- Overview of Sector

Growth

Headwinds

Tailwinds

Government initiatives

2. Indian drone market

3. IdeaForge Technology

Core Business & Market share

Fundamentals

News

Good part

Bad part

4. Paras defence(same as ideaforge technology)

5. BEL(same as ideaforge technology)

6. HAL(same as ideaforge technology)

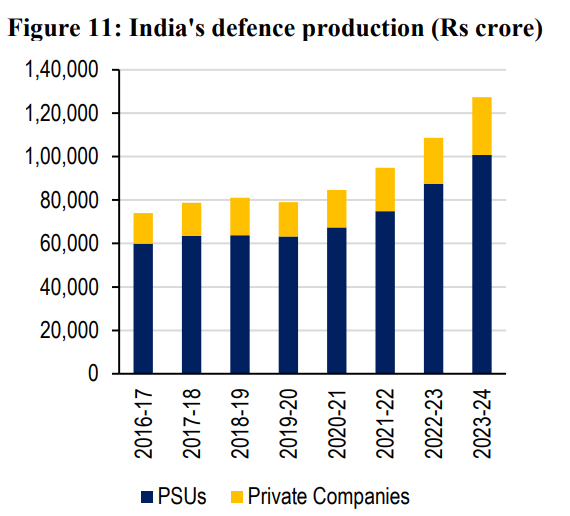

India’s defence sector is showing remarkable growth, backed by government support and strategic policy initiatives. The Ministry of Defence has been allocated ₹6,21,940.85 crore in the 2024-25 budget, representing the highest allocation among all ministries,which accounts for a 4.79% increase from the previous fiscal year. This allocation of funds shows the government’s commitment to reducing dependence on foreign military imports & technological advancements.Below is the chart where you will see the increase in India’s defence production.

Fig : India’s defence production (Rs Crore)

Image: Indian Express news snapshot

If you are following the Ukraine-Russia War, you may be aware of “Operation Spiders.” This demonstrates the significant role drones play on modern battlefields. Furthermore, companies manufacturing drones could present promising investment opportunities.

