How the RBI Monetary Policy 2025 Will Influence Inflation and Economic Growth

July 9, 2025

The RBI monetary policy 2025 is a tale of two positive sides: rising growth and falling inflation. After facing the highs of inflation and global uncertainty for a long time, the Indian economy is now showing signs of strength and stability in the overall economy. Recently, the Reserve Bank of India (RBI) announced a few […]

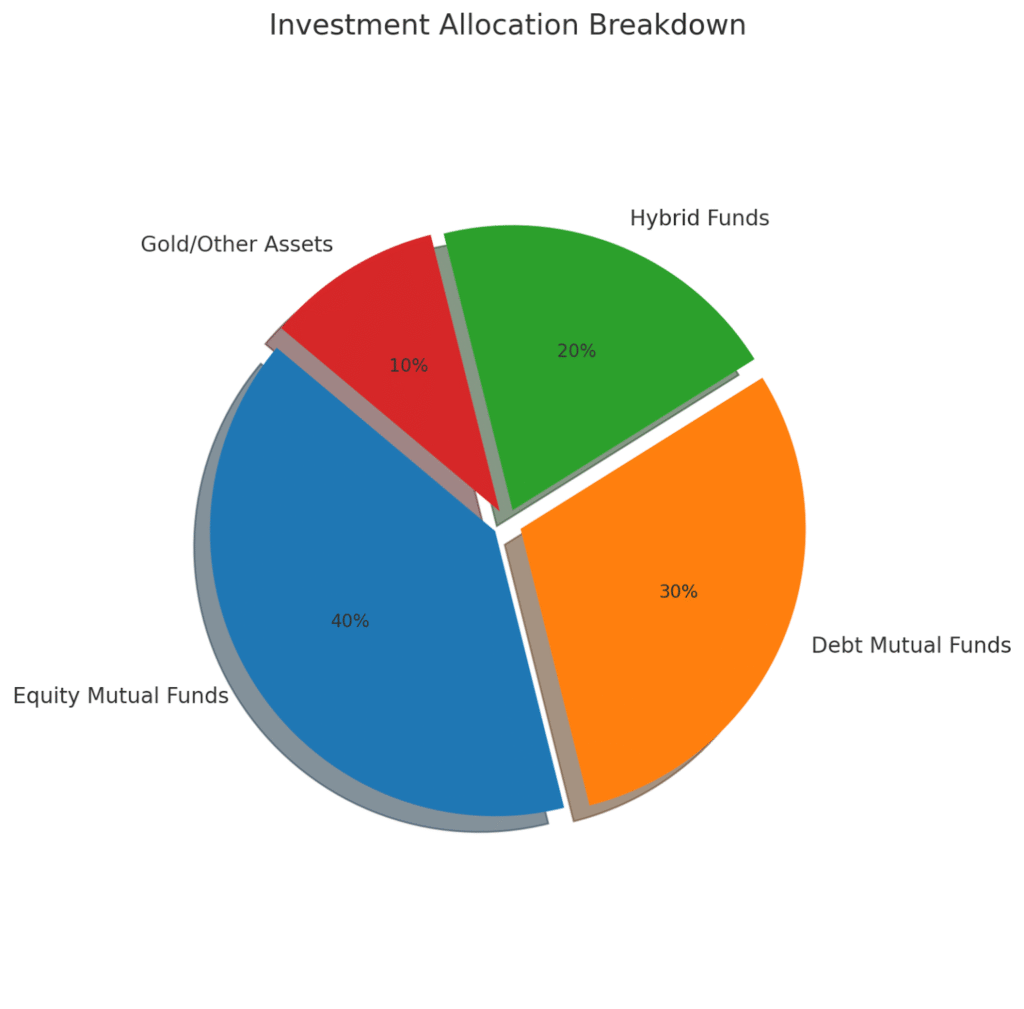

Mutual Funds Portfolio Enhancement: Complete Guide for Expert Tips

July 8, 2025

Are mutual fund terms too confusing to act on? Read this blog for a clear path to mutual fund portfolio enhancement. Started investing in mutual funds lately, but somehow your returns don’t match your expectations? It’s a common gap between putting your money and actually knowing how it’s working for you. While India’s mutual fund […]

Save Big in 2025: Best Tax Saving Options in India

July 7, 2025

Worried about paying too much tax this year? Find out which tax saving options in India can help, read our full guide! Balancing household expenses while trying to grow your savings is becoming harder and harder each year. With incomes rising and spending patterns changing, many families find themselves paying more in taxes than they’d […]

