Table of Contents

Worried about an inoperative PAN affecting your mutual fund investments? Find out about the recent SEBI guidelines.

If you’ve been unable to invest in mutual funds due to an inoperative PAN, you are not alone. An astonishing 1.3 crore mutual fund accounts were on hold until early May due to incomplete KYC compliance.

The Securities and Exchange Board of India (SEBI) announced in October 2023 that all individuals investing in mutual funds must link their Permanent Account Number (PAN) with their Aadhaar. This mandate, which is part of the Know Your Customer (KYC) process, must be completed by March 31, 2024. Failure to do so resulted in a freeze on investment activities. But there’s a silver lining!

As of May 14, SEBI has eliminated the necessity for mutual fund investors to link their PAN with their Aadhaar to attain the status of ‘KYC registered’. However, it’s important to note that the linkage of Aadhaar with PAN remains a prerequisite for obtaining the ‘KYC validated’ status.

Here’s everything you need to know about this significant update and how it can get your investments back on track.

What is KYC and how to invest in mutual funds without a PAN-Aadhaar link?

KYC, or “Know Your Customer,” is a procedure employed by financial entities such as banks, mutual fund companies, and brokers to authenticate the identities of their clients. This process aids in the prevention of unlawful activities like money laundering or fraud, thereby safeguarding both the institution and the customer.

There are typically a few steps involved in KYC, including collecting and verifying a customer’s ID and address information. In certain instances, these institutions may also be interested in discerning the origin of a customer’s funds. This is all part of their commitment to adhere to counter-financing of terrorism (CFT) and anti-money laundering (AML) regulations.

New SEBI rule

Being KYC compliant is a prerequisite for an investor to invest in mutual funds.

It’s crucial to stay updated as the SEBI frequently modifies the KYC regulations. For instance, in October 2023, they decreed that all mutual fund investors must associate their Permanent Account Number (PAN) with their Aadhaar. This linkage was required for the completion of the Know Your Customer (KYC) process, with a deadline set for March 31, 2024. Failure to link PAN and Aadhaar would result in the suspension of the KYC process, thereby inhibiting any investment activities.

Another shocking rule came in April 2024!

Starting April 1, 2024, the SEBI has introduced new KYC norms for mutual fund investors.

Before April 1 2024, bank statements and utility bills were acceptable as KYC documents.

Now, as per new rules, these documents are not officially accepted.

What are the officially valid documents (OVDs) for KYC?

Here are the OVDs for KYC:

- Aadhaar card

- Driver’s licence

- Voter Identity Card

- Passport

- Job card issued by NREGA

- Any other document notified by the central government.

Different types of KYC statues

As per new KYC guidelines, Aadhaar is the most IMPORTANT document.

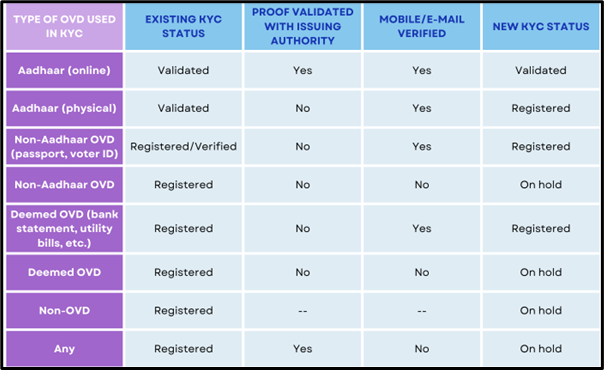

According to the document submitted, the KYC status of the customers can be:

a) KYC-validated

b) KYC registered

c) KYC on-hold

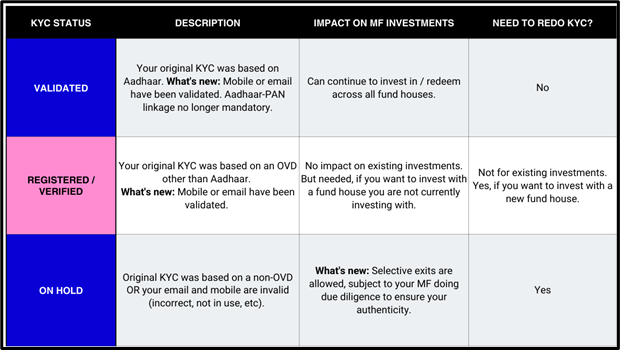

KYC validated

If you have done your KYC through your Aadhaar, your Aadhaar and PAN are linked and validated, and your mobile number and email ID are also validated, then you will receive “KYC validated” status.

Investors with KYC-validated status can continue their investments seamlessly.

KYC registered

Investors will receive “KYC registered” status if any of the following conditions are satisfied:

- If investors have used other officially valid documents (not Aadhaar) or

- PAN-Aadhaar linkage has not been done, or

- The mobile number and email ID have not been validated.

In the case of KYC registered status, investors can continue to invest in their existing folios. To invest in a new mutual fund house, investors will have to do a re-KYC or get their KYC status validated.

KYC on-hold

Investors will receive “On-Hold” status if they have submitted Non-Aadhaar OVDs or bank statements or utility bills and these documents are not validated. Further, investors will receive KYC on-hold status if their email ID and mobile number are not validated.

Investors marked with an “On-Hold” status will be unable to conduct any transactions in their existing investments or make new ones.

However, SEBI has implemented a few steps to simplify the KYC procedure, providing relief to mutual fund investors.

SEBI eases MF KYC rules

Starting from May 14th, the Securities and Exchange Board of India (SEBI) has revised its rules for investors to attain “KYC-registered” status. The requirement to link PAN and Aadhaar has been removed. Now, investors can fulfil their KYC requirements using other officially valid documents (OVDs) such as Aadhaar, passport, driving licence, or voter ID card.

However, for “KYC-validated” status, the linking of PAN and Aadhaar remains a requirement. This represents a shift from the earlier regulation where both ‘KYC registered’ and ‘KYC validated’ statuses necessitated the linkage of PAN and Aadhaar.

In addition, for KYC compliance, validation of either email or mobile is now sufficient, unlike the previous requirement where both needed to be validated.

These new guidelines will change investors’ KYC status to ‘KYC Registered’ unless it’s ‘On-hold’ for other reasons. This modification will empower investors to carry out any financial or non-financial transactions in their current mutual fund investments. Additionally, they can venture into new mutual fund houses, albeit after submitting supplementary documentation.

Conclusion

In conclusion, SEBI’s recent amendments to the KYC requirements bring significant relief to mutual fund investors. The removal of the mandatory PAN-Aadhaar linkage for obtaining ‘KYC registered’ status allows many investors to resume their investment activities, which were previously halted due to incomplete KYC compliance.

Staying informed about these changes and understanding the new requirements will help investors navigate the KYC process efficiently and keep their investments on track.

If you have not checked your status yet, do it now and complete re-KYC if required.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024