Table of Contents

As humans we often let market ups and downs and our feelings guide our investment choices. But fear not, here are five strategies to assist you.

In February 2024, the Indian stock market experienced heightened volatility due to international and domestic influences. Globally, speculation around the Federal Reserve’s first interest rate cut of the cycle and the retreat of overseas institutional investors from developing economies have been pivotal considerations.

But it’s not just what’s happening out there – plenty is going on within India too. Within India, the declaration of third-quarter financial data, the surge in pre-election activity, and the projected economic effects of the recently passed budget have each played notable roles in shifting market dynamics.

Despite these challenges, the Indian stock market demonstrated a robust capacity to withstand shocks. However, experts anticipate market volatility will remain elevated before the 2024 general elections.

So, what should long-term investors do? What should be the strategies? Let’s find out.

Understanding volatility

The unpredictable nature of financial markets triggers price fluctuation in stocks or the entire market in a brief span – a phenomenon called volatility. In essence, it is the speed of price change for a particular stock during a set time.

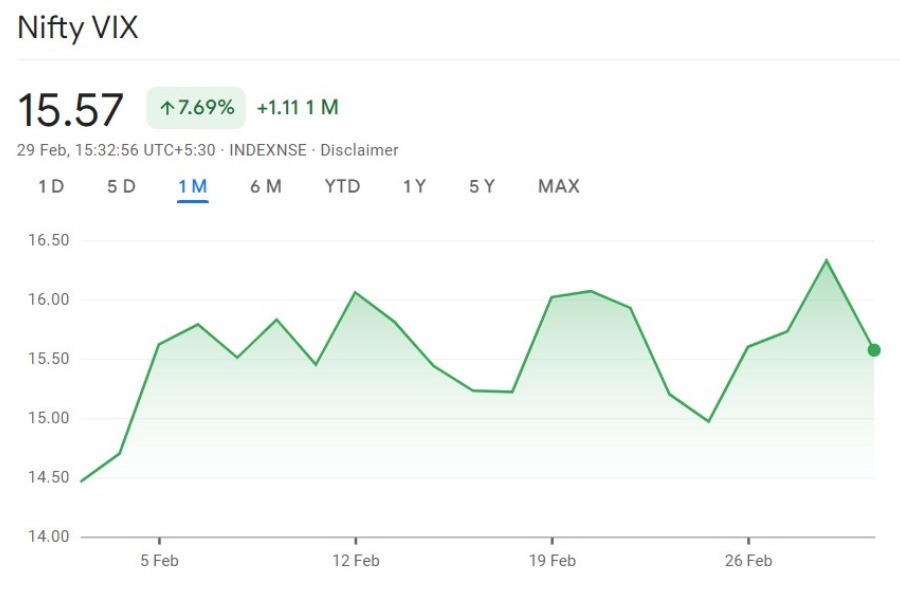

An increase in stock price volatility often signifies a rise in risk, aiding investors in predicting future fluctuations. For instance, India’s financial market volatility is captured by the India VIX, which is based on the option prices of Nifty 50.

Source: Google Finance (as of 29th Feb, 2024)

Market volatility is influenced by several aspects ranging from economic situations, global political disruptions, and the mindset of investors to unexpected news. Such factors can stir significant price movement, coupling it with risk and chances of gains for investors.

Crucial economic markers like interest rates and inflation also play an essential role in affecting market volatility.

But the question is, what should an investor do during volatile markets? Let’s see some tips.

Tips for investors in the market volatility

Long-term investors’ main focus should be on the bigger picture. However, we humans tend to get swayed by short-term market volatility and let our emotions influence our investment decisions.

Here are some tips to help you beat the market volatility:

1. Power of diversification

Just as we usually crave variation in our everyday lives, it is essential to ponder revamping your financial portfolio. Firmly keeping to the same stocks could result in setbacks during unforeseen market volatility. To protect and grow your investments, diversifying your portfolio can be an advantageous approach.

Portfolio diversification is the method of distributing your investments over a diverse array of sectors and asset types. It provides a method to alleviate the risk linked to a single investment by scattering your investments through different asset classes, sectors, and global areas.

A well-diversified portfolio can act as a buffer against the impact of poorly performing stocks during market volatility.

2. Stay calm and invested

In times of market volatility, it’s essential to remain composed and adhere to your long-term investment strategy. Short-term volatility may bring about worry, but making investment decisions driven by emotional responses might result in considerable loss.

An essential tactic in handling market volatility is to aim for long-term outcomes rather than getting caught up in daily market ups and downs. It can be tough to persist with your strategy, but it can equally bring about new opportunities.

