Choosing between crypto vs equity investing can feel like choosing between two very different worlds. While stocks have powered retirement portfolios for decades, cryptocurrencies made headlines when Bitcoin jumped over 60% in 2024. In the same period, Nifty 50 delivered an 8.86% gain.

For many first-time investors, understanding each market’s volatility comparison and risk profiles is key. This blog will discuss what makes stocks and crypto unique, compare their returns and risks, and help answer the ultimate question: is crypto better than the stock market for beginners?

Understanding Stocks

Stocks denote the partial ownership in a public company. The transaction of stocks implies that the investor agrees to the company’s profit and loss. In India, stock market activities are most active on two leading exchanges, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

These two are regulated by SEBI (Securities and Exchange Board of India) and are responsible for transparency and investor protection. The stock market in the past has been a reliable tool to build wealth in the long term. Up to March 2024, India recorded over 15 crore demat accounts, indicating a rising number of retail investors.

Using mobile apps and various investment platforms, people can now trade stocks, start SIPs, or dive into mutual funds. Stocks are best suited for those investors who want a steady increment supported by research, good regulations, and the actual performance of the companies.

Understanding Cryptocurrency

Cryptocurrency is a digital currency that runs on blockchain technology, which is a decentralised and immutable database. Unlike equities or traditional currency it’s not issued by any government or authority. You can buy or trade cryptocurrencies like Bitcoin or Ethereum on online platforms with minimal investment.

Crypto’s true USP lies in its round-the-clock market availability, fractional ownership without minimum lot sizes, and the absence of traditional intermediaries, allowing investors to trade anytime, anywhere, with utmost flexibility.

Indian investors can start with as low as ₹100. The 2024 Chainalysis report ranks India at 3rd position in crypto adoption countries worldwide, showing an exaggerated retail participation and interest in digital assets.

On the other hand, cryptocurrency markets are infamous for their high volatility. The value of cryptocurrencies can change in minutes, so newbies need to understand the risks involved before they start trading.

