Company Overview: From NBFC to a Diversified Bank

Incorporated in 1996, AU Small Finance Bank is engaged in providing a range of banking and financial services including retail banking, wholesale,commercial banking and treasury operations and other services.The Bank provides services to the unserved and underserved retail, small and medium enterprises (SMEs) and micro-enterprises while providing complete banking solutions to its customers including self-employed and salaried individuals, students, senior citizens, farmers, Non-resident Indians, corporates etc. The bank operates in 21 states and 3 union territories through its branches and touchpoints.

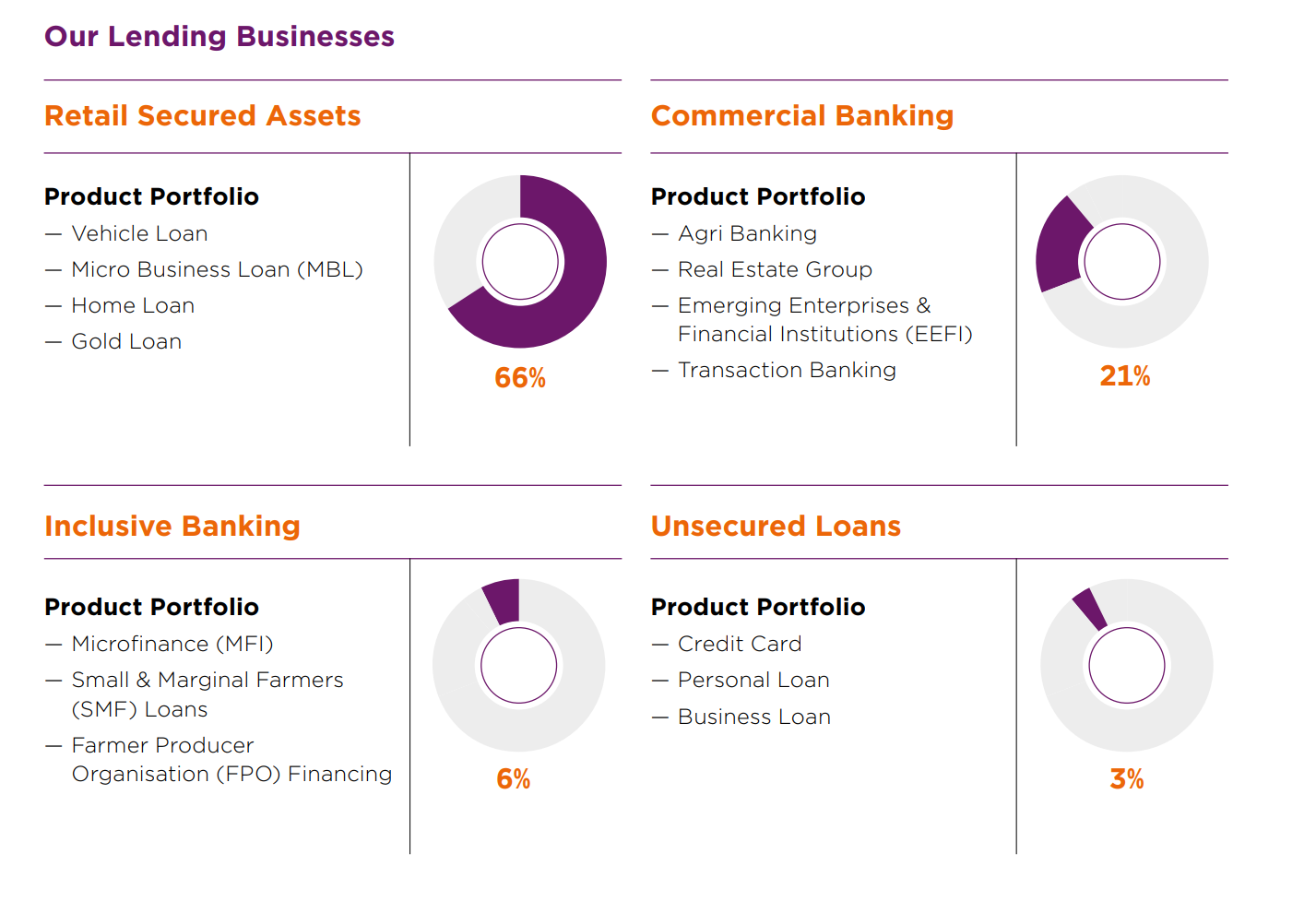

AU SFB’s lending business is now structured into four focused verticals as shown below

The bank maintains a strong focus on rural India, which contributes 71% of its lending, against 29% from urban areas. Critically, its portfolio remains conservative, with approximately 90% of all loans being secured.