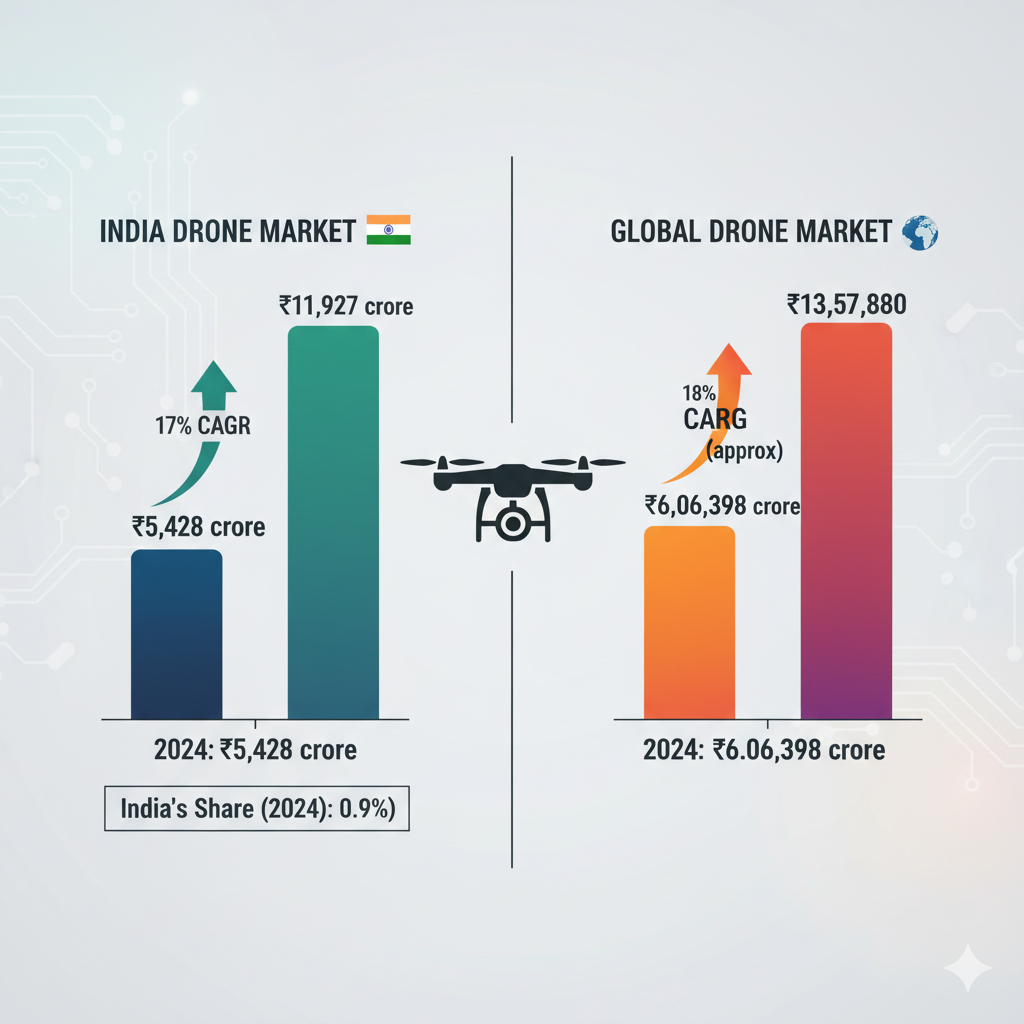

In the Indian drone market, it is 5,428 crore currently & is supposed to reach 11,929 crore by 2029, showing a 17% CAGR. The Indian drone market currently only represents 0.9% of the total global market, which shows the sector’s massive growth potential ahead.

Fig : Indian vs Global Drone market

IdeaForge Technology: Navigating Challenges Amid Strategic Wins

IdeaForge Technology, India’s leading drone manufacturer, recently secured a ₹137 crore contract to supply mini unmanned aerial vehicles (UAVs) and accessories to the Ministry of Defence, scheduled for execution over 12 months. This order pushed the stock up by 10% to ₹631.05 on 23 June 2025, bringing it closer to its IPO price of ₹672.

Despite this positive development, IdeaForge faces some financial challenges. The company posted a ₹24 crore net loss in Q1 FY26 as against a ₹1 crore profit in Q1 FY25. Revenue fell 85% year-on-year in Q4 FY25. (₹86 crore -> ₹13 crore). The company’s OPM margins turned negative at -32% in FY25 from a positive 18% in FY24.

However, the company is the leader in India’s UAV market, holding a 50% market share. It was the first to develop VTOL hybrid UAVs and high-altitude drones. It is ranked 3rd globally in dual-use drones (civil and defense) in the 2024 Drone Industry Insights Global Drone Review. Despite financial pain, IDEAFORGE’s increase in fixed assets and investments indicates a strategy to build capacity and prepare for long-term growth opportunities.

The company’s decline in short-term profitability and operational ratios is partly due to these expansion initiatives and the macroeconomic environment. We don’t see an immediate rebound in this stock unless there is improvement in revenues,margins & some more sector tailwinds.

Paras Defence: Anti-Drone Systems Drive Growth

Paras Defence and Space Technologies has emerged as a key player in anti-drone systems. The company recently secured a ₹46.19 crore contract from the Ministry of Defence for supplying anti-drone systems, including drone jammers, with delivery expected by March 2026. This order contributed to a 5% increase in the company’s stock price to ₹725 per share on 3rd October 2025

Earlier, this company also received high-value, diverse orders. In September, Paras Defence received an international order worth ₹34 crore from Elbit Security Systems Limited, Israel, for electro-optics systems. Additionally, the company secured ₹26.6 crore worth of orders from Opto Electronics Factory for Electronic Control Systems used in Thermal Imaging Fire Control Systems for battle tank applications. Also, it has received an order from Bharat Electronics Limited (BEL) for the supply of signal and data processing systems and multi-sensor fusion systems.

PaParas Defence’s top line & bottom line show steady growth, with consolidated net profit of ₹14.87 crore in Q1 FY26 compared to ₹14.85 crore in the corresponding period last year. Revenue from operations grew by 11.51% year-over-year to ₹93.19 crore. The company’s stock has performed exceptionally well, rising 42% year-to-date(as of 6th October 2025).

With consistent sales and profit growth, along with new orders. Then, FII DII has an interest in the stock(increasing ownership). This stock looks attractive from an investor’s perspective. Also, with a PE of around 90, the stock is getting a premium valuation. An investor’s safe strategy should be allocating only a few percent of funds based on their own research.

BEL : Electronics Giant Powers Defence Modernization

Bharat Electronics Limited (BEL), a Navratna Defence PSU, has got new contracts worth ₹1,092 crore(September 2025). These contracts further enhance BEL’s robust order book and investors’ preference for this company.

BEL’s strong order book is also supplemented by news of a possible ₹30,000 crore Indian Army tender for the QRSAM (Quick Reaction Surface-to-Air Missile) air defence system. The giant contract, if executed, would give multi-year revenue visibility and greatly boost BEL’s already large order book, which was around ₹71,650 crore as of April 2025

The company’s financial performance reflects its strong market position. BEL recorded a 22.61% increase in consolidated net profit to ₹969 crore in Q1 FY26, compared to ₹791 crore in the same period of the previous year. Revenue from operations grew 4.62% to ₹