Table of Contents

India’s financial fortress is here! RBI’s Intelligence Platform is the new era of secure payments. Get all the insights on India’s financial evolution.

In a time when making digital payments is as routine as breathing, the threat of cyber fraud casts a shadow, posing a serious risk to the foundation of our financial well-being. Enter the Reserve Bank of India’s (RBI) latest arsenal in the war against digital deceit: the Digital Payments Intelligence Platform.

This groundbreaking initiative promises to fortify the ramparts of our digital economy, ensuring that every transaction you make is a bastion of trust and security.

Join us as we delve into the RBI’s visionary strategy, designed to safeguard your hard-earned money and keep the digital marketplace a safe haven for all.

The surge in cyber frauds

The year 2024 has seen a troubling increase in cyber fraud in India. The Indian Cyber Crime Coordination Centre (I4C) has reported losses exceeding ₹1,750 crore due to these crimes in just the first four months of the year 2024. This clearly indicates that cyber threats are on the rise and getting increasingly complex.

Every day, about 7,000 cybercrime reports are filed, which is a significant increase from the past few years. Most of these crimes, around 85%, involve money being stolen online, showing how risky online financial activities have become.

Fraudsters are using a variety of methods to steal money, including fake investment opportunities, gaming apps, manipulating software algorithms, unauthorized loan apps, sextortion, and tricking people into giving away their one-time passwords (OTPs). In 2023, there were more than 100,000 reports of investment scams, and this number has been growing since the start of 2024.

The financial damage is substantial. Trading scams alone have led to over 20,000 cases and losses of ₹14.2 billion. There have also been tens of thousands of investment scam complaints, resulting in losses of ₹2.22 billion, and dating app scams have cost users ₹132.3 million.

RBI’s digital payments intelligence platform

The RBI is taking decisive action to strengthen the security and trustworthiness of digital transactions by proposing a new digital payments intelligence platform. This platform aims to boost consumer trust and reduce the risk of payment fraud. In order to make digital payments safer, it will use cutting-edge technology to identify and stop fraudulent actions.

A special committee, headed by AP Hota, the ex-MD and CEO of NPCI, has been appointed by the RBI to guide the development of this platform. Their task is to scrutinize the various elements necessary for the digital infrastructure of the intelligence platform and to submit their findings in two months.

The proposal has received positive feedback from industry specialists, who acknowledge it as a major step forward in the realm of digital payments. They have pointed out the potential benefits of using AI and machine learning to lower the risk of payment fraud. This initiative is in line with the RBI’s ongoing commitment to safeguarding customers, and it complements its continuous efforts to set standards for data protection, cybersecurity, and KYC norms.

Moreover, the Reserve Bank of India has revised the GDP growth estimate for the FY 2024-2025 to 7.2%, reflecting a more robust economic fortitude. Maintaining the repo rate at 6.50% for the eighth time in a row underscores a consistent economic forecast, underpinning the prospects for ongoing expansion.

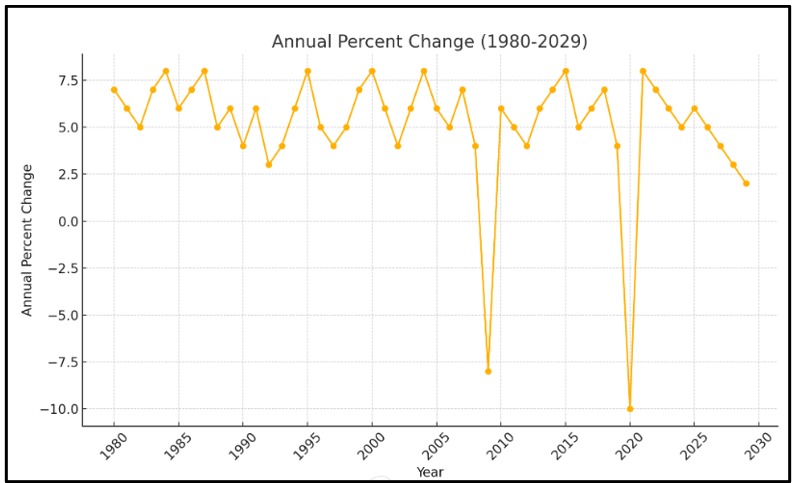

This chart represents the historic trend in India’s GDP growth:

Source: IMF

Global context and comparisons

The RBI’s Digital Payments Intelligence Platform is contributing to the global effort to strengthen the security of digital transactions. Different nations have embarked on comparable projects, each customized to fit their distinct financial environments.