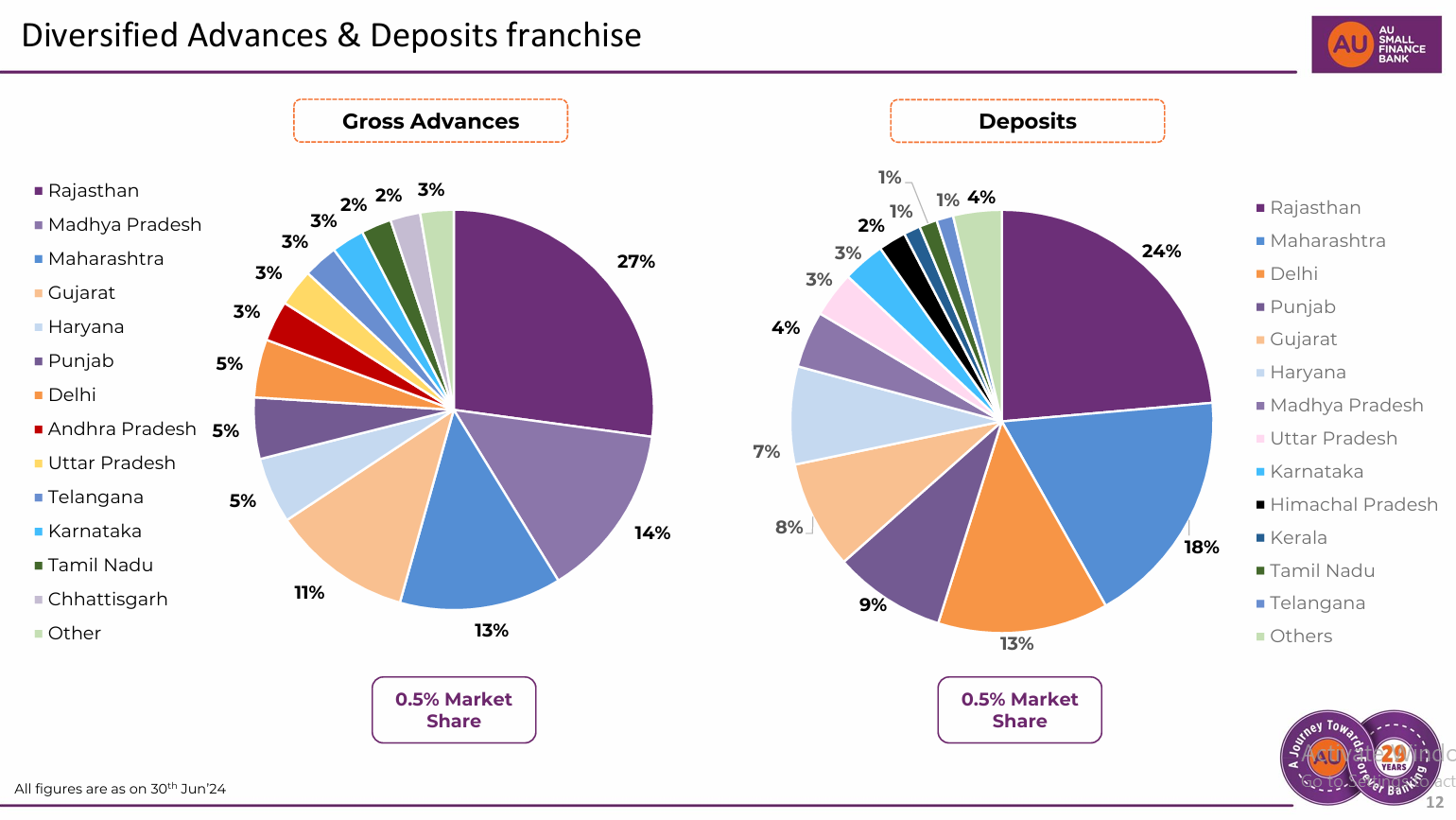

From the above pie chart you can see that the company has diversified gross advances(loan given) & deposits into different geographies(i.e across 13+ regions).So product & region wise the company is completely diversified.

