Table of Contents

Investment with returns of two mutual fund schemes in a single plan – seems unreal? A Systematic Transfer Plan can make it possible. Explore the opportunity now.

Investors in India are always seeking more returns with less risk. It is also the reason for the growing popularity of mutual funds in India. Mutual funds offer the market returns of securities, diversification, safety of funds, professional assistance of fund managers, etc. As of June 30, 2024, there are 19.1 crore active mutual fund portfolios in India.

Investment in mutual funds with a Systematic Investment Plan (SIP) is famous. People are accustomed to investing fixed amounts at equal intervals in the fund. There are 898.6 crore active SIPs as of June 2024.

However, fewer people are aware of the unique Systematic Transfer Plan (STP), which enables investors to obtain the benefits of more than one scheme in a single plan.

What is a Systematic Transfer Plan?

Investing in the secondary market is accompanied by the risk of volatility. The market prices the instruments as per the demand-supply force. However, this affects the long-term investors as short-lived market fluctuations can affect the corpus adversely.

When an investor has a lump-sum fund, but the market he/she is willing to invest in is not in suitable conditions, the investor can opt for a Systematic Transfer Plan . As the name suggests, the plan facilitates easy transfer from one scheme to another. The only condition is to invest in the scheme from the same Asset Management Company (AMC).

First, investors need to select two funds between whom the money is transferred. This decision is crucial and should be taken only after analysing the return and timings for both funds. The investor can decide the amount to be transferred at an equal interval from the former scheme. Also, the transfer can be monthly, quarterly, half-yearly, etc. Understand these main terminologies:

- Source fund – Transfer from this fund. (Former)

- Target fund – Transfer to this fund. (Later)

- Frequency – Total number of transfers and time of transfer, such as monthly, quarterly, etc.

Benefits of STP

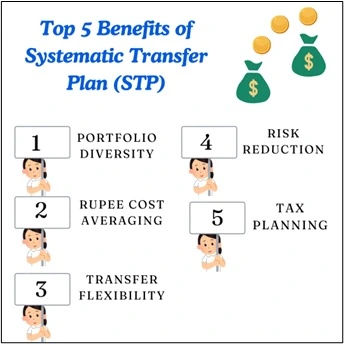

Some unique benefits of STP are as follows:

- Rupee Cost Averaging (RCA)

It is a famous technique to hedge against the decreasing time value of money. Due to the systematic transfer of investment from one fund to another, the value of money invested is retained with the varying NAV. This benefits in averaging the cost of investment. This gain is visible in the long term. For example, A person transfers ₹5000/- from a debt mutual fund to an equity mutual fund.

| NAV | Amount | Units purchased |

| 20/- | 5000 | 250 |

| 25/- | 5000 | 200 |

| 24/- | 5000 | 208 |

| 20/- | 5000 | 250 |

| TOTAL | 20,000 | 908 |

| Average cost per unit | = ₹22.02/- | |

Every time, with the amount of ₹5000, the number of units purchased was different due to the changing NAV of mutual funds.

However, after a period, the average cost paid was lower than the visible cost.

- Flexibility of transfer

The investors can decide the amount and frequency of the transfer. It allows the investor to invest feasibly in the market.

- Risk reduction

When the investment is transferred from one scheme to another, the risk of stagnant return is mitigated for that amount. Moreover, the risk is balanced between both the funds while earning returns. The facility of easy transfer mitigates the risk of missing any transfer.

- Tax planning

While the amount is transferred from one scheme to another, the gain earned is taxed as short-term capital gain. However, with proper planning, the transfer can be planned by managing the tax liability.

- Diversity of portfolio

The plan provides an opportunity to diversify the allocation of funds in different securities simultaneously. One can get equity and debt returns simultaneously within one plan.

Let us understand STP with this example

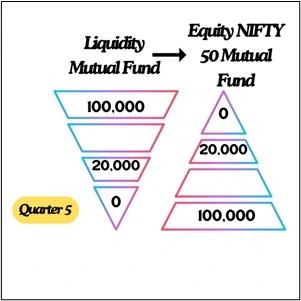

Mr. M invested ₹100,000/- in lump-sum in a Systematic Transfer Plan.

Calculation of STP

Source fund: Liquidity mutual fund

Target fund: Equity Nifty 50 mutual fund

Frequency: 5 quarters (₹20,000 quarterly)

Source fund:

(Amount in ₹)

| Quarters | NAV | Amount in Liquidity fund | Unit of liquidity fund | Amount transferred |

| 0 | 40 | 100,000 | 2500 | – |

| 1 | 38 | 80,000 | 2105 | 20,000 |

| 2 | 41 | 60,000 | 1463 | 20,000 |

| 3 | 40 | 40,000 | 1000 | 20,000 |

| 4 | 38 | 20,000 | 526 | 20,000 |

| 5 | – | – | – | 20,000 |

Target fund:

(Amount in ₹)

| Quarters | NAV | Amount in equity fund | Unit of Liquidity fund |

| 1 | 20 | 20,000 | 1000 |

| 2 | 21 | 40,000 | 952 |

| 3 | 25 | 60,000 | 800 |

| 4 | 23 | 80,000 | 869 |

| 5 | 25 | 100,000 | 800 |

| Total | 100,000 | 4421 | |

- In the first quarter, ₹20,000 was transferred to the Equity Nifty 50 fund, where the NAV was ₹20/-.

- So, 20,000/200 = 1000 units were obtained.

- However, in liquid funds, the number of funds decreased to 2105 (80,000/38) from 2500(100,000/ 20).

- Similarly, the amount was transferred in other quarters.

- In the final quarter, the amount of the liquidity fund was completely transferred to the equity fund.

Types of Systematic Transfer Plans

- Flexible

These are also known as flex STPs. The investors can transfer variable amounts as per the feasibility of market conditions. This helps investors to make the decisions as per market returns and risk of the target fund.

- Fixed

These are straightforward STPs. The amount to be transferred is decided by the investor at the start of the investment. This provides a clear map of the returns earned over a long time. Investors should have sound knowledge of the market while investing through fixed STPs.

- Capital appreciation

This type helps investors earn returns in the target fund over the appreciated amount in the source fund. The principal amount stays in the source fund safely, and only the appreciated amount is transferred.

Factors to consider

- Fund availability

The STP scheme is most suitable when an investor has a lump-sum amount. This fund can be first invested in a safe fund and can be further transferred to the target fund.

- Objectives and parameter

Objectives of the investors should be clear enough regarding the time for investment, fund to invest, returns, etc. The parameters, such as type of plan, transfer amount, frequency, liquidity, etc, should be assessed before making an STP investment.

- Returns

Investors may need to wait a while to earn desired returns from the source fund. Moreover, the selection of source and target funds should be on the basis of knowledge of market conditions, or the fund may stagnate.

- Exit load

When an investment is withdrawn before a specified time, the investor has to pay fees, which is known as exit load. In STP, the scheme should be selected by considering this exit load.

- Tax implications

As per the holding period of the source fund, the capital gain tax will be imposed while transferring the funds to the target fund. This tax implication should be planned first before opting for STP.

Conclusion

Every investor desires for safe and more returns. However, the risk can not be escaped if the objective is to earn good returns. Through a STP, this risk associated with the investment can be balanced and diversified. Investors can invest in a source fund first and transfer this investment in regular small fractions to the target fund. For an investor with the availability of lump-sum amounts, returns of two funds, and diversification is a golden opportunity.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025