Table of Contents

SEBI has proposed a new asset class with mixed features of MFs and PMS. Read the blog to know more.

India is home to nearly 18 crore registered investors, as of July 29, 2024. There are different investor classes based on exposure, investments, frequency, etc. However, human wants are unlimited. So, investors usually seek better opportunities than existing ones.

When investors do not find desirable investment options in an organised market, they usually start inclining toward informal and unlisted securities. However, this poses a threat to their hard-earned money as well as to the market sanity.

The market regulator, the Securities Exchange Board of India (SEBI), takes note of such requirements and works towards making the market more efficient and investor-friendly. The board has also started releasing a consultation paper for public comments before any crucial policy change. It helps in understanding the market sentiment and making decisions while considering a wide spectrum of views.

Recently, on July 16, 2024, a consultation paper was released to introduce a new asset class that will be categorised between mutual funds and portfolio management services. It will be suitable for investors with comparatively higher ticket sizes and investments.

The last date for submitting a public response to this SEBI consultation paper is August 6, 2024.

Let us explore the two ends of MFs and PMS, understand the categories between them and analyse the implications of SEBI’s proposed asset class.

What are mutual funds?

It is an investment pool with varied asset options based on their features, sectors, payoffs, etc. This pool is known as mutual funds. This pool is managed by expert professional fund managers. It offers investors diversification among various assets in a single portfolio. Mutual funds have a net asset value (NAV) per unit that indicates the total market value of all the assets and liabilities of the fund per unit available in the market.

The availability of diverse assets spreads the total risk of the portfolio among them and reduces the burden. Its features, such as systematic investment plans (SIPs), benefit retail investors to start investing small amounts and gradually increase it to build a considerable corpus.

What is a portfolio management service (PMS)?

It is an investment service, rather than a pool, that is managed by professionals. It is subjective, meaning that it is offered to a particular investor. It uses tailor-made strategies according to the investor’s risk appetite, preferences and corpus.

These services are expensive and are usually subscribed to by high net-worth individuals (HNIs). They need proper expertise to manage their large investments. Minimum of ₹50 lakhs is the requirement for PMS.

Investors between MFs and PMS

The MFs and PMS are two extreme ends. Investment in the former starts at as low as ₹500/- SIP, while the latter needs ₹50 lakhs. They also have different risk exposures according to assets. However, this limits the options available to investors. Then what about the investors who don’t have capital of ₹50 lakhs for an initial investment?

To bridge this divide and provide a wide range of investment options to investors, SEBI proposed a new asset class.

SEBI proposal

The new proposal by SEBI suggests an asset class that falls between mutual funds and PMS in terms of risk exposure and structure. Separate nomenclature will be introduced by the SEBI for this asset class. The following are some aspects which explain the proposal in detail:

Reason for the new asset class

Over the years, investment norms have become investor-friendly to support investment in different areas like mutual funds, alternative investment funds (AIFs), PMS, etc. However, investors with more risk appetite invest in unregistered PMS, which employ risk strategies and earn higher returns.

So, by balancing the risk-return profile between mutual funds and PMS, this asset class can satiate the needs of investors who are investing with unregistered PMS. It would help bring more and more investors under organised market regulations.

Investor eligibility

- The risk exposure in this class would be high. Thus, SEBI has raised the minimum investment limit for this. The limit is ₹10 lakhs for investors across different investment strategies.

- The investors can have the facility of SIPs, systematic withdrawal plans (SWPs) and systematic transfer plans (STPs) for investment. However, after such withdrawals or transfers, the balance cannot be less than ₹10 lakhs.

- Also, mutual funds and professional fund managers need to fulfil certain norms regarding assets under management (AUM).

Structure

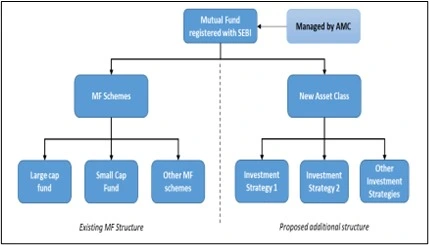

The asset class would be under mutual funds managed by asset management companies (AMCs). However, the AMC should take all measures to keep the mutual funds and the new asset class distinct based on usage, advertising and branding.

Source: SEBI

- The redemption of this asset class should be decided based on the investment. The period has to be more than weekly.

- The offer document should be similar to mutual funds.

- Mutual funds have different schemes, while the new asset class would have investment strategies.

- Only the investment strategies recognised by SEBI nomenclature, can be employed. These investment strategies can be of varied nature, like generating returns opposite to the investment, specific theme strategy, etc.

Investment exposure

Different assets can be constituted in this investment after following the proposed norms:

| Particulars | Investment norms |

| Single issuer debt security limit | 20% of NAV |

| Single issuer debt credit rating and contribution to NAV | AAA: 20% of NAV AA: 16% of NAV Below A: 12% of NAV |

| Equity or equity-related instruments exposure in NAV | 15% |

| Real estate investment trusts (REITs) & Infrastructure investment trusts (InvITs) | Less than or equal to 20% of NAV (less than 10% from a single issuer) |

| Debt limit in particular sector | 25% |

| Derivative | Maximum 10% of NAV (single stock) A maximum of 50% of net assets can be invested in exchange-traded derivatives. |

Examples by SEBI

The regulator has released the following illustrations explaining how the new asset class would work:

- Hedge fund lite/ Liquid alternative fund in the United States of America.

It employs hedge fund strategies but is available to a wide base of investors. They also provide alternative investments but with the liquidity feature of funds. They aim to offer hedge fund-like returns to retail investors while safeguarding them from some of its risks.

- Inverse funds/ ETFs or Bear Funds in Australia.

These funds invest in derivatives, swaps, indexes, etc, and generate returns when they decline. Single reverse funds generate returns opposite to the daily performance of the benchmark. While leveraged hedge funds multiply these daily returns. However, they are also sometimes accompanied by losses.

Implications

- Illegal or unorganised PMS operate without binding to thresholds and are potentially a threat as they can create higher volatility situations with bigger ticket sizes for small investors. The new asset class can pave a path to eradicate this and promote smooth functioning with safety.

- The main effect of this opportunity would be on HNI investors, with high-risk appetite. It would benefit them to have a mutual fund-like structure with PMS-like assets and strategies.

- Thus, the asset class has the potential to suit the investors having an investment amount, more than mutual funds but less than PMS. Early-age investors having amounts equal to more than ₹10 lakh can have exposure to varied assets.

- However, as its structure classifies it under AMCs like mutual fund schemes, the fund managers, investors and other stakeholders have to make its nomenclature clear before investment, at the time of its implementation.

Conclusion

Mutual funds have shined as a feasible opportunity for retail investors in the country. The HNI with funds more than ₹50 lakh have PMS for the effective management of their funds. However, there are investors between the extremes of PMS and MFs, who (as per SEBI) are indulging in unregistered PMS.

The proposal by SEBI to introduce a new asset class, can be a worthy opportunity for such investors with high ticket size and risk appetite. Moreover, its exposure to assets with investment strategies like PMS is an attractive feature.

The experts, professionals and the public are invited to share their views on this consultation paper. After this process, SEBI will understand the inclination and overall criticism for this opportunity.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025