Crypto vs Equity Investing: Comparing Metrics

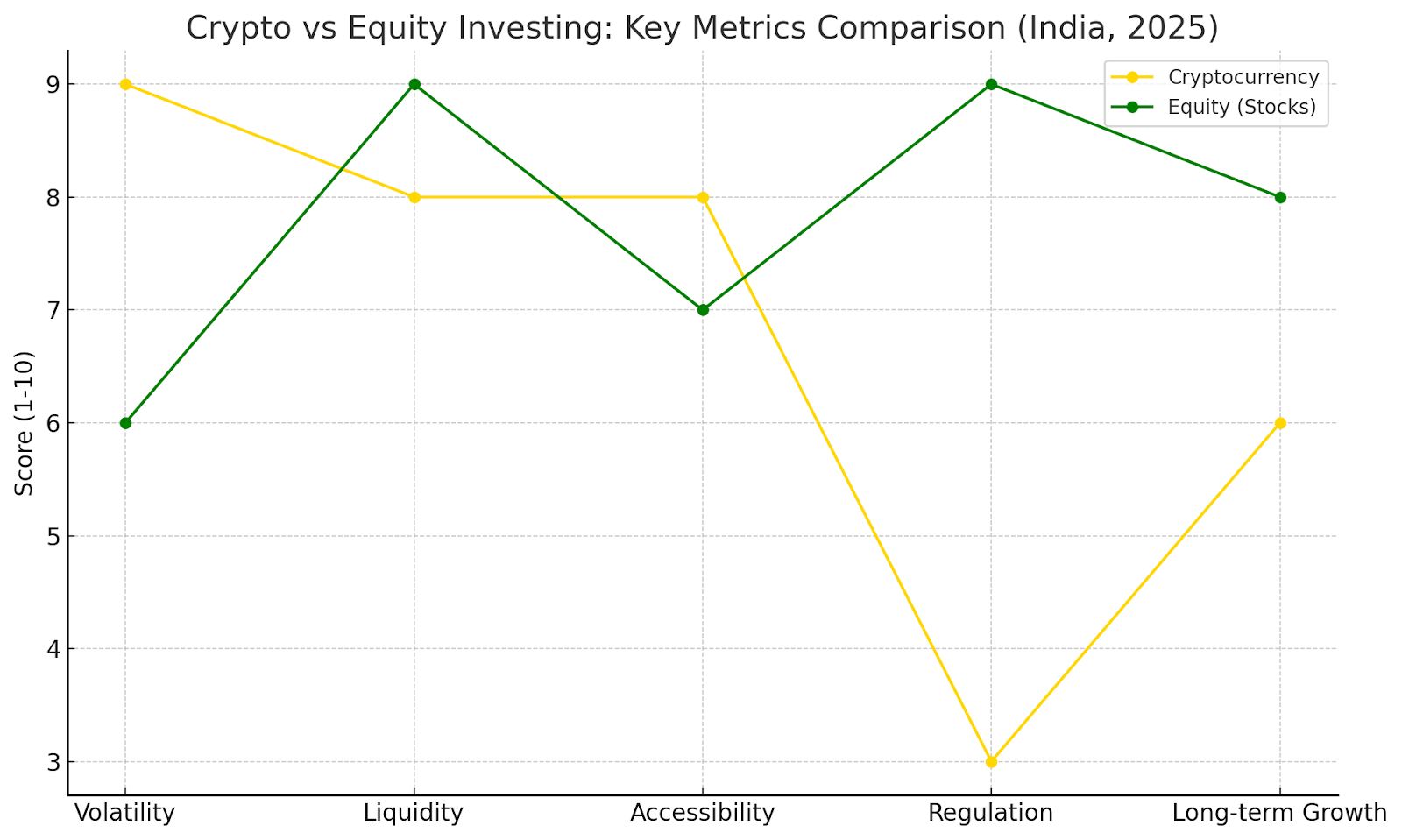

Understanding the difference between crypto vs equity investing comes down to examining a few key metrics: volatility, liquidity, accessibility, regulation, and long-term growth.

| Criteria | Cryptocurrency | Equity (Stocks) |

| Volatility | Highly volatile (60-68% in late 2024) | Relatively stable (11.61% 30-day volatility for Nifty 50 in 2024) |

| Risk Profiles | Suited for aggressive, short-term investors | Ideal for conservative, long-term investors |

| Liquidity & Access | 24/7 trading globally, invest from ₹100, including weekends | Trading is limited to weekdays, 9:15 AM–3:30 PM IST; stronger investor protections |

| Regulation | Still under regulatory uncertainty | Regulated by SEBI, offering legal and financial safety |

| Historical Returns | Drop of over 8.2% in 4 months, from $63,825.87 in April, 2024 to $58,530.13 by mid-August. | Annual returns of minimum 12% last 5 years (e.g., Nifty 50) |

| Long-Term Growth | Unpredictable, lacks strong fundamentals | Stable, compounding potential backed by India’s economic growth |

Refer to the graph below to comprehend the breakdown of how crypto and equity score across these key factors. It reflects how each asset class stacks up from an Indian investor’s perspective in 2025.

Is Crypto Better Than the Stock Market For Beginners? Know The Reality!

The hype around crypto often attracts new investors, but is it truly better than traditional stocks for beginners? Let’s break it down:

- Volatility: Crypto markets are highly volatile. For example, Bitcoin went up 60% in 2023 and down 30% in a few weeks. That’s a lot to handle for beginners.

- Stock Market Stability: The S&P 500 has given average annual returns of 10% since 1957, with far fewer crashes than crypto.

- Regulation & Safety: Stocks are regulated by SEBI, which makes them transparent and safer. Crypto in India isn’t fully regulated yet, so it carries more risk.

- Learning Curve: Stocks have easier valuation (via company reports), while crypto requires understanding of blockchain, wallets and tokenomics.

Reality Check: Crypto may give higher short-term gains, but for beginners, the stock market is a safer, more structured way to get into investing.

Conclusion

Crypto is fast, innovative and offers rapid gains, while equity investing is decades of trust, regulation and steady growth. Each asset class has its pros and cons. Beginners may find the stock market more approachable, while experienced risk takers may explore crypto.

To make informed decisions, it’s wise to try out reliable trading platforms that fit your investment style. Diversifying and balancing both asset classes may be the smartest way to long-term financial health.Understanding your risk appetite and financial goals is key to making the right choice in crypto vs equity investing.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025