What a Beginner Investor Journey Really Feels Like: A Year in Review

July 7, 2025

Afraid of making mistakes in your beginner investor journey? Here’s my first-year experience that shows how to avoid the common traps. The value of money doesn’t stay still, it quietly erodes over time. In December 2024, annual inflation rate spiked to 5.22% overall, with food inflation at a striking 8.39%. With the cost of living […]

Top 5 Daily Income Strategies for Long-Term Wealth

July 4, 2025

Can income now mean wealth later? These 5 investment strategies offer consistent earnings and long-term growth security. Read the blog to learn more! Waiting years to see your investments pay off is not something any of us want. Nowadays, more and more people are looking for options that offer regular returns, so they can earn […]

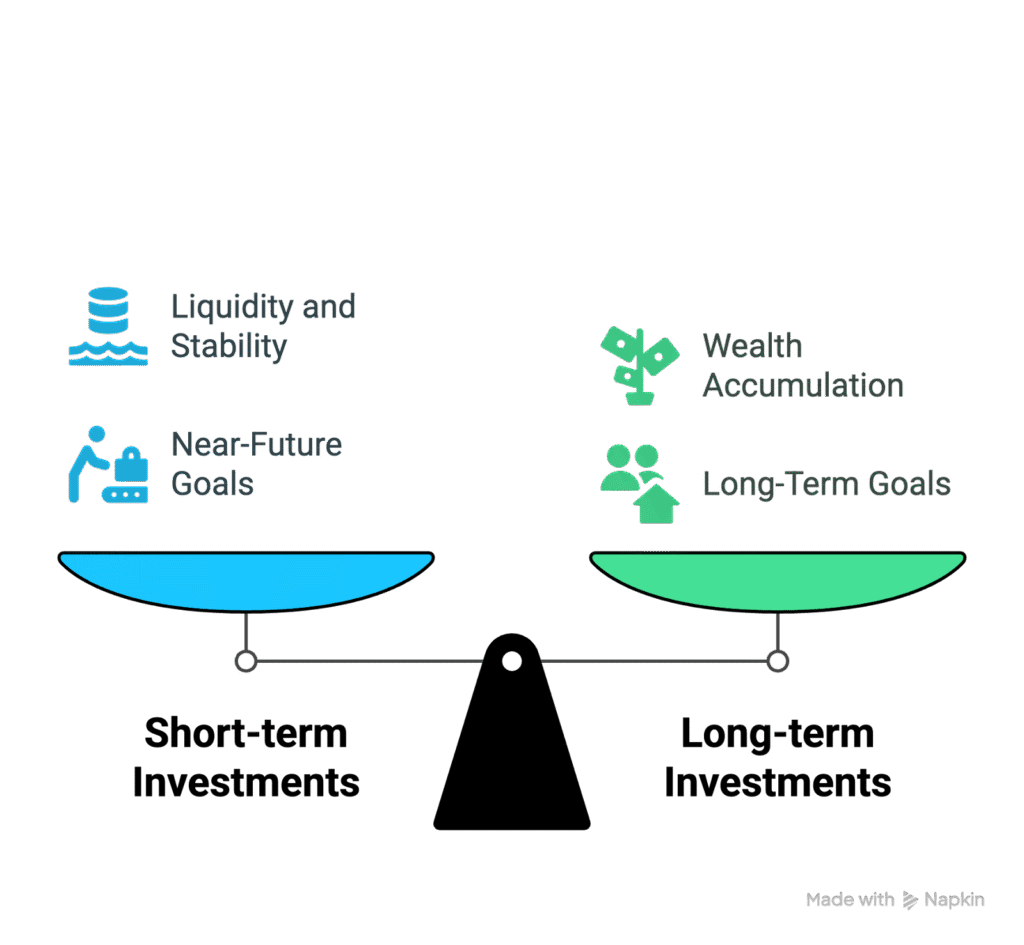

Smart Investments for Young Adults: From Short-Term Investments to Retirement

July 3, 2025

From short-term investments to retirement planning, secure your future with smart financial strategies. If you’re in your 20s or early 30s, chances are investing feels like something you’ll think about later in life. Maybe after you earn more, pay off a student loan, or finally “understand” the markets. However, you don’t need to be a […]

