Table of Contents

Invest in green bonds for a better tomorrow. Read further to know how!

The focus on sustainability is rising by the day. From business planning to investment strategies, sustainability is a significant factor influencing major decisions.

The government, with various international organisations, has been introducing new measures and concepts to improve sustainability. One such concept is green financing. In today’s blog, let us go through what green financing is and its role in India’s development.

What is green financing?

Green finance is the process of directing funds towards sustainable practices. It is where different sources of financing, such as loans, investments, insurance, etc., prioritise eco-friendly businesses over other public and private sectors.

The concept of ESG is gaining popularity in the investment world today. ESG stands for Environmental, Social and Governance, where investors focus on companies that are responsible in these three aspects. Green finance in investing is also a component of this.

The rise of green finance

Green finance is a popular concept across the globe. The United Nations, through its environment programme wing, is one of the significant forces for the development of this strategy.

In 2015, the United Nations and all its member countries formulated a list of goals towards sustainable development to be achieved by 2030. The list has 17 goals, with sustainability and the protection of the environment as the primary focus. It also has other goals covering various aspects, like hunger, poverty, gender equality and so on.

The objective of green financing is to support the member countries of the United Nations to meet the 2030 Sustainable Development Goals (SDG). Besides formulating policies, the UN monitors each country’s progress towards these goals.

According to the United Nations, achieving sustainable development goals through green financing and other measures requires participation from stakeholders at various levels. This includes:

- The government, whose role is to formulate environment-friendly regulations, provide incentives and subsidies to companies in this sector, monitor the country’s progress towards goals, etc.

- Businesses, whose role is to strategise their operations in an environment-friendly manner, include environmental concerns as part of their CSR (Corporate Social Responsibility), develop products and services that are in line with sustainable practices, etc.

- Financial institutions such as banks, insurance companies and NBFCs (Non-Banking Financial Institutions) provide affordable loans to companies in this segment.

- Consumers, too, have a significant role in promoting a country’s sustainability. From shifting their mindsets towards eco-friendly products to incorporating ESG as an influential aspect of their investments, the role of a consumer is noteworthy.

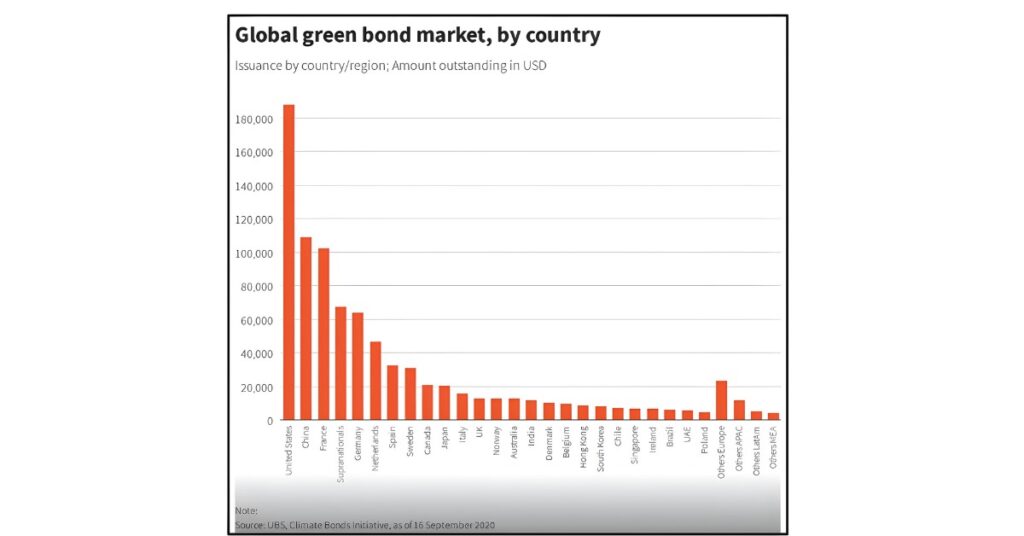

Besides these efforts towards green financing, another unique development was the introduction of green bonds by the World Bank. Today, green bonds, also known as climate bonds, are issued by multiple organisations, including corporations. Green bonds, like regular bonds, are fixed-income securities that raise debt funds from the public. Such funds raised from green bonds are used exclusively towards projects focusing on environmental development.

