Table of Contents

Valuable finance content keeps existing customers engaged and strengthens their connection with the institution. Learn more!

Introduction

In this rapidly changing financial world, where trust and transparency are most important, financial firms have to not only provide competitive products but also create connections that matter to their customers. This is the point at which content marketing becomes significant.

Today, Gen Z and Millennials are the trendsetters, and winning their trust is a complex challenge since they are unswayed by traditional marketing tactics, preferring digital-first experiences instead.

As per a report, 74% of surveyed people feel overwhelmed by ads, while 63% use ad blockers online and 99% of Gen Z consumers would skip ads. More interestingly than this, young consumers actively seek information about products before making a purchase decision, with approximately (85%) having researched on a brand they bought from.

Thus, by leveraging content, financial institutions can improve brand awareness, educate buyers, earn trust and eventually drive business growth.

Why is finance content essential?

Traditional marketing in finance was product-centric and formal. Today, the digital age demands a customer-centric approach.

Source: VectorStock

People crave financial knowledge, making informative and engaging finance content a powerful tool.

This content should be:

- High-value and educational

- Compelling and interesting

- Snackable and digestible across formats (blogs, videos, infographics)

- Simple and easy to understand for all audiences

- Timely and relevant to current events

Empowering content with tools builds trust and positions financial institutions as thought leaders. Provide calculators, apps, or website features that help customers, like an EMI calculator helping them estimate monthly payments. This fosters financial control and builds brand trust.

This strategy is also crucial in a competitive landscape with new disruptors emerging constantly.

Benefits of financial content

This is how content marketing gives power to financial institutions:

Source: Justwords

1. Building trust and credibility: Valuable and informative content makes the financial institutions finance leaders. Quality finance content breeds trust and makes them appear reliable counsellors; hence customers tend to look at them beyond mere service providers.

2. Enhanced customer acquisition and retention: High-quality content draws in prospective clients seeking financial guidance. Engaging blog posts, social media content, and informative webinars can be like magnets that pull in new customers wanting to learn or probably convert. Moreover, it is essential that the content keeps the present customers involved as well as strengthens their connection with the company.

3. Promoting products and services: Informative content about specific products and services can be integrated into the overall strategy for content development. This approach allows financial institutions to highlight benefits provided by their offerings without resorting to direct sales talk.

4. Educating and empowering customers: Many people still lack financial literacy. Bridging this gap can be done through finance content. Institutions may develop educational resources which explain intricate financial ideas in simple ways. This enables customers to make knowledgeable choices about their finances, cultivating a feeling of empowerment and allegiance.

Who stands to gain from content marketing?

While content marketing offers a wealth of benefits for all financial institutions, here are some specific categories that can see significant advantages:

Banking institutions: Finance Content can fill the gap between traditional banks and younger generations who spend most of their time on the Internet and are aware of recent technological advancements.

Budgeting resources, savings tips, and responsible credit card usage materials could be used to attract new market entrants by demonstrating how much you know about their finances.

Investment firms and wealth management companies: Since these companies target high-net-worth individuals, they can use finance content to demonstrate their expertise in various investment strategies and market analysis.

Whitepapers, long-form articles or webinars on specific asset classes can help them become credible advisors to sophisticated investors.

Fintech startups and online lenders: The newcomers into the financial market may use content marketing techniques to build their brand reputation and credibility.

Informative content that elucidates their new products and services can pique interest and draw in customers who are reluctant to transition from conventional providers.

Diverse formats for finance content

Versatility is what makes content marketing so attractive. Financial institutions can select from various content forms to cater to the varied preferences and learning approaches of their diverse audience.