Financial Performance: A Story of Top-Line Growth

AU Small Finance Bank delivered a strong financial performance for the fiscal year ending March 31, 2025, demonstrating robust growth across key metrics despite a challenging macroeconomic environment characterized by tight liquidity and high interest rates.

Profitability

The bank demonstrated strong profitability during the year.

- Net Interest Income (NII): This core measure of a bank’s earnings from its lending activities grew by an impressive 55% year-over-year (YoY) to ₹8,012 Crore.

- Profit After Tax (PAT): The net profit for the year surged by 32% YoY to ₹2,106 Crore.

- Earnings Per Share (EPS): The EPS for FY25 improved by 22% (₹28 <- ₹23)

Balance Sheet

The bank’s balance sheet has also improved due to the amalgamation of Fincare SFB and organic growth.

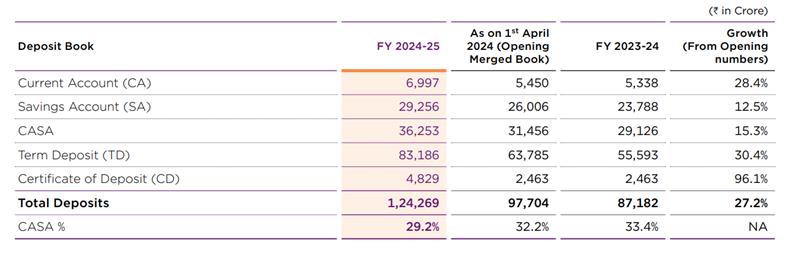

- Total Deposits: The deposit base of the bank increased substantially by 27% YOY (97,704 -> 124,269).

- Gross Loan Portfolio (Advances): The total loan book increased by 46.4% YoY. An important detail within this growth is the strategic shift in the portfolio’s composition. The growth was primarily driven by the secured business segments (like vehicle and MSME loans) which grew by 25.3% YoY. while, the unsecured portfolio (including MFI and credit cards) has fallen by 17.6% YoY, highlighting the bank’s focus on reducing the risk on its balance sheet.

Risk Management & Asset Quality

Asset Quality Metrics:

- Gross NPAs (GNPA) increased from 1.7% in FY24 to 2.3% in FY25. (Q1FY26 -> 2.47%)

- Net NPAs (NNPA) increased from 0.6% in FY24 to 0.7% in FY25.(Q1FY26 -> 0.88%)

Provisioning and Coverage:

- In response to rising stress, provisions and contingencies nearly doubled YoY to ₹533 crore in Q1 FY26. The bank maintains a healthy provision coverage ratio of 84%

Management Commentary and Outlook:

- During the Q1 FY26 earnings call, management noted that slippages were primarily driven by the MFI, Cards, and parts of the Mortgage and vehicle loan portfolios.

Credit costs are expected to remain elevated for the full year, particularly in the unsecured segments. The bank has guided for full-year credit costs in FY25 to be around 1.5% – 1.6% of the gross loan portfolio.

Credit Rating: The bank holds strong credit ratings ‘AA+/Stable’

So from the above analysis, you might be wondering that this is the perfect case for investment, as it is showing good top-line and bottom-line growth for decades. Then why is the stock not performing for the last few weeks, or why is the stock available at 13% discount to 52W high. A deeper look at the bank’s Key Performance Indicators (KPIs) over the last five years reveals the underlying challenges.

