Table of Contents

Great news for India! S&P upgrades the country’s credit rating outlook, reflecting a robust economic forecast. Learn what it means and why it matters.

In a significant turn of events, S&P Global Ratings has revised India’s economic outlook from ‘stable’ to ‘positive’, attributing this change to robust growth and enhanced quality of government expenditure. Nevertheless, the sovereign rating continues to stand at ‘BBB Minus’.

This represents a significant transition as the rating has been consistent at BBB- since its elevation from BB+ on January 30, 2007. The rating has been stable at BBB-/stable since September 26, 2014, following its placement on a negative outlook on April 25, 2012.

Notably, S&P is the first agency to revise the outlook, signalling a positive sentiment towards India’s economic trajectory.

Let’s delve into what this upgrade means for India, the reasons behind it, and what the future might hold.

S&P Global Ratings brightens India’s credit outlook

S&P Global Ratings made a remarkable change to India’s credit rating outlook on May 29, 2024, by slightly modifying it from ‘stable’ to ‘positive’.

This is indicative of the increasing faith in Indian economic resiliency and its ability to navigate global financial storms. Besides, this also showed that India’s long-term sovereign credit ratings affirmed at “BBB-” and short-term sovereign credit rating “A-3” are all a recognition of the robustness of the country’s financial status.

A favourable credit rating outlook can substantially enhance a country’s economic prospects. It can lead to lower interest rates on loans, more investments, currency stabilisation, and improving the country’s overall economic health.

Though ‘BBB Minus’ is the lowest investment grade rating offered, the change of outlook from stable to positive is a good sign!

Reasons behind India’s outlook upgrade

The primary drivers behind India’s outlook upgrade are:

- One main reason for this positive stance is the expectation of stability in the Indian policy environment.

- Additionally, as the government has shown commitment to economic reforms, this also gives a positive outlook.

- It is notable to observe that significant infrastructure investments are stimulating favourable perceptions about India’s economy.

- Over the next three years, GDP growth should maintain a strong pace with close to 7% annual expansion.

- Furthermore, obstacles to sustained economic development can be eliminated by investing in infrastructure and connectivity.

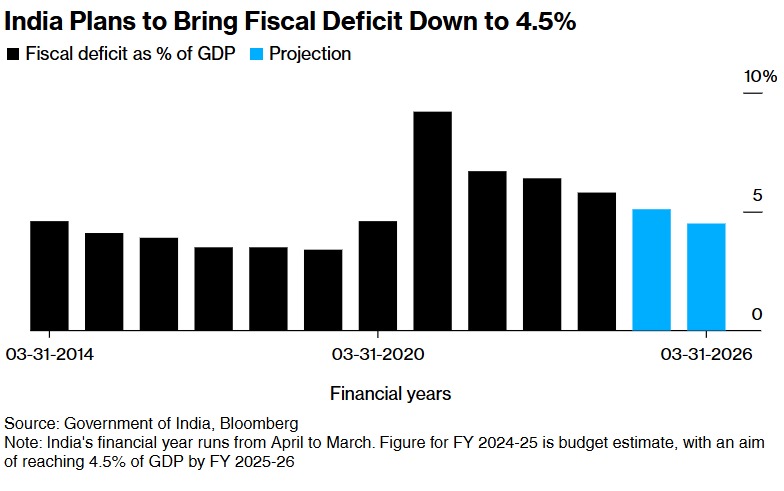

- The government is gradually moving towards fiscal consolidation, aiming at bringing the general government deficit down from 7.9% in fiscal year 2025 to 6.8% by fiscal year 2028.

- Irrespective of the outcome of the June 2024 general elections, it is anticipated that the incoming government will continue economic reforms, supporting growth, infrastructure investment, and fiscal consolidation efforts.

- India’s sovereign ratings are supported by its strong external balance sheet, dynamic and fast-growing economy and democratic institutions, which provide policy predictability.

- However, these strengths are offset by poor fiscal performance, high debt levels, and low per capita income levels. These factors mitigate against positive aspects of the economy.

Solid economic fundamentals

India has also demonstrated strong economic fundamentals, which have contributed to the outlook upgrade.

- The Indian economy has grown by 46% in rupee terms since the COVID-19 pandemic.

- Despite being faced with difficulties, the economy continues to perform well. It is expected to grow by 6.8% in FY 2025, 6.9% in FY 2026 and 7.0% in FY 2027.

