September 5th, Friday,

The Sensex opened higher at around 81,012, registering an initial gain of about 294 points or 0.36% from its previous close of approximately 80,718. However, by 12:30 pm, it reversed some gains and was trading slightly lower, down by about 150 points, to near 80,566- a decline of approximately 0.19% from the previous day’s close.

Source: Tradingview

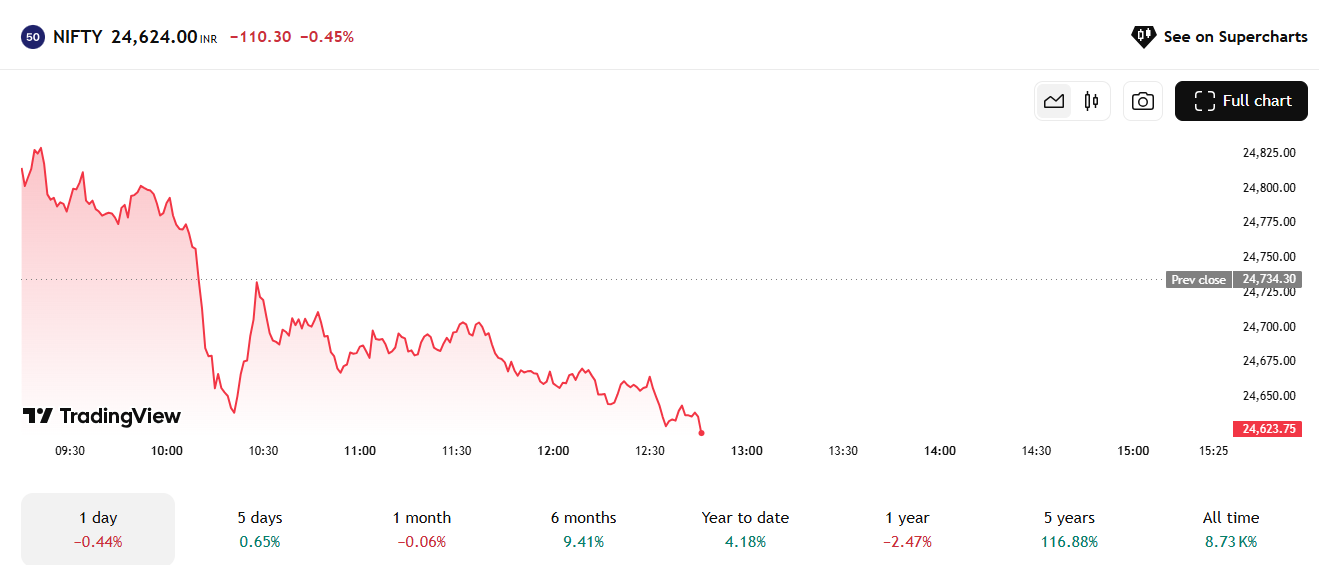

The Nifty50 started the day at roughly 24,794, up 0.24% from its prior close of about 24,734.30, but later slipped by 0.1% to trade near 24,624 at mid-morning, reflecting similar profit booking pressure.

Source: Tradingview

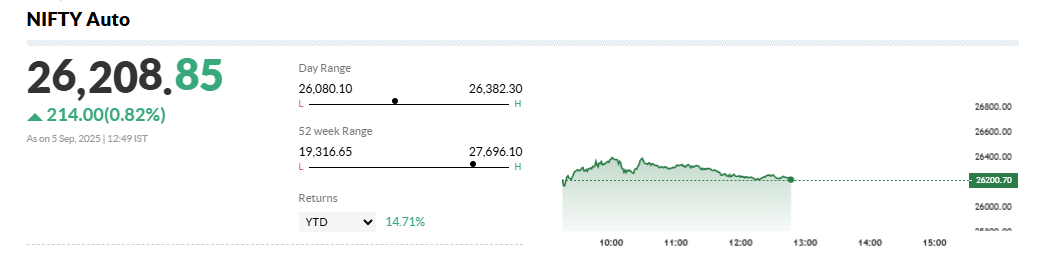

Nifty Auto was a clear outperformer, rallying over 0.82%, boosted by positive market sentiment following GST rate cuts benefiting automobile manufacturers and associated suppliers.

Source: Moneycontrol

Nifty Midcap and Smallcap indices showed marginal gains of around 0.2% to 0.4%, indicating selective buying in broader markets.

But why such a reversal?

Three Major Reasons for Market Direction Today

1. Profit Booking after Recent GST-led Rally

Investors booked profits in consumer staples and IT sectors after the strong upward moves following the recent GST reforms. Market participants are cautious about valuations at current levels, leading to a rotation away from recent winners.

This profit booking was partly offset by fresh buying in autos and pharma sectors, seen as beneficiaries of the GST rate reclassification and defensive plays.

2. Mixed Global and Domestic Sentiment

Mixed cues from global markets, including modest gains in US indices but volatility in commodity prices and interest rate expectations, contributed to cautious trading in India.

Domestic investors are also awaiting further clarity on implementation details of GST 2.0 reforms expected later this month, leading to some consolidation in benchmark indices.

3. Technical Consolidation and Support Levels

Technically, the Nifty is consolidating in the 24,600-25,000 range with support near 24,700. Analysts suggest that the near-term trend remains range-bound as investors digest recent policy announcements and global trends.

Market experts recommend a buy-on-dips strategy focusing on sectoral leaders in banking, auto, and healthcare.

Now,

Let’s also have a look at the top 3 gainers and losers till 12:55 pm.

The top 3 gainers were:

| Stock Name (Full) | Previous Close (₹) | Opening Price (₹) | Last Traded Price (₹) | % Change |

| JITF Infralogistics Ltd (JITFINFRA) | 338.80 | 333.00 | 406.55 | 20.00% |

| S.A.L Steel Ltd (SALSTEEL) | 18.48 | 22.17 | 22.17 | 19.97% |

| Sarveshwar Foods Ltd – Rights Entitlement (SARVES-RE) | 0.38 | 0.38 | 0.45 | 18.42% |

Source: NSE

And top 3 Losers were:

| Stock Name (Full) | Previous Close (₹) | Opening Price (₹) | Last Traded Price (₹) | % Change |

| Akshar Spintex Ltd (AKSHAR) | 0.55 | 0.55 | 0.50 | -9.09% |

| Olectra Greentech Ltd (OLAELEC) | 64.50 | 64.10 | 59.87 | -7.18% |

| InfoBeans Technologies Ltd (INFOBEAN) | 597.30 | 600.10 | 559.35 | -6.35% |

Source: NSE

In summary, markets stayed volatile on September 5th, with Sensex and Nifty slipping from early highs due to profit booking in IT and consumer sectors. Auto stocks stood out, gaining on GST cuts, while broader markets showed selective buying. Technical consolidation signals a range-bound trend, with buy-on-dips opportunities in banking, auto, and healthcare leading the way.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025