Long-term investments in mutual funds offer several advantages ranging from compounding returns to reduced market volatility impact. Dive in to learn more!

Mutual funds have become a dominant feature within the Indian financial space as depicted by their assets under management (AUM) as an indication of growth and investor confidence. By the end of May 31, 2024, total assets under management (AUM) in the Indian mutual fund industry had reached ₹58.91 trillion and this showed a sixfold increase over ten years since 2014 when the figure was ₹10.11 trillion.

Mutual funds are investment pools that combine many investors and invest their capital in various types of securities, including bonds and shares, among others. Investing in mutual funds has many benefits and sometimes one’s time horizon is essential for success.

This article will majorly focus on understanding why it is crucial to think long-term while investing in mutual funds.

Understanding mutual funds

A mutual fund acts as a trust that collects funds from several people with the same investment objective and invests these amounts in shares, bonds, money market instruments, or indeed other securities. And these pooled investment income/ gains are then shared amongst the investors in proportion, after deducting all relevant expenses and charges intended to calculate a scheme’s “net asset value” or NAV.

Simply put, pooled resources from multiple investors create a mutual fund.

Mutual funds are ideal for small savers and those who don’t have enough time to do stock analysis yet need wealth maximisation.

To the scheme’s written objective, experienced fund managers invest the money pooled from such schemes into different investments. The fund house also levies a small charge which is deducted from investments. These fees are capped by the Securities and Exchange Board of India (SEBI) through regulation on rates charged by various mutual funds.

There are various types of mutual funds, including equity funds (investing in stocks), fixed-income mutual funds (emphasising income generation), money market funds (for liquidity), balanced funds (combining stocks and bonds), and target date funds (tailored for specific retirement dates). Each type serves different investment goals and risk profiles.

Benefits of staying invested for the long term

There is often an allure in short-term investments due to market volatility which creates opportunities for quick returns but can also be riskier than long-term ones that tend to produce regular profits. They allow investing and getting back money in the future.

These are some of the advantages of keeping mutual funds over a more extended period:

Compounding returns

This technique involves putting profits earned from trading back into the business thus making more profits. Over time, this exponential growth can multiply the value of investments significantly; hence, compounding is one of the most powerful benefits associated with long-term investing.

Rupee cost averaging

Rupee cost averaging requires that one makes regular investments at fixed sums in a mutual fund regardless of its NAV. By doing this, it is possible to average out unit purchase costs over time, thus reducing market volatility impact and likely lowering the overall cost of investment.

Reduced impact of market volatility

Mitigating risks and handling potential downsides are some functions of long-term investment. Consequently, the impact of market volatility significantly decreases as the investor extends his or her investment horizon. Thus, price instabilities which cause nonlinear deviations from expected returns lead to substantial profit margins and emotional decisions by traders.

As a result, though, with an increasing period of holding, the likelihood that you exit at a profit approaches 100% while possible losses diminish in magnitude. This is evidence enough that perseverance and belief in long-term investment strategies can help an investor manoeuvre through stormy times on Dalal Street.

Tax benefits

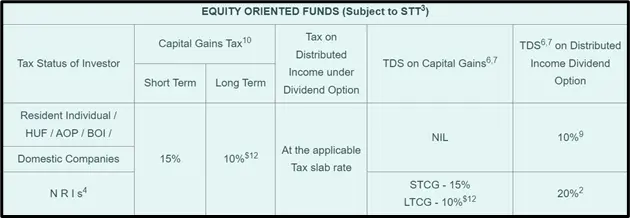

The taxation rules are skewed in favour of long-term investments, like lower tax rates on equity mutual funds for long-term capital gains (LTCG) than short-term capital gains (STCG). Moreover, deferral in tax liabilities can be created by holding onto an investment longer leading to more money remaining invested and growing.

These are the tax rates for equity mutual fund investments:

Source: AMFI

Potential for higher returns

Studies indicate that generally there are higher returns on long-term assets than their short-term counterparts do. This has been observed across different asset classes including mutual funds where staying invested for extended periods has historically resulted in significant wealth accumulation.

