

August 22, 2025

Shreeji Shipping is preparing to launch its initial public offering (IPO), attracting interest with its business model in the maritime sector. The offering presents a chance to participate in a company active in the shipping and logistics industry. Here are the latest updates on Shreeji Shipping’s IPO, including the current Grey Market Premium (GMP), price […]

Patel Retail IPO details: What Investor Need to Know Before Listing

August 21, 2025

Patel Retail is a reputable company that has been operating in the retail sector, supplying consumers with a variety of products. IPOs are quite important in the stock market as they provide the companies with the opportunity to raise funds and the investors with a piece of their expansion. The present blog intends to disseminate […]

Vikram Solar IPO GMP Insights and Listing Price Prediction Explained

August 21, 2025

Vikram Solar, an upcoming Indian company operating in the solar energy sector, is coming with its awaited IPO. As the clean energy market thrives, such an offer is a chance to know a company with more than twenty years of expertise and a considerable market share. Read the blog for the latest insights on Vikram […]

The Compound Effect: How Tiny Habits Quietly Build Massive Wealth

August 8, 2025

Have you ever dreamed of finding the “perfect” investment that would make you wealthy overnight, winning the lottery, or landing your ideal job? We’ve all been there: searching for a quick fix to make a lot of money. But what if I told you that flashy tricks and quick wins aren’t the secrets to building […]