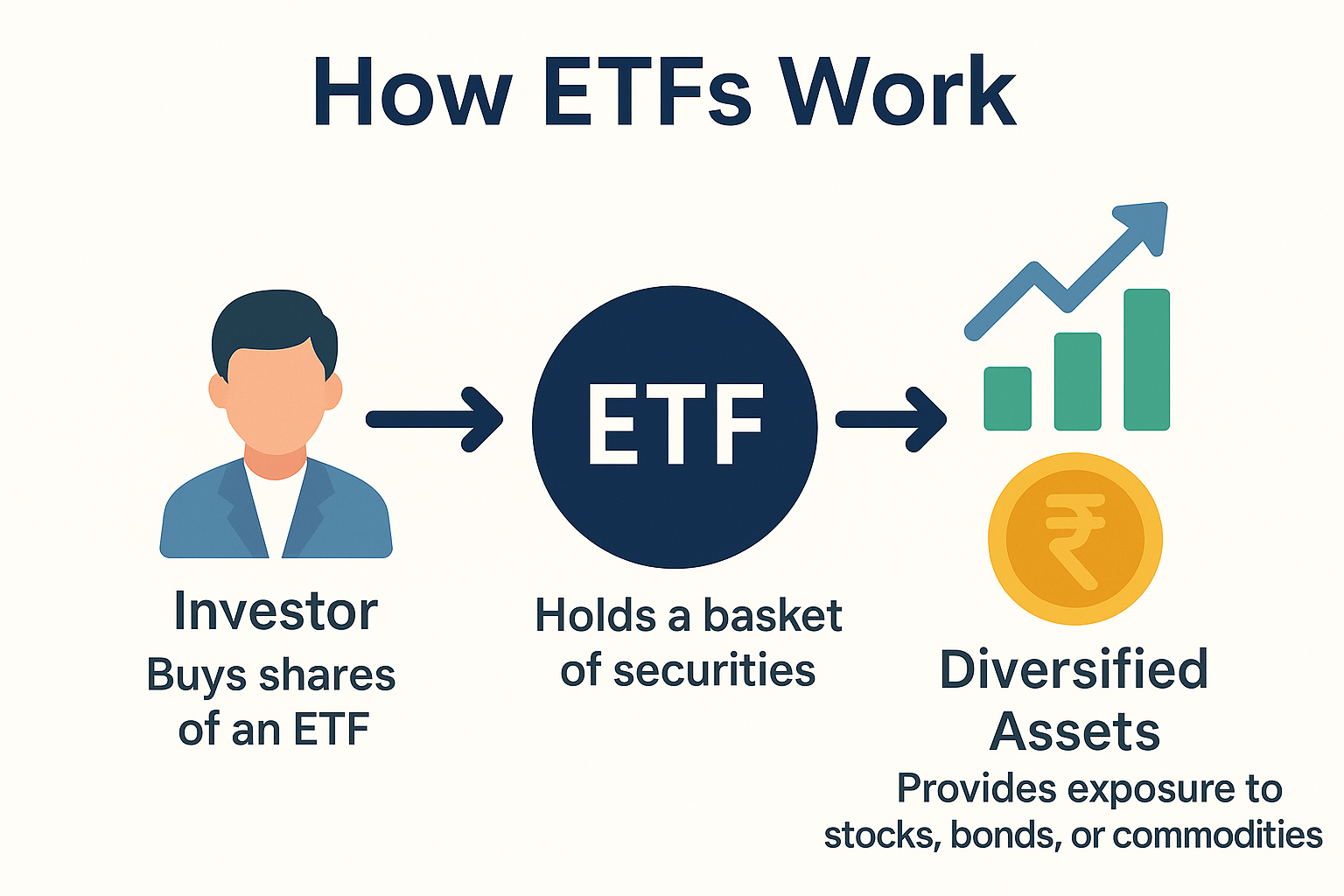

Smart Investing for Beginners: A Guide to ETF Investment in India

July 3, 2025

Breaking down the concept of ETFs in simple terms and explaining why they’re a smart starting point for new investors. Exchange-traded funds, or ETFs, are rapidly becoming one of the most popular investment assets globally. With markets growing and rising, ETF investment in India has become a core part of passive investing strategies across diverse […]

Understanding the Objectives of Financial Planning: Top 5 Goals

July 3, 2025

Want financial clarity? Read about the top 5 objectives of financial planning here in-detail in this blog! Many of us struggle with managing expenses, saving for our goals, or feeling confident about our future. Without a clear plan, financial stress can stand in the way of achieving your financial dreams. That’s where financial planning can […]

India Finance Headlines: Key Updates from June 2025

July 2, 2025

Missed the big financial stories of June? Here’s your power-packed rundown of India finance headlines and why they matter to YOU. June has been anything but ordinary for India’s financial ecosystem. From major RBI moves to market swings driven by global tensions, the month was packed with action that kept investors, analysts, and everyday taxpayers […]

Crypto vs Equity Investing: What’s Right for Beginners in 2025?

July 1, 2025

Choosing between crypto vs equity investing can feel like choosing between two very different worlds. While stocks have powered retirement portfolios for decades, cryptocurrencies made headlines when Bitcoin jumped over 60% in 2024. In the same period, Nifty 50 delivered an 8.86% gain. For many first-time investors, understanding each market’s volatility comparison and risk profiles […]