Source: World Economic Forum

Green financing in India

The concern about a high carbon footprint is prevailing in India for a long time. Industries operating in the power sector are the major contributors towards high carbon emissions in the country. One way to reduce carbon emissions is to change the processes and operations that these industries follow. This requires new machinery with higher efficiencies to bring down carbon emissions. Sourcing such machinery is expensive, making green financing essential in India.

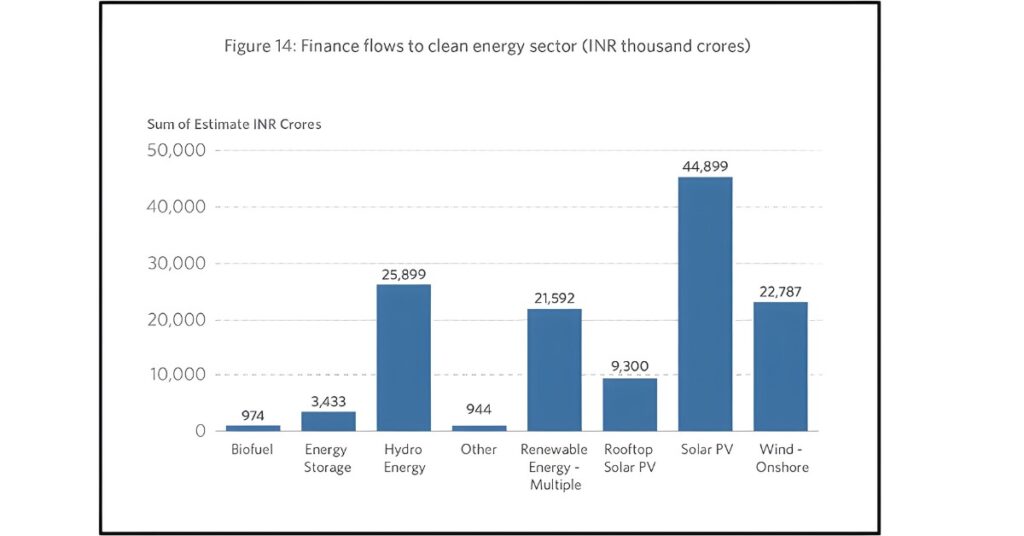

India is currently working towards reducing carbon emissions by 45% by 2030, as compared to the levels in 2005. The estimated cost to achieve this target is about $403 billion. Hence, the country is counting on green financing as one of the ways to raise the required funds.

Source: Climate Policy Initiative

As the first step, the government decided to issue two green bonds to raise funds of ₹16,000 crores. The first bond was issued in January 2023 for ₹8,000 crores and saw an overwhelming response from investors. The proceeds from green bonds will be used across nine different areas, including renewable energy, sustainable water and waste management, pollution control, etc.

Benefits and risks

The benefits of green financing are:

- The first and foremost benefit is the potential to reduce environmental degradation and handle issues of global warming and climate change.

- Green projects not only help in environmental growth, but they also aid the financial growth of the economy. New industries and companies establishing their businesses in the green segment create new jobs and opportunities.

- Focusing on green projects improves the overall health and well-being of the country’s citizens. A cleaner environment leads to a reduction in the number of health hazards due to pollution.

- From an investment perspective, green projects offer diversification to investors. Since the demand for such projects is growing, holding green stocks benefits the investor’s portfolio to a large extent.

The risks of green financing are:

- The green segment is still evolving. Policies and regulations are slowly emerging but are prone to change since this is the beginning of sustainable development. Hence, investing in green projects brings uncertainty and volatility, which some investors may be averse to.

- Green financing can increase fraudulent activities such as greenwashing. Companies may deceive investors about their plans while raising green funds, and then employ such funds for other uses.

- Some investors may prefer investing in traditional companies that have been operational for a considerable time. Since such companies may have stronger fundamentals and financials, investors may feel more comfortable investing there, than exploring the unknown.

Conclusion

Green financing is an initiative by the United Nations and member countries towards promoting sustainable development globally. Benefits of Green financing aims to prioritize environmentally friendly projects, over traditional ones, while lending loans, investments and other financial services.

While the government and financial institutions have a significant role here, we, as consumers play a crucial role, too. From choosing sustainable products for daily use to choosing sustainable projects for investments, consumers can contribute effectively towards improving sustainable practices in the economy.

Remember, your small step towards sustainability will go a long way towards providing a better environment for future generations!

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025