September 2nd, Tuesday,

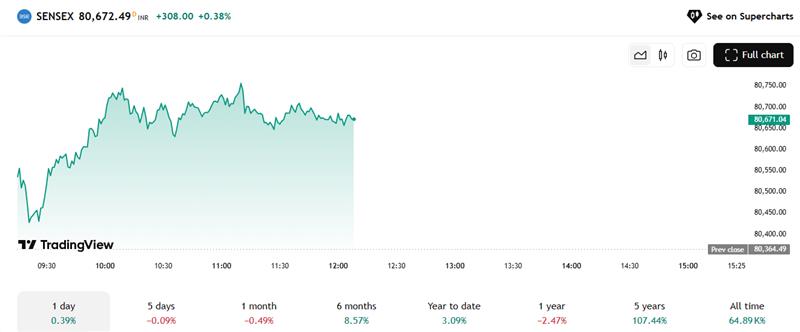

The Indian stock market opened on a cautious but positive note today, September 2, 2025, with the benchmark indices showing marginal gains amid mixed sectoral performances. BSE Sensex opened at 80,520.09 (Previous close: 80,364.49). By mid-morning, it was seen trading at the 80,672 level.

Source: Tradingview

Source: Tradingview

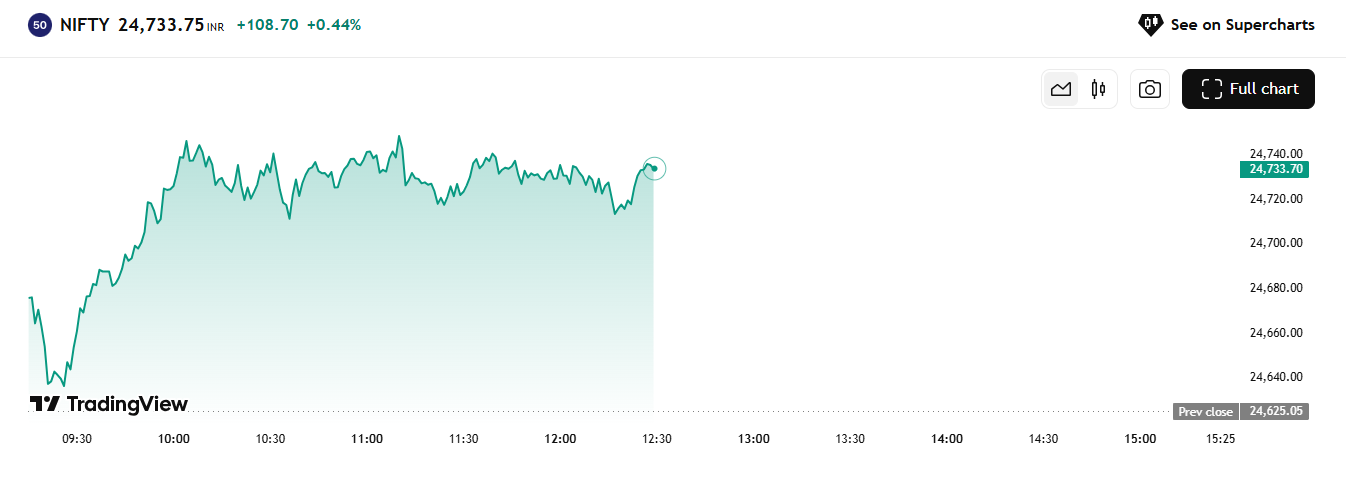

The NSE Nifty 50 opened at 24,653 (Previous close: 24,625) and was hovering around 24,672 levels, up about 0.19%.

Source: Tradingview

Meanwhile, the Midcap and Smallcap indices continue to outperform the frontline indices. The Nifty Midcap 100 index has surged by 287.30 points, while the Nifty Smallcap index is up 0.60%, reflecting strong buying interest in these segments.

The Nifty Bank index is showing a modest gain, slightly trailing the main benchmark indices, with a rise of around 0.14% this morning.