Take the United States, for example, where the Federal Reserve is developing FedNow — a service designed to upgrade the nation’s payment system to support 24/7 instant payments. Similarly, the European Central Bank has introduced TIPS, the TARGET Instant Payment Settlement system, enabling real-time fund transfers throughout the eurozone at any time.

Both these initiatives underscore the need for:

- Real-time processing: Ensuring that transactions are processed without delay to meet the expectations of instantaneity in the digital age.

- Scalability: Capacity to process an increasing volume of transactions in response to the proliferation of digital payment methods.

- Security: Defending against fraud and cyberattacks by implementing cutting-edge security solutions.

- Regulatory compliance: Adhering to the regulatory standards set by financial authorities to maintain trust and stability in the financial system.

The RBI’s platform can benefit from these lessons by incorporating features that promote seamless, secure, and efficient digital transactions. By doing so, it can significantly contribute to the growth of the digital economy and reinforce India’s position as a leader in the digital payments space.

The platform’s success will depend on its ability to adapt to the rapidly evolving technological landscape and the changing needs of consumers and businesses alike.

Future of digital payments in India

India’s digital payment sector is on the brink of a major transformation, with the RBI’s Digital Payments Intelligence Platform set to play a key role in this change. This platform is anticipated to be a fundamental element in the RBI’s plan to ensure a more secure and resilient system for digital transactions.

The Reserve Bank of India (RBI) is dedicated to shaping a future where digital payments are a fundamental part of daily life, universally available and consistently reliable. This commitment is reflected in the RBI’s Payments Vision 2025, which seeks to establish an e-payment system that is both secure and user-friendly. The RBI’s strategic goals are centered on improving the reliability and reach of payment systems, encouraging innovative practices, and broadening international connections. The RBI is actively working to revolutionize India’s payment mechanisms. The aim is to cater to the changing requirements of a vibrant economy and secure India’s place as a leader in the worldwide digital payments arena.

The intelligence platform will supervise the network to enhance the safety of internet-based financial transactions. In order to detect and stop fraud as it occurs, it will leverage state-of-the-art technology like artificial intelligence and machine learning. This initiative is expected to not just safeguard consumers but also to increase their trust in digital payments, leading to broader acceptance and use.

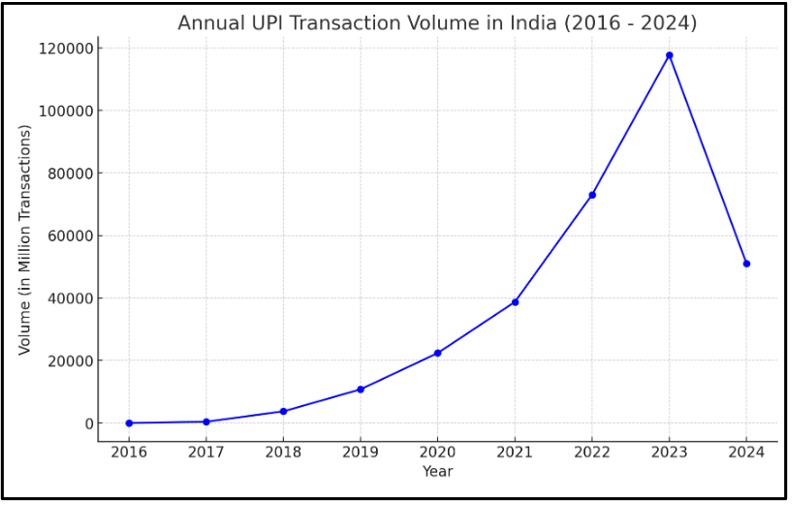

India’s digital payment sector is on the cusp of a major growth spurt, with expectations that UPI transactions will see a 60% surge in 2024 over the previous year. The Account Aggregator framework is anticipated to be a game-changer, offering safe data sharing with user consent, thus improving the efficiency of financial services and advancing financial inclusion.

Additionally, the push for contactless mobility payments, backed by the government’s Digital India initiative and the RBI, is set to make transactions smoother and bolster the security of the digital finance space. These advancements signal a period of transformation for India’s digital payment infrastructure, aiming to make transactions more user-friendly, accessible, and secure nationwide.

This chart represents the significant volume growth in UPI:

Source: NPCI

*Please note that the data for the year 2024 is not for the whole year but is for the year till date (January to April 2024).

Conclusion

As India stands on the cusp of a major transformation in its digital payment infrastructure, the RBI’s initiative represents a significant step towards a future where digital transactions are universally trusted and seamlessly integrated into everyday life.

This platform is expected to drive broader acceptance and usage of digital payments, paving the way for a more secure, inclusive, and efficient financial ecosystem in India.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025