Table of Contents

Money is a tool that can help us achieve our goals. And our children should understand this from an early age. Here’s how.

Little ones are usually only aware of the value of anything if you explain it to them. Likewise, managing money is something that takes time to come naturally.

One needs to face and have first-hand experience to understand how money works and how to manage their wealth. This is why having a solid grasp of managing finances from an early age is so important.

Financial literacy is becoming more critical for young children today, given how quickly the world is changing.

Financial literacy for children includes more than just careful spending; it also includes the art of saving and investing.

While talking about money in India still seems like an “odd” family topic to discuss, in today’s article, we will ponder why your child needs to be financially literate from a young age and how you can make them aware of money management in some practical ways. Stay tuned!

What does financial literacy mean?

The term “financial literacy” describes how well one can learn and apply various money-related skills, such as budgeting, saving, and personal finances.

Being financially literate enables someone to achieve financial security by helping them become self-sufficient.

Knowing how to manage your money sensibly is the essence of financial literacy. Even in adulthood, many individuals still struggle with financial literacy.

This is usually because of the wrong ideas or a need for knowledge about what it involves.

Being financially literate is all about how a person goes about their day-to-day interactions with money and how they see it.

Why is financial literacy so important from a young age?

Financial literacy helps one become self-dependent and financially secure.

Everything from managing finances, setting priorities, and budgeting to paying bills and making retirement plans is included in money management.

Those who are financially literate not only handle money a lot better, but they also have a greater chance of overcoming financial difficulties because they know how to avoid or deal with money-related problems when needed.

For example, whether it’s an emergency hospital visit or an unplanned expense, it’s always crucial to have some cash on hand.

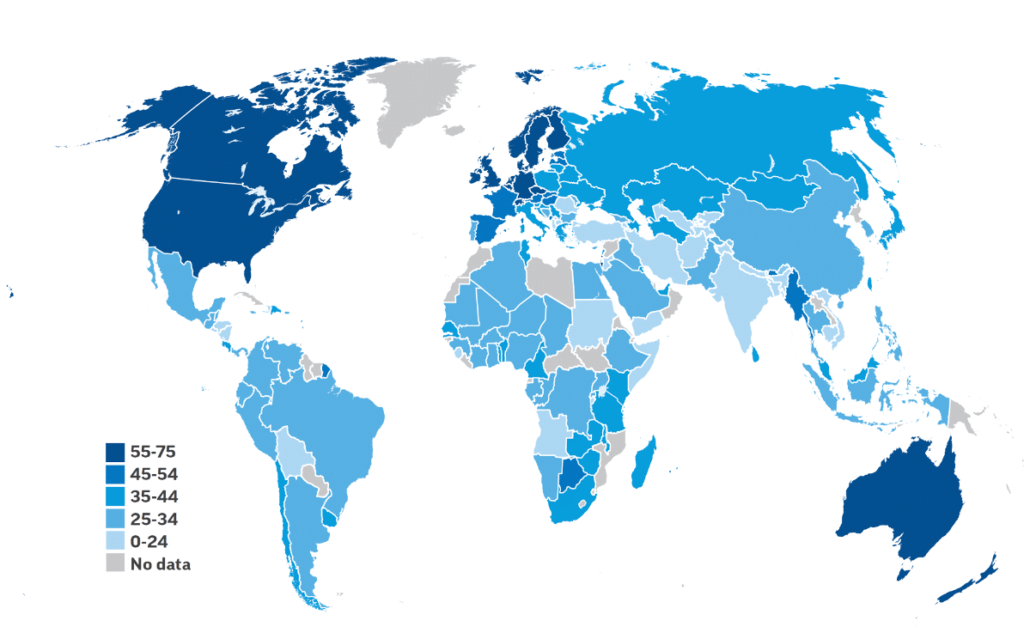

Only 33% of adults worldwide have satisfactory financial knowledge, according to the FinLit survey by S&P Global. One of the nations with the highest percentage of financial literacy in the world may be India.

With 27.6% of its 25- to 44-year-old population still taking part in the financial inclusion project via financial education, it seems like a doable opportunity for the country.

Source: S&P Global FinLit Survey

This is why, as parents, teaching your kids the value of money and how to handle it responsibly should be one of your priorities.

Children have more opportunities to learn healthy money management the more parents talk to them about money from a young age.

Youngsters who develop sensible and practical financial habits early in life are more likely to become financially aware and self-sufficient adults.

Practical tips to teach kids about financial literacy

Early financial education can help your kids become savers rather than spenders.

That said, let’s explore some practical tips and techniques for teaching your kids about money management and preparing them for success in the financial world.

Describe how needs and wants are different

Research reveals that children’s views about money are fully formed by the time they are seven years old. Teaching financial literacy to children means that they understand what necessities and desires mean.

We cannot survive without particular essentials, such as food, clothes, and shelter.

On the other hand, desires include expensive cars, high-end footwear, fashionable clothing, or the newest technology.

As a parent, you might ask your kids to make a list of their belongings and classify them as needs or desires after giving such examples.

Teaching kids to tell the difference between these two aspects can help them learn how to handle their money effectively.

Encourage your youngster to save their pocket money

Since savings are the cornerstone of a solid financial foundation, try establishing the idea of saving early in life.

Give your kids pocket money every month and advise them to budget their spending and save aside money for future purchases.

In addition to giving them pocket money, give them rewards for each job or goal they complete. This will motivate them to keep going until they reach their objective.

Shop for groceries with the kids

Grocery shopping with kids is another way to teach them about money management. The advantages are long-term.

To help them understand what they need while avoiding overpaying, have your kid make a shopping list before you go shopping.

By avoiding impulsive purchases and keeping their attention on the essentials, this exercise may help youngsters manage their money more wisely in the long run.

Introduce them to books and strategic games

Teaching your kid to play board games like Payday, Monopoly, or Game of Life is an excellent way to help them learn about money management.

Children may learn topics like stock investment, bank savings, and emergency fund maintenance by playing these strategic games.

Similarly, you may also encourage them to read some books on financial literacy, like A Kids Book About Money, The Four Money Bears, and more.

Engage your kids in these activities to help them learn vital financial concepts and cultivate a healthy attitude towards money.

Help them keep track of expenses

Encourage your kid to keep a spending journal, highlighting that they should balance their entries regularly and that they must keep track of every expense.

This will assist your child in comprehending their spending patterns and pinpointing areas in which they may enhance their financial literacy.

Consider opening a minor demat account

Last but not least, you may also consider opening a minor demat account for your child.

This will help you plan your kids’ future better financially.

Introducing your child to the world of investing from an early age is also a great way to help them learn the means of money management and wealth creation before others.

Conclusion

In addition to making your kids feel more at ease when they talk about money, early money talks are essential in preparing them to be successful, financially savvy adults.

Look for opportunities to include financial topics in your children’s daily conversations.

To help kids become ready for the future, give them a safe environment where they can ask questions, make mistakes, and learn.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025