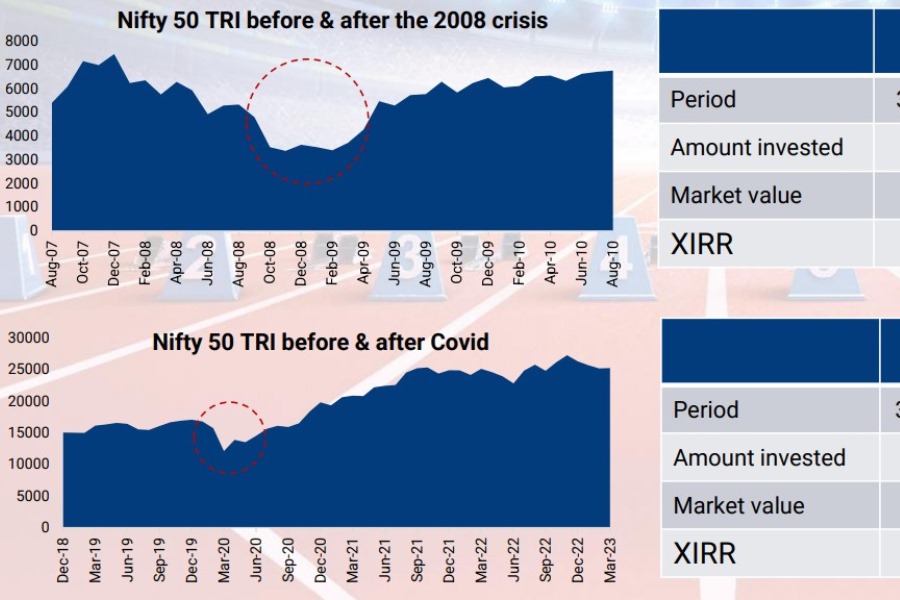

For instance, let’s say you started an SIP (Systematic Investment Plan) in Nifty 50 TRI on August 31, 2007. However, when the 2008 financial crisis hit, you became anxious and stopped your SIP (July 31, 2008). In this scenario, your Extended Internal Rate of Return (XIRR) would have been -26.40%.

Contrastingly, if you had remained invested throughout the crisis and continued your SIP until August 31, 2010, your XIRR would have significantly increased to 16.10%. The same holds for other market downturns as well, such as the one caused by Covid-19.

Source: Edelweiss Mutual Fund

3. Focus on fundamentals

In periods of market volatility, it is essential to concentrate on the core characteristics of the businesses or assets you have invested in. Instead of getting influenced by temporary price changes, assess the financial stability, competitive standing, and future potential of these companies.

This strategy enables you to make knowledgeable investment choices rooted in the intrinsic worth of your investments rather than responding to fleeting market trends.

4. Embrace rupee-cost averaging

Rupee-cost averaging is a strategy that helps mitigate the impact of market fluctuations. This approach involves consistently investing a fixed amount of money at set intervals, regardless of market conditions.

This technique allows you to acquire more shares when their prices are low and lesser when the prices surge. It effectively neutralises the influence of short-term market shifts and empowers you to accumulate more shares over a period at an average cost.

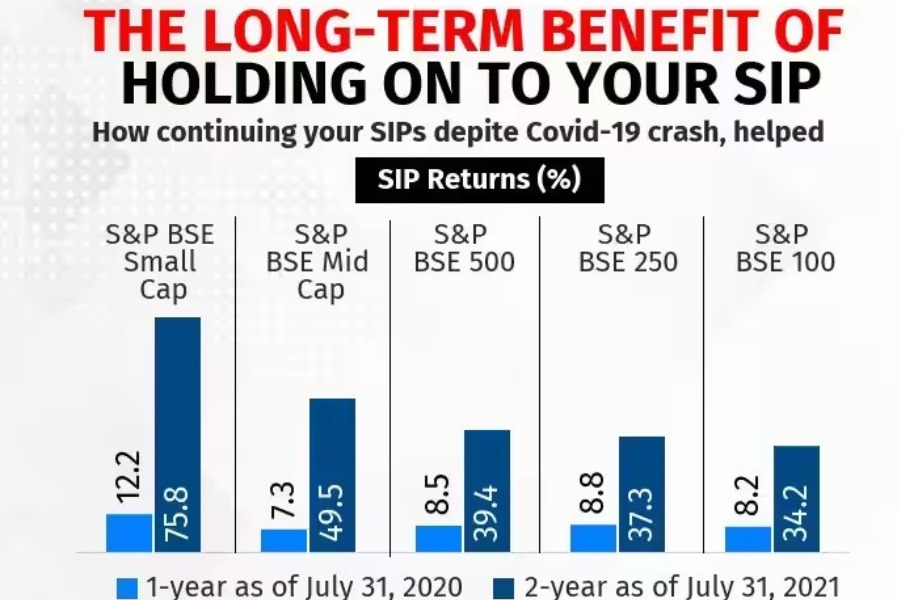

For instance, investors who maintained their SIPs post the COVID-19 market crash would have reaped significant benefits.

As per the data, the S&P BSE Small-Cap TRI yielded an impressive 75.8% return on two-year SIPs, while its one-year return stood at 12.2% until July 31, 2020. Similarly, the S&P BSE Mid Cap TRI posted two-year SIP returns of 49.5%, marking an increase of 7.3% up until July 31, 2020.

Source: Moneycontrol

5. Review and rebalance portfolio

Always keep a keen eye on your investment basket, especially when market conditions are ever-changing. By running frequent assessments, you can affirm that your investments are syncing with your targets and comfortable with risk.

When necessitated, rebalance your portfolio to safeguard the asset mix that you prefer. This habit contributes to maintaining your portfolio’s alignment with your goals and prevents excessive exposure towards any particular investment or sector.

Conclusion

Just like other global markets, the Indian stock market also experiences volatility, swayed by several events locally and worldwide. Indeed, it can be a stressful time for investors when volatility strikes. However, it also opens doors for those armed with the right knowledge and readiness.

Although the market may seem like a topsy-turvy journey in the short run, remaining committed to a strategy and considering the long haul can ensure you stay on the right path and potentially prosper.

Always bear in mind that such fluctuations are not necessarily a downside – there may be opportunities for you as well!

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025