Want to know the reasons behind this rally? Check these out:

-

Anticipation for GST Council Meeting:

Markets are closely watching the upcoming 56th GST Council meeting scheduled for September 3-4, which is expected to deliberate on significant GST reforms. Investors are hopeful for rationalisation of tax slabs and simplification of compliance, which could boost consumption and industrial activity. This cautious optimism is contributing to the mild rally in consumer and industrial sectors.

-

Mixed Global Market Cues:

Global markets showed a mixed tone during early Asian trading hours. US S&P 500 futures rose modestly by 0.05%, while European markets also posted slight gains. However, geopolitical uncertainties and renewed trade tensions, especially in Indo-US relations, continue to weigh on investor sentiment, keeping markets cautious. -

Foreign Portfolio Investor (FPI) Outflows:

Even though the stock market observes a rally, foreign portfolio investors have been net sellers for the sixth consecutive session, offloading Indian equities worth approximately ₹1,700 crore on Monday. This persistent outflow is putting pressure on the currency, which hovered near a record low of ₹88.20 against the US dollar. The cautious stance of FPIs is causing some defensive trading, particularly in banking and IT stocks.

Let’s have a look at the top 3 gainers and losers up till 12:40 pm today.

Top 3 Gainers:

| Stock Symbol | Full Name | Opening Price (₹) | Previous Close (₹) | Last Traded Price (₹) | % Change (%) |

| KAUSHALYA | Kaushalya Textile | 1,278.00 | 1,268.60 | 1,522.30 | 20.00 |

| PNC | Punjab National Corporation | 39.36 | 32.80 | 39.36 | 20.00 |

| KOTARISUG | Kotari Sugars | 30.81 | 30.12 | 36.14 | 19.99 |

Source: NSE

Top 3 losers:

| Stock Symbol | Full Name | Opening Price (₹) | Previous Close (₹) | Last Traded Price (₹) | % Change (%) |

| SARVES-RE | Sarvesh Re | 1.05 | 1.76 | 1.05 | -40.34 |

| JINDALPHOT | Jindal Photo Limited | 1,230.40 | 1,235.20 | 1,115.00 | -9.73 |

| LICNMIDI00 | LIC Nomura Mutual Fund | 62.49 | 63.55 | 58.26 | -8.32 |

Source: NSE

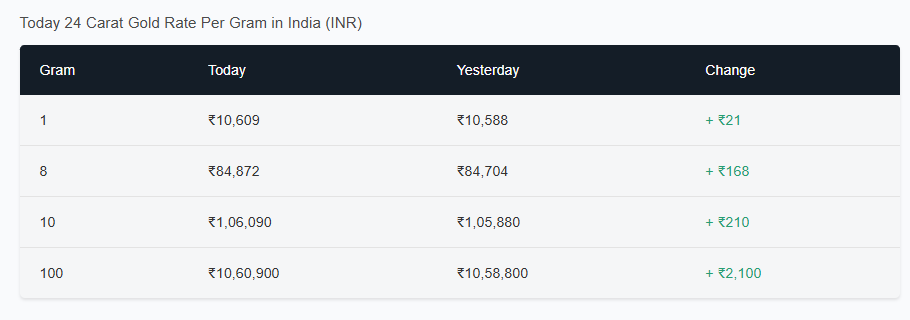

Talking about commodities, gold prices in India soared to an all-time high today, captivating investors and traders alike. According to Goodreturns, 24-carat gold glittered at an unprecedented ₹1.06 lakh per 10 grams, while 22-carat gold commanded ₹97,250 per 10 grams. Even the popular 18-carat variety shone brightly, fetching ₹79,570 per 10 grams.

Source: Goodreturns

Source: Goodreturns

This surge highlights gold’s enduring allure as a safe haven amid global market uncertainties and domestic demand pressures.

Conclusion:

In conclusion, the Indian stock market demonstrated cautious optimism on September 2, 2025, with benchmark indices gaining modestly amid mixed sector performances. Anticipation of the upcoming GST Council reforms, mixed global market cues, and ongoing foreign portfolio investor outflows shaped today’s market dynamics. Midcap and smallcap stocks outperformed, reflecting selective investor confidence despite prevailing uncertainties.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025