Friday morning witnessed a weak start with the Sensex down by 400 points and Nifty50 falling below the 24,950 mark. In this mini blog, we uncover why stock market is falling today in India.

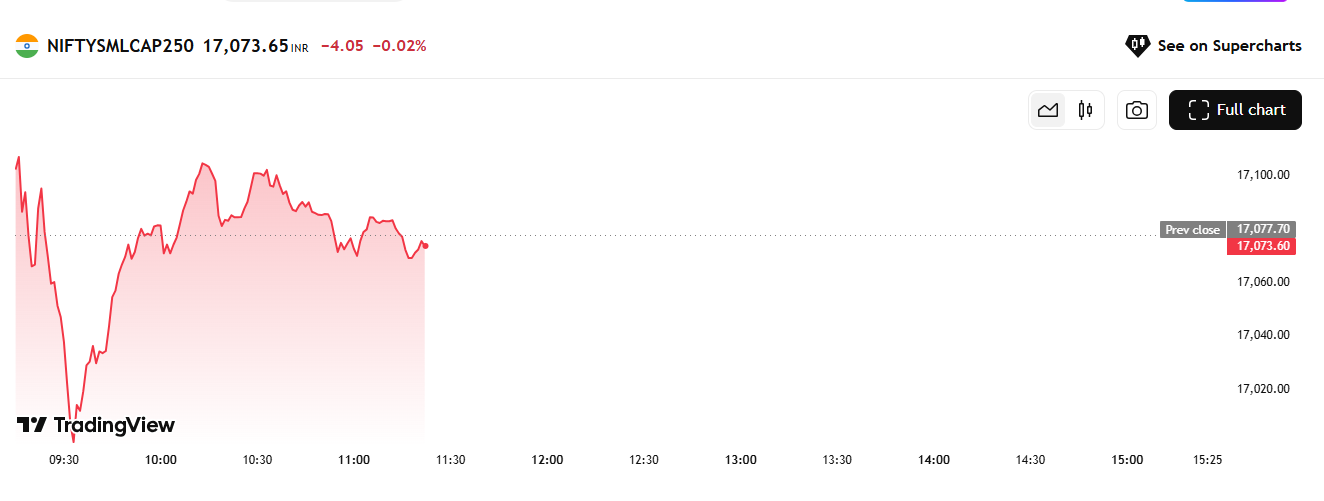

Source: Tradingview (As of 22nd August, 2025)

This sharp decline comes in around the same time as SEBI Chairman’s proposed directive on increasing the tenure of derivative expiries.

The SEBI chairman’s proposal to increase the tenure of derivative expiries has caused uncertainty among investors, leading to subdued trading and muted stock prices in capital market companies like BSE and Angel One.

US President Donald Trump also instills fear among investors with the new proposed 25% tariffs, which now seem more likely. Such tariffs are expected to slow down India’s economic growth, and this makes the investors worried. They have, thus, indulged in selling off in certain sectors such as metals, banks, IT, etc.

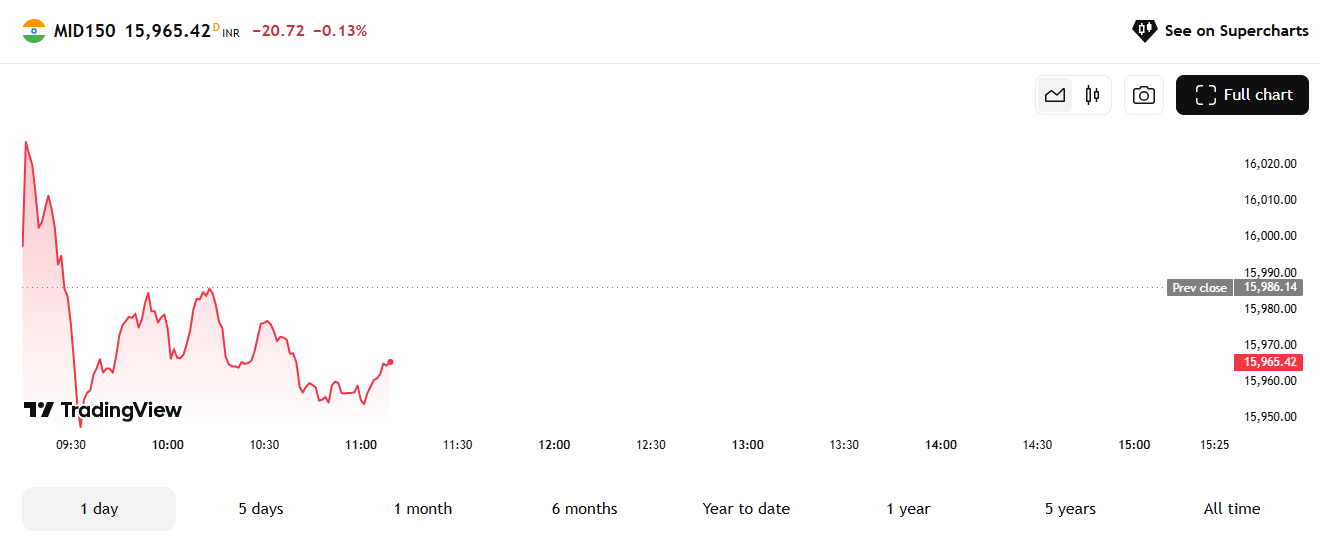

The midcap and smallcap sectors also declined amidst the negative outlook.

Source: Tradingview (As of 22nd Aug, 2025)

Source: Tradingview (As of 22nd Aug, 2025)

Comprehensively, investors are fearful of the overall trade scenario and upcoming trading restrictions. This has negatively affected the market.

Another reason for this decline is the fear around US Federal Reserve Chair Jerome Powell’s speech today, which is expected to provide an interest rate outlook, along with global market direction.

Some of the stocks that were heavily impacted are below:

| Stock | Last price | Previous Close | %change |

| Grasim Industries Ltd. | ₹2,821.9 | ₹2,881.2 | 2.06% |

| Asian Paints Ltd. | ₹2,520.3 | ₹2,566.6 | 1.8% |

| Adani Ports Ltd. | ₹1,340.2 | ₹1,361.5 | 1.56% |

| Hero Motocorp Ltd. | ₹5,025.2 | ₹5,097.1 | 1.49% |

| HCL Technologies Ltd. | ₹1,472.6 | ₹1,493.5 | 1.44% |

Source: NSE

In conclusion, investors face uncertainty regarding the looming tariffs, global interest rate direction, and the ongoing regulatory concerns in the stock market. This fear coupled with a cautious investor mindset has led to a fall in these indices today.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025