Case study: Long-term returns

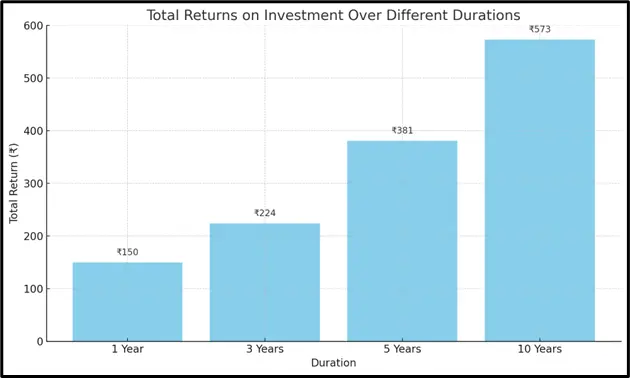

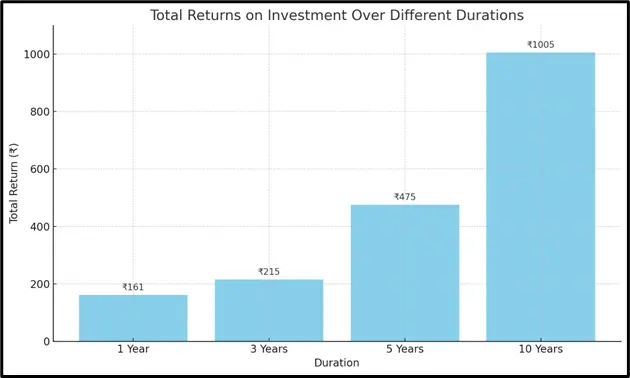

To illustrate the advantages of long-term investments in mutual funds, here are comparative tables showing the performance of two different mutual funds over 1, 3, 5, and 10 years.

Let’s take the example of the SBI Contra Fund – Direct Plan-Growth and the Quant ELSS Tax Saver Fund – Direct Plan-Growth. Both of these are top-rated funds in their categories, ranked by CRISIL based on their historical performance(as of March 31, 2024).

The tables contain columns for initial investment, duration, average annual return and total return.

Table 1: Performance of SBI Contra Fund – Direct Plan-Growth

| Initial investment | Duration | Annual return | Total return |

| ₹100 | 1 year | 49.67% | ₹150 |

| ₹100 | 3 years | 30.78% | ₹224 |

| ₹100 | 5 years | 30.64% | ₹381 |

| ₹100 | 10 years | 19.08% | ₹573 |

Source: Moneycontrol

Let’s look at another example:

Table 2: Performance of Quant ELSS Tax Saver Fund – Direct Plan-Growth

| Initial investment | Duration | Annual return | Total return |

| ₹100 | 1 year | 61.09% | ₹161 |

| ₹100 | 3 years | 28.97% | ₹215 |

| ₹100 | 5 years | 36.54% | ₹475 |

| ₹100 | 10 years | 25.96% | ₹1,005 |

Source: Moneycontrol

This case study has compared two mutual funds – SBI Contra Fund – Direct Plan-Growth and Quant ELSS Tax Saver Fund – Direct Plan-Growth to their performances over one-year, three-year, five-year and ten-year periods; it has demonstrated how advantageous it is to make a long-term investment into mutual funds. Both funds record significant growth over time despite variations in annual returns due to compounding effects.

These examples underscore the potential for substantial wealth accumulation through disciplined long-term investing in mutual funds thus emphasising patience as well as consistency as key drivers to achieving financial goals.

Common myths about long-term investment

Many people consider long-term investment as a wise strategy toward wealth creation. However, several myths surround investment in the long run and can be misleading. The following are a few debunked common myths:

Myth 1: Long-term investment means ignoring your portfolio

Reality:

Long-term investments may not require daily monitoring, but it is essential to periodically review your portfolio. Regular reviews ensure that your investments correspond with your financial goals and you are on track to achieve them. This will include adjustments due to changes in market conditions, personal circumstances or the performance of the fund.

Myth 2: Long-term investments are only for the wealthy

Reality:

Nevertheless, any individual may take up long-term investment strategies, irrespective of their financial status. Through systematic investment plans (SIPs), an investor can begin with small regular contributions which eventually convert into a huge corpus over time. It makes long-term investment possible even for individuals with lower income levels.

Myth 3: Long-term investing requires extensive knowledge

Reality:

Investing in the long term does not require much expertise, though some basic understanding of investment principles may be helpful. For example, mutual funds are managed by professional fund managers who make decisions about investments on behalf of investors. Moreover, there are many resources and financial advisors who exist to guide you through investing.

Myth 4: Long-term investments are too risky

Reality:

While all investments carry some level of risk, over longer periods they tend to have lower risks associated with them compared to shorter runs. Over extended periods market volatility averages out helping long-term investments recover from short-term fallow times. Diversification and appropriate asset allocation could further reduce the risks tied to long-term investing.

Myth 5: High returns are guaranteed in long-term investments

Reality:

Nonetheless, as long-term investments are supposed to generate higher returns, there is no guarantee. Performance of investment is determined by several factors including market situations, economic trends and individual choices made during the period of investment. For one to get into a good position for better results they must have realistic expectations and understand that returns fluctuate.

This would be helpful for any investor who wants to invest over long periods and is fully aware of what happens in such cases. If made through an informed decision embracing such kind of strategy can lead towards substantial financial improvement and stability.

Conclusion

Embracing a long-term investment strategy in mutual funds requires a clear understanding of the market, realistic expectations, and a commitment to periodic reviews and adjustments. By doing so, investors can leverage the full potential of mutual funds, ensuring steady growth and financial stability over time.

This comprehensive approach to long-term investing positions mutual funds as a powerful tool for achieving enduring financial success.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025