Table of Contents

In this blog, women investors can explore and combat some of their fears and mistakes, obstructing their way towards financial independence.

We often hear the names of great investors such as Benjamin Franklin, Warren Buffet, Peter Lynch, Rakesh Jhunjhunwala, etc. However, do we ever hear of Muriel Seibert, Geraldine Weiss, Catherin Wood, Renuka Ramnath, and Vani Kola? The majority of people don’t know the names of these female investors, as conventionally, ‘women and money’ has always been a relationship that is frowned upon. However, in Indian households, we always observe how our mother saves money to help in emergencies. The qualities of women are so aligned with investing that they can be the best in this field if they avoid some mistakes and fears. Let us explore these fears and mistakes, in detail, and find ways to manage them.

Women and investment

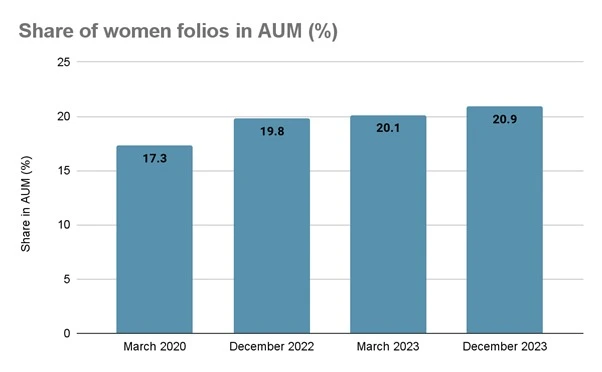

Women are always associated with the words like – household, children, caregiving, teacher, artist, etc. However, in these conventional methods, women either earn no money and take care of the house or if she earns then that money belongs to her house or her husband. These fragile conventional norms were merely baseless. However, as time progressed, women realised their potential was not only limited to households or children. Theoretically, freedom may have some other definition, but practically, independence starts with financial independence. Women now earn, save and invest on their own. In India, the share of women portfolios in total assets under management (AUM) of the mutual fund industry is growing as follows:

Women comparatively have higher life expectancy than men, and thus, they may need more health services in the long term. Moreover, women are also more likely to take a break in their careers after their marriage or kids.

Such different reasons emphasise the need for a more aggressive approach of women towards investing. However, over the years, the exclusion has resulted in women making mistakes due to some fears of investing.

Fear of women before investing

Sudden exposure to money and lack of financial literacy in our conventional education system, leads women to fear investing. They save their money in traditional ways of cash and bank, which stagnates the growth of their money. However, here are some common fears of women investors and ways to combat them:

1 .Extremely risk-averse attitude

Generally, women fear the risk associated with modern investment techniques. A study shows that women park 51% of their funds in fixed deposits (FDs) and only 15% in mutual funds. They are very conservative when it comes to investing. Moreover, women have low self-confidence when it comes to handling their money.

How to face this fear: Women generally can multitask, which also alleviates their ability to analyse multiple situations in one stance. If women use these analytical skills wisely, then investing would be easy for them.

2 .Trust issues

Women inherently have the trust issues of either over-trusting or under-trusting. They trust their advisors totally or would not even go to an advisor. This extremity affects their investing journey.

How to face this fear: Women should be actively informed about their money. They should inquire about their finances and their growth to their advisors. If it doesn’t suit her, she can always explore other options. It would help women trust their advisors or even their intuition in a better way.

3 .Lack of education

Usually, women fear investing their money before taking formal education. Moreover, there is little provision for financial literacy in our education system, which alleviates this fear. As education and experience increase, financial autonomy also increases. A study shows that women aged 45 years or more have a high financial independence of 65%.

How to face this fear: Today, the world is connected via the internet. Women can make optimum use of these resources to learn about investing. Moreover, it is not necessary to have a specific formal education in finance. One can always go to a financial advisor if they need help.

4.Patriarchal mindset

Women have grown up watching their fathers make all the investment decisions, which imprints the stereotype in their minds that men handle the finances in a better way. Usually, women and finance are paired jokingly. This convention of society is also the reason for the low self-confidence of women.

How to face this fear: Women should always keep in mind that historically, they are always capable of more than what society tells them. As of July 2024, women are handling the finances of India- Nirmala Sitharaman as Union Minister of Finance, and Madhabhi Puri Buch as chairperson of SEBI. So, beating the stereotypes is an old habit of women!

Mistakes of women before investing

Every human being is prone to make mistakes. Similarly, women investors are also prone to make mistakes while starting or during their investing journey. However, the core value lies in embracing these mistakes, understanding them and trying to combat them.

1.Passive management

Women usually assign their money to their husbands and financial advisors for investment. Completely giving control to anyone else, would hold more risk. No one knows your goals and needs better than yourself.

How to avoid: Women should seek guidance rather than completely neglecting. They should actively participate in their investment journey. Regretting later could be costlier than trying to understand your finances.

2.Prioritising others

Usually, women have this inherent tendency to keep their partners, children, and parents ahead of themselves. However, this results in women neglecting their financial safety. Women usually have a longer life, and money is a crucial aid in the later years.

How to avoid: Women can allocate a part of their finances to insurance, retirement planning, and regular investment. It leads to better planning for her future.

3.Conventional investments

Due to the risk factor associated with modern instruments, women investors usually invest in conventional instruments like fixed deposits (FDs), provident funds (PF), etc, which stagnates the growth of their money. If women are aware of their investments, planning for a financial journey would be easier.

How to avoid: Women should take risks and invest in modern instruments like mutual funds and exchange-traded funds(ETFs), which are comparatively less risky and can diversify their risk and returns.

4.Listening more to the world

The world has always prescribed limitations for women. Money or investment is a part of it. However, women have always proved the world and society wrong. So, believing what others preach about restricting oneself from financial planning/investing, would be the biggest mistake of women.

How to avoid: Rather than listening to all the gibberish of how women are not capable of managing their money, one should make a wise decision to believe in herself. Women should make efforts to increase one’s knowledge about investing, take help, and make informed decisions regarding investment.

Conclusion

The money or investment doesn’t ever discriminate against any gender. It is the humans who decide the boundaries. Women can make the most of their investment journey by effectively handling these fears and avoiding these mistakes.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025