The union budget 2024-25 is out and may affect your mutual fund investments. Read this blog to understand the impact in detail.

India is a bright star in the world economy and has been growing at nearly 8% for the past two years. Amidst global tensions like war, climate crisis, economic slowdown, etc, our country is working at an impressive pace to develop comprehensively.

The union budget is a document of projections, past performance, and a roadmap of fiscal aspects of a country. In India, it is presented every year on February 1. However, on account of general elections in the country, an interim budget was presented on February 1, 2024. The final budget was later presented by the elected government on July 23, 2024.

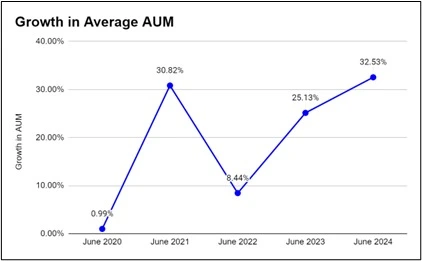

The mutual fund industry in India has been a ‘hot favourite avenue’ for investors due to its unique benefits of diversification, small investments, risk spread returns and steady growth. Over the past five years, its growth is evident:

Source: AMFI

This year’s budget is in the news due to its changed taxation norms, ceilings, allocations, etc. All the investors are in the spotlight due to changes in capital gain taxation. Similarly, some implications may affect the mutual fund industry in various ways. Investors should make an informed investment decision by understanding these implications. Read this blog to explore the intricacies of 5 key impacts of budget 2024 on mutual funds.

TDS

The tax deducted on the source (TDS) was applicable on the redemption of mutual fund units or at the closing of the scheme. However, this provision is now removed. No TDS will be applicable on the redemption after October 1, 2024. Understand it with this example:

- Before: Mr Kush has 1000 units, which will be redeemed by the fund @₹300 per unit. So, he would gain ₹3 lakhs, but 20% TDS would be deducted by the fund before this payment. He would finally get only ₹2.4 lakhs.

- After: Mr Kush would receive a full amount of ₹3 lakhs on redemption, without any TDS.

Capital gains

The profits earned by the investors after selling an asset, are known as capital gains. Its categorisation, based on the holding period for an asset during its sale, was changed in this budget. The categorisation and changed tax norms would be as follows:

| Particulars | Long-term | Short-term |

| Listed financial assets | Held for more than 12 months. (more than 1 year) | Held for less than or equal to 12 months. |

| Listed non-financial assets, Non-listed financial & non-financial assets | Held for 24 months or more. (2 years or more) | Held for less than 24 months. |

| Taxation norms | 12.5% | 20.0% (some specific, rest at slab rates) |

| Tax relief | Limit raised to 1.25 lakhs | – |

These amendments in the taxation of capital gain will be applicable. Taxation will be as follows:

- Long-term investors

The increase in the tax may not affect these investors adversely as they will also be getting the benefits of increased ceilings. For example,

An investor has made an investment of ₹3 lakhs in an equity mutual fund. However, after 18 months (1.5 years), the investor decides to sell them at ₹4.2 lakhs. The profit earned is ₹1.2 lakhs.

So, as per the old norms, it would have been taxed at 10% for exceeding ₹1 lakh limit.

However,due to new norms, it would be 100% tax-free, as it falls within the ceiling of ₹1.25 lakhs.

- Short-term investors

These investors may be discouraged due to a 5% point increase in the taxes on short-term capital gains. It may adversely affect investor’s perspectives towards short-term investment in mutual funds .

Debt mutual funds

According to the new budget norms, the debt mutual funds will attract tax on capital gains, irrespective of the holding period. The debt funds would be charged tax as per the previous rates only. However, certain amendments regarding the holding period were also made in budget 2023-24. Its simplification will be as follows:

| Particulars | Long term | Short term |

| Before budget 2024-25 | 20% with indexation (held for 3+ years) | Slab rate. (held less than 3 years) |

| After the budget 2024-25 | Slab rate | Slab rate |

The above taxation applies to the ‘specified mutual funds’ that invest more than 65% of their funds in debt and money market instruments. Thus, this change in the norms may root back investors into debt mutual funds investment, such as corporate bond funds, credit risk funds, gilt funds, etc.

Gold ETFs and overseas FoF

Instruments like gold exchange-traded funds, overseas fund of funds, hybrid funds , and balanced funds are not categorised under the term ‘specified mutual fund’ as they invest less than 65% of their funds in debt and money market instruments in the budget 2024-25. Therefore, the holding period of more than 36 months (three years) is altered to 24 months (two years) to categorise it as a long-term fund.

The following taxation is applicable:

- The short-term capital gain on such funds is applicable as per the income tax slab rate of investors.

- The long-term capital gain is applicable at 12.5%.

The reduced holding period and tax liability widen the prospects of making investments in such mutual funds for the investors.

Macroeconomic indicators

Every investment is directly or indirectly affected by the macroeconomic factors of a nation or world. Similarly, mutual funds are also affected by global and national factors. The recent announcement in the budget 2024 regarding the macroeconomic indicators of India, may have a significant impact on the perspective of investors and eventually on mutual funds.

- The fiscal deficit, as % of gross domestic product (GDP) growth, has decreased significantly in recent years. In 2023-24 it was 5.6%, and the target for 2024-25 is 4.9%. It has the potential to instil investor’s confidence in the country’s growth, and encourage them to invest more.

- The allocation for the infrastructure sector is in an upward trend. Nearly ₹11 lakh crore is allocated for the year 2024-25. Infrastructure investment drives business growth. In turn, it may increase the returns on investment. Moreover, mutual funds invest in pools with diversification. So, there are prospects for higher returns.

- The corporate tax rate is reduced to 35% for foreign companies, which widens the prospects of more companies coming to India. It would thus provide better investment opportunities.

Conclusion

The union budget is a detailed representation of the upcoming financial year’s revenues and expenditures by the government. It also determines rates, ceilings and norms for taxes. Understanding them in detail is very important.

Union budget 2024-25 is in the news for its capital gains taxation norms. Budget 2024 impact on mutual funds can be assessed in various aspects, and investors should determine their investment strategies after analysing these aspects.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025