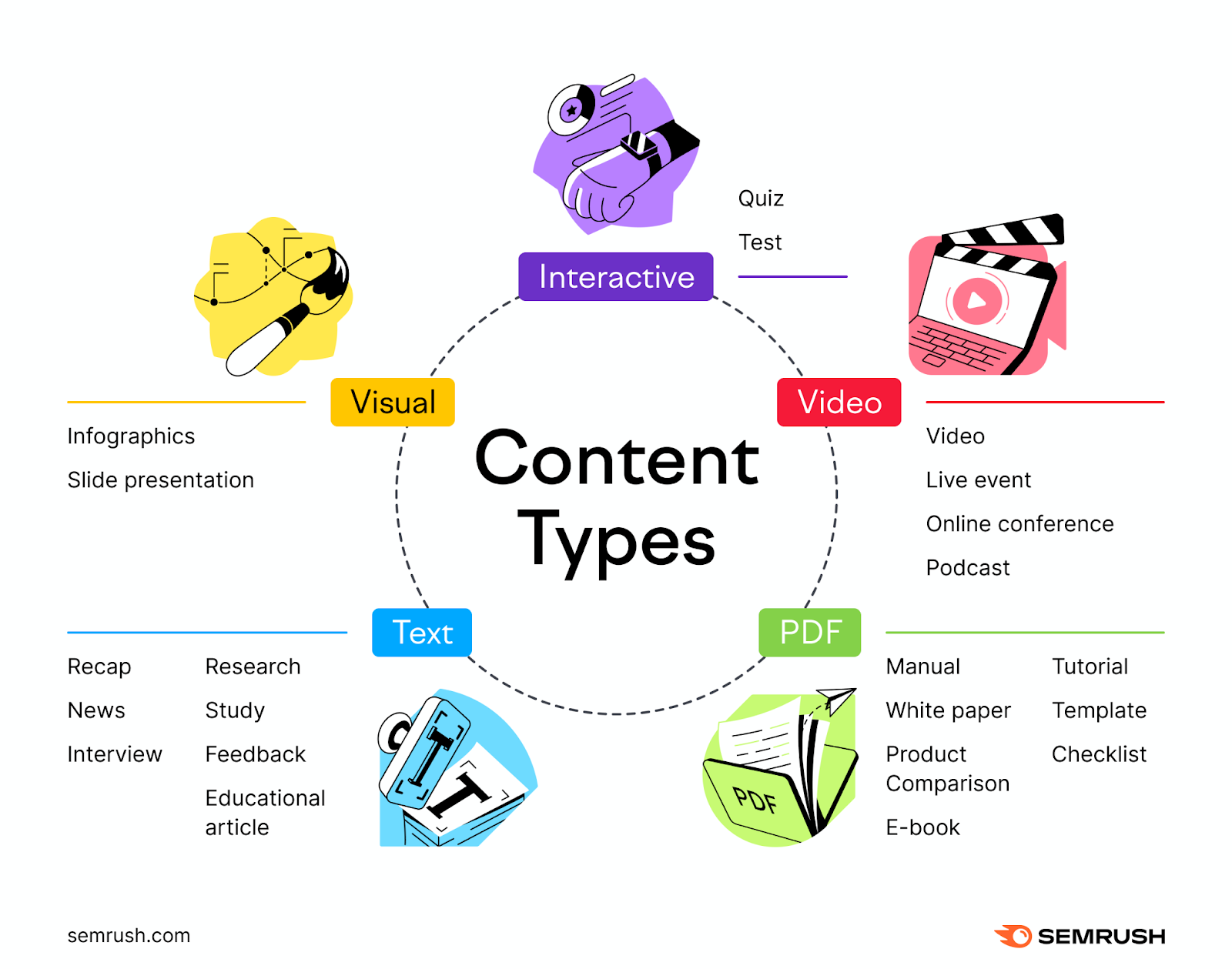

Source: Semrush

Here’s a glimpse into the diverse content landscape:

- Blog posts: Regularly updated blogs filled with informative and relatable writing on budgeting, saving for specific goals, managing debt, and understanding different financial products can form the basis for any financial institution’s finance content strategy.

- Infographics and videos: Visual formats, such as infographics or videos, can make complicated financial topics more interesting and understandable. They can be used especially when there is a need to simplify complicated matters.

- Ebooks and whitepapers: When it comes to detailed analysis of intricate fiscal topics, ebooks and whitepapers are invaluable resources. Some of these may include subject matters such as tax optimisation, retirement planning, or navigating through the intricacies of the stock market.

- Podcasts and webinars: Audio podcasts along with interactive webinars allow extensive discussions about finance matters. Industry experts and financial advisors can engage in conversations, answer questions, and provide real-world insights—winning the hearts of their listeners.

- Social media content: Posting bite-sized engaging content across social media platforms like Twitter, Instagram, or Facebook helps in creating brand awareness while also maintaining customer awareness on top. This can include financial tips, industry news snippets, and interactive polls.

Tips for getting started with content

The universe of financial content marketing is immense and continually changing.

Here are some tips for financial institutions seeking to embark on this strategic journey:

1. Understand your audience: Successful content marketing begins with a clear understanding of the people you want to target. Demographic factors, levels of financial literacy and preferred forms of content all play an essential role in shaping a tailored content strategy.

2. Concentrate on value and significance: Make sure to create content that has real meaning to the people it reaches. Target their areas of concern, address their questions and make them financially knowledgeable.

3. Consistency and quality: Content marketing is not a sprint; it’s rather a marathon. Develop a consistent publishing schedule while ensuring high-quality standards across all formats.

At Investcon Market Intelligence, we believe that creating finance content goes beyond mere text; it’s about shedding light on the journey towards knowledgeable financial choices. We serve as a lighthouse of financial acumen, offering a range of services that go beyond the usual.

Our equity research reports offer meticulous stock analysis, while our industry reports give a broad perspective of various sectors, tailored to meet distinct client requirements. Our white papers radiate proficiency, and our finance content services span a wide range of financial subjects. In essence, we’re not just about words, we’re about guiding you towards informed financial decisions.

Final thoughts

Financial institutions can use content marketing to thrive in the digital era. It is through creating informative and engaging content that financial institutions can gain trust and build credibility with their clients, enlighten them on personal finance, ultimately leading to business growth.

This approach works best since it is geared towards attracting younger generations who are suspicious of traditional advertising methods and depend so much on digital resources for informed choices.

Ready to leverage content marketing for your financial institution? Let’s discuss how we can create a strategy that resonates with your target audience and achieves your business goals.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025