A 5-Year Trend Analysis of Key Ratios

| AU Small Finance Bank | 25-Mar | 24-Mar | 23-Mar | 22-Mar | 21-Mar | Trend |

| CASA (%) | 29.17 | 33.40 | 38.43 | 37.28 | 23.00 | Deteriorating |

| Net Profit Margin (%) | 13.10 | 14.54 | 17.40 | 19.07 | 23.64 | Deteriorating |

| Operating Profit Margin (%) | 19.98 | 22.23 | 26.15 | 26.72 | 30.67 | Deteriorating |

| Return on Assets (%) | 1.33 | 1.40 | 1.58 | 1.63 | 2.26 | Deteriorating |

| Return on Equity / Networth (%) | 12.26 | 12.21 | 13.00 | 15.03 | 18.65 | Deteriorating |

| Net Interest Margin (X) | 5.07 | 4.71 | 4.90 | 4.68 | 4.58 | Improving |

The bank’s profitability ratios (Net Profit Margin, ROA, ROE) are deteriorating primarily because of a sharp, 189.5% surge in provisions set aside for potential loan losses, which is eroding profits despite strong revenue growth. The falling CASA ratio also indicates a higher cost of funds, putting additional pressure on profitability.

Investors should focus on two key areas: the trend in asset quality (specifically Gross NPAs and credit costs) to see if the loan book stress stabilizes and the bank’s ability to maintain its Net Interest Margin (NIM) to offset these rising costs.

Relative valuation

To perform relative valuation of the AU SFB we have not only taken Small Finance Bank (SFB) Peers but also considered Mid-Sized Pvt banks Peers. The AU Small Finance Bank is on a trajectory to become a Universal Bank.

| S.No. | Name | Mar Cap Rs.Cr. | P/E | CMP / BV | ROE % | ROA 12M % | Gross NPA | Net NPA |

| 1 | AU Small Finance | 54231.13 | 24.79 | 3.2 | 14.19 | 1.58 | 2.47 | 0.88 |

| 2 | Ujjivan Small | 9298.28 | 17.58 | 1.6 | 12.42 | 1.65 | 2.52 | 0.7 |

| 3 | Equitas Sma. Fin | 6488.32 | 1.1 | 2.43 | 0.3 | 2.92 | 0.98 | |

| 4 | Jana Small Finan | 5046.65 | 11.66 | 1.2 | 13.03 | 1.41 | 2.91 | 0.94 |

| 5 | Utkarsh Small F. | 2371.74 | 0.8 | 0.79 | 0.09 | 11.42 | 0.5 | |

| 6 | IDFC First Bank | 50534.14 | 38.81 | 1.4 | 4.21 | 0.46 | 1.97 | 0.55 |

| 7 | The Fedral Bank | 47488.71 | 11.75 | 1.4 | 12.86 | 1.25 | 1.91 | 0.48 |

Source : Screener.in

AU Small Finance Bank commands a significant valuation premium over its peers. Its P/E ratio of 24.79 and P/B ratio of 3.2 are substantially higher than both its direct Small Finance Bank competitors, such as Ujjivan (P/B 1.55) and Jana (P/B 1.21), and its larger aspirational peers like IDFC First Bank (P/B 1.35) and Federal Bank (P/B 1.37). This premium is largely justified by the bank’s superior profitability, as shown by its strong Return on Equity (14.19%) and Return on Assets (1.58%), which are among the highest in the peer group. Despite its asset quality (Gross NPA at 2.47%) being in line with other SFBs, the market is clearly pricing in a premium for AU SFB’s consistent performance, larger scale, and strong growth prospects. Investors need to keep an eye on the NPAs & how they are improving in coming quarters. As we have seen earlier with the case of Utkarsh Small Finance Bank, the company eroded the investors’ money by more than 50% due to a rise in NPAs.

Technical analysis

Based on weekly analysis of AU SFB, the stock is consistently trading above it’s 200-day EMA (with a few exceptions for the same around Oct 2024 to April 2025).Currently, the stock is trading around 13-14% below its 52-week high, while still being approximately 32% above its 52-week low.Given the bank’s strong fundamentals and improving key performance indicators (KPIs), it is unlikely the stock will fall back to its 52-week low unless there is a significant negative trigger affecting the company. If your investment horizon is at least 2 to 3 years, this is the best business to look into for the long term.

Conclusion

Ultimately, buying into AU Bank today is a bet on the management’s ability to juggle. The real test will be whether they can clean up the current stress in their loan book while simultaneously navigating the massive, complex transition into the big leagues of banking. If you’re watching this stock, your focus for the next few quarters should be: the Gross NPA numbers to see if they can stop the bleeding, and whether those declining profitability ratios finally start to turn the corner. If the leadership can steer the bank through this turbulence, they stand a good chance of proving they are worth the high price the market is asking for today.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025