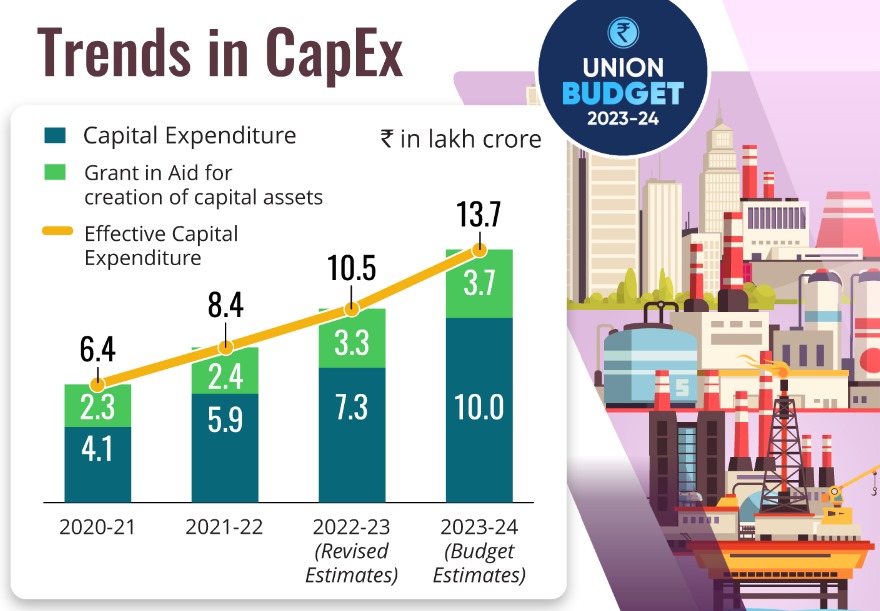

- Capital spending by the central government has increased lately. The total capex grew by 25% and 28% for the fiscal year ending March 2023 and March 2024, respectively. In FY25, the government plans to increase the allocation of funds for capex by a further 17%.

Source: PIB

- Higher allocations towards capital expenditure (capex) have resulted in improved quality of government’s expenditure. Over time, effective capex programs are projected to bridge infrastructure gaps and enhance productivity in the economy.

- For fiscal year 2025, the central government aims for a fiscal deficit of 5.1%, followed by 4.5% in fiscal year 2026. This indicates efforts to manage government spending.

Source: Bloomberg

- As a result of the slowdown in price inflation, it is anticipated that the central bank will ease its monetary policy approach by the conclusion of the 2025 fiscal year. This may result in a reduction in interest rates and more favourable conditions for borrowing.

Here’s a snapshot of India’s key economic indicators:

Rating upside and downside scenarios

The S&P Global Ratings might further upgrade or downgrade the ratings based on some conditions.

Upside scenarios

- S&P Global Ratings may consider a rating upgrade if India’s fiscal deficits see a significant reduction, leading to a decrease in the net change in general government debt to less than 7% of GDP consistently.

- An upgrade might also be on the cards if there is a persistent and considerable enhancement in the effectiveness and trustworthiness of the central bank’s monetary policy, resulting in enduringly low inflation rates.

Downside scenarios

- The outlook could revert to stable if there is a discernible decline in the political will to uphold sustainable public finances, suggesting a deterioration in the nation’s institutional capability.

- A significant widening of current account deficits that weakens India’s external position, potentially making the country a narrow net external debtor, could also prompt a revision to a stable outlook.

Will India’s Sovereign rating upgrade by 2026?

Citigroup envisages that S&P Global Ratings’ would lift India’s sovereign rating by the end of 2026, a move that will be supported by the rating’s faith in the South Asian nation’s macroeconomic parameters and positive economic and political cycles.

Nevertheless, if S&P is confident about the Indian fiscal path, it may result in an earlier upgrade.

Citi noticed that the “fiscal health of India is a major weakness” and called for improvement in this area.

According to government projections, the fiscal deficit will be at 4.50% of GDP by the close of 2025/26 against around 5.8% in FY24.

If the general government deficit consistently stays below 7% of GDP, while public investment continues its upward trajectory towards infrastructure development, then a rating upgrade could happen within two years.

Conclusion

The change in India’s credit rating outlook from ‘stable’ to ‘positive’ by S&P Global Ratings is a significant milestone for the country, indicating that confidence in its economic resilience, policy stability and commitment to fiscal discipline remains intact. With solid economic fundamentals and proactive infrastructure development initiatives being undertaken by the government, India has made itself well-positioned to sustain growth.

However, challenges remain, and the path to a rating upgrade will require continued fiscal prudence and effective policy implementation.

Only time will tell if India can rise to the occasion and achieve this coveted upgrade!

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024