Table of Contents

The taxation for salaried people has eased and also restricted in budget 2024-25. Curious about how? Read this blog for more information.

The Union Budget 2024-25 in India is a crucial event every year. People are eagerly looking forward to it with aspirations. This one event dominates the income, taxation, investing and overall finance game for the Indian citizens. Moreover, the statistics regarding the preceding year indicate how the economy is performing in various aspects.

Among all, the salaried people, who have a separate income head, are quite anxious about the budget. Their biggest income source is affected by the taxation norms rolled out in the budget. Direct taxes affect their income, and indirect taxes affect their key expenses.

The income tax has five separate income heads:

- Income from salary

- Income from house property

- Profit and gains from business and profession

- Income from capital gains

- Income from other sources

Concerning general elections 2024 and inflation, people expected some relief in the union budget 2024-25. However, the budget had some surprising elements, specifically the salaried class. Understanding them in detail is very crucial for the management of finance for salaried individuals.

Salary taxation

Under the head of income from salary, the employee has constituents like basic pay, allowances, perquisites, bonuses and commissions, retirement benefits and pensions. Moreover, a salaried individual can claim deductions such as house rent allowance (HRA), leave travel allowances (LTA) and standard deductions during the final calculation of taxable salary.

Usually, this head accounts for the biggest share of the total taxable income of a salaried individual. So, they are willing to reduce direct taxes or increase the taxable income ceiling. Currently, there are two tax regimes: the new tax regime and the old tax regime.

Old tax regime vs new tax regime (pre budget)

- The new tax regime starts taxing the total income above ₹3 lakh/-. The old tax regime applies tax from the total income above ₹2.5 lakh/-.

- The old tax regime offers deductions and exemptions. However, the new tax regime does not.

| Old income tax regime | New income tax regime | ||

| Up to ₹2.5 lakhs | Nil | Up to ₹3 lakhs | Nil |

| ₹2.5 lakhs to ₹5 lakhs | 5% | ₹3 lakhs to ₹7 lakhs | 5% |

| ₹5 lakhs to 10 Lakhs | 20% | ₹7 lakhs to ₹10 lakhs | 10% |

| Above ₹10 lakhs | 30% | ₹10 lakhs to ₹12 lakhs | 15% |

| ₹12 lakhs to ₹15 lakhs | 20% | ||

| Above ₹15 lakhs | 30% | ||

Source: Income Tax Department

What’s new?

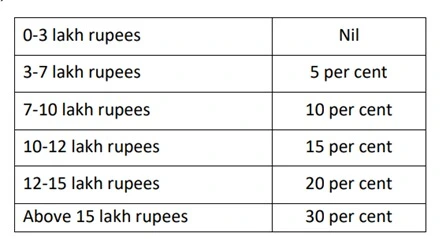

The budget 2024-25 made some key changes as follows:

- Increase in the standard deduction amount from ₹50,000/- to ₹75000/– under the new tax regime.

- The tax ceilings in the new regime are increased.

For the 10% tax slab, the ceiling would be ₹7 lakhs (before ₹6 lakhs) For the 15% tax slab, the ceiling would be ₹10 lakhs (before ₹9 lakhs)

Source: Budget 2024-25

Deduction for family pension increased to ₹25000/- from ₹15000/-.

Investment taxation

Along with fixed salary income, investments play a crucial role in the financial management of a salaried individual. There are multiple opportunities for investment, such as the stock market, mutual funds, fixed-income assets, government securities, etc. After the sale of such investments, the gains earned are taxed under ‘Income from capital gains’. These capital gains are classified based on the assets and tenure holding of these investments.

What’s new:

In budget 2024-25, the holding tenure and taxation of capital gains were changed as follows:

| Particulars | Short-term | Long-term |

| Listed equity or equity-oriented funds (holding tenure: 12 months) | 20% | 12.5% |

| Unlisted equity or equity-oriented funds (holding tenure: 24 months) | Slab rate | 12.5% |

| Listed debt instruments (holding tenure: 12 months) | Slab rate | 12.5% |

| Debt-oriented funds (more than 65% in debt) (no tenure limit) | Slab rate | Slab rate |

| Other funds (gold funds, fund of funds, etc.) (holding tenure: 24 months) | Slab rate | 12.5% |

Source: Memorandum for explanation of The Finance Bill, 2024

The above tax rates have serious implications for the secondary source of salaried individuals. The substantial increase in short-term capital gain taxes can negatively affect them.

Other implications

- The indexation benefit is removed. It will majorly affect gains in real estate. Indexation provided inflation adjustment against capital gains.

- Custom duty on precious metals like gold and silver was reduced to 6%, which will help reduce its hiking prices.

- Tax deducted at source (TDS) on redemption of mutual funds or UTI units will be eliminated.

Calculation of income tax [as per provisions of the new budget 2024-25]

The income tax calculation under the new and old regimes, can be easily understood from this example. Ms Hema is 30 years old and has a salary of ₹7 lakhs per annum. She also pays a life insurance premium of ₹30,000/-.

Let’s calculate her tax implications:

Old tax regime

| Particulars | Amount in ₹ |

| Gross salary | 7,00,000 |

| Standard deduction (less) | 50,000 |

| Income from salary | 6,50,000 |

| Net Income | = 6,50,000 |

| Sec 80C: Life insurance premium deductions | 30,000 |

| Total Taxable Income | = 6,20,000 |

| Tax liability | 36,500 (12,500+24,000) |

| Health and education cess (4%) | 1,460 |

| Total tax liability | = 37,960 |

New tax regime

| Particulars | Amount in ₹ |

| Gross salary | 700,000 |

| Standard deduction (less) (below 7 lakhs) | 75,000 |

| Income from salary | =6,25,000 |

| Total taxable income | = 6,25,000 |

| Tax liability calculation | 17,500 (15,000+2,500) |

| Rebate (taxable income below 7 lakhs) | 25000 |

| Tax liability | Nil |

| Health and education cess (4%) | Nil |

| Total tax liability | = Nil |

From the above example, it is clear that Ms Hema will pay no tax by opting for a new tax regime. But, it is due to her income level, lack of deductions and rebate benefit under ₹7 lakh. The old tax regime provides deduction benefits. However, the new tax regime (which is also the default regime) does not, but it has more tax slabs with lower rates. Individuals should assess the favourable regime according to income level and tax rates.

Implications

The salaried class may be affected in mainly two ways:

- Positive

The increase in standard deduction amount, and change in tax slabs for the new regime would benefit investors opting for it. Also, the deduction in customs duty may reopen the investment in precious metals like gold and silver by reducing its price. Salaried individuals may sort their secondary income from investments for the long term as it attracts less tax.

- Negative

The heavy rise in capital gain taxes can also discourage investors from investing mainly in the short term. Moreover, the indexation benefit removal is a massive setback as inflation will not be accounted for in the calculation.

Conclusion

Budget 2024-25 has crucial implications regarding salary taxation, such as an increase in the ceilings and standard deduction, making the new tax regime attractive. However, capital gain taxation makes investment planning difficult. The sharp increase in short-term capital gain tax can benefit the long-term investors in the market. The indexation benefit is removed, which may disappoint some people. Salaried individuals need to plan wisely regarding their investments, deductions, and regimes for tax payment after this budget.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025