Table of Contents

Money is mysterious, and everyone strives to know its secret. These top 10 lessons from Morgan Housel can take you closer to it. Read this blog to learn more.

The topic of money is deceptive – One person would advise to spend it wisely, and the other would advise to invest it wisely. There are conflicting views and experiences in the world. However, a person has tried to accommodate the best of it in his best-selling book- The Psychology of Money. He is a famous columnist- Morgan Housel.

His books provide the best insights into money, investing, risk, opportunities, and happiness. Explore these top 10 lessons about money by Morgan Housel in this blog.

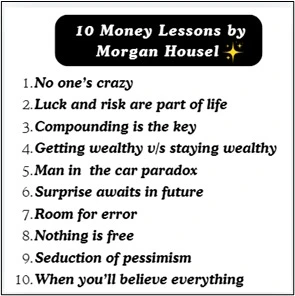

No one’s crazy

Every individual is a byproduct of various factors and situations. A sane perspective of investing for one person would seem insane to another, as that person’s experiences differ. So if you find someone crazy, know that person would have a different logic than yours.

For example:

People born at the start of the 2000s in India would have experienced a boom at the beginning of their investing journey when Indian equity market returns outperformed other equity markets in the world.

Luck and risk

Individual efforts are always accompanied by luck and risk. Not accounting for them would be a big mistake for investors. One should be financially sound enough to curb any risk to stay in the game for long. It is also the reason people advise diversification.

For example:

A person invests in a stock with good fundamental conditions and trends. However, on the next day, the CEO dies by accident. This mishappening shakes the investor’s confidence in the market, and the stock falls significantly. However, this is very incidental, so if the investors have other well-performing stocks in the portfolio, they can wait for the volatility to settle down as the company prospects are good.

Confounding compounding

Compounding, in a general sense, refers to when the value of an asset increases based on its principal and the accumulated interest. The power of money compounding over a considerable period is magical, but it costs in the measure of time. An investment continuously generating good returns in a long time is more beneficial than an investment that quickly pays high returns. Sustainability is the key to successful investment.

For example: Warren Buffet is usually regarded for his investing skills, but the real driver of his success is the time, for which he is persistently making wise investments. One such investment is in Coca-Cola, where his company bought total shares of $1.3 billion, which are worth $24.7 billion in 2024. His wealth has grown over the years, and time is the heroic element of his compounding success.

Getting wealthy vs Staying wealthy

One can earn good returns in a single day if the market breaks its records that day. However, the taste of this success only stays when the returns are sustained over a longer time. Getting wealthy can be a one-time thing, but staying wealthy involves fear, uncertainty, volatility, etc. The investors capable of sustaining through these factors stay wealthy over a long time.

For example:

Warren Buffet saw multiple recessions in his lifetime and sustained them. There were losses, uncertainty, changes in strategies, and partners leaving the side, but all this didn’t break him, due to which he sustained and successfully earned marvellous returns.

Man in the car paradox

Humans have this weird behaviour of wanting others to admire them due to their wealth. However, in reality, people do not admire the person owning that wealth, rather they set a benchmark for themselves to be in the possession of that wealth. So, the objective of owning wealth should be personal rather than public display. For example:

A person owning a villa would want others to admire him. However, people would bypass that villa casually, and would admire it, to be in their possession.

Surprise

Markets are not based on history. What happened in the past will not certainly occur in the future. So, forecasting the future based on the past is misleading. The structural changes causing outlier events in the future may certainly be missed, as every event has its-‘first’ sometime.

For example:

A person who would have thought that investing in the stock market is risky would have missed the returns earned in those 2-3 years.

A room for error

The future is uncertain, and markets are unbeatable. History may or may not repeat in the future. So, having a margin of safety for this uncertainty provides a cushion. It is also why experts advise planning for retirement in the early years, and that too with different instruments. Because if one investment doesn’t provide the expected returns, one should have another to fill in the gap.

For example:

The writer, Morgan Housel, assumes that the returns he will obtain will be lower than the previous market averages. So, with this probability, he saved more in the present to account for any error in the future.

Nothing is free

Every benefit has a cost attached to it. Sometimes, it is evident, while sometimes it is hidden. Somehow, when a person can figure out the fee to be paid (directly or indirectly) and decide whether he/she is willing to pay it, this analysis changes the mindset.

For example:

In a market, when investors stick to their investments even during volatility, they are rewarded later. If an investor accounts for volatility as the fee rather than as a fine during such times, then his mindset would favour him to stick to the long term. The volatility, regret, fear, and doubt accompanying are the fees paid for these returns.

Seduction of pessimism

Investors would not notice the 1% rise in the market but would panic if there was a 1% fall. It is a human tendency to focus on the negatives rather than the positives. If a person is optimistic about markets moving up, people would find it as a sales pitch for something. However, if that similar person talks about the market falling in the future, people would think he is safeguarding them before the situation. The fact is that, however, the market is going to adapt to it.

For example:

The product of a company takes years to make a place in the market, but its decline takes just one bad news.

When you’ll believe everything

A story well told is more powerful than a fact just mentioned. If people believe something to be true then they are unwilling to assess the probability of it and would stick to the convincing immediate story. Moreover, we always want to believe that everything is in control rather than accepting that we are ignoring the ancillary facts that can affect our control.

For example:

People want to believe analysts, predicting high returns for the upcoming year rather than anticipating returns similar to market averages for the past few years. If we account for them, provisions would be made, and thus accuracy would increase.

Conclusion

All the lessons by Morgan Housel are comprehensively combined in these 10 lessons. They are unique and surely very thought-provoking. One can change his/her game of investing and wealth management by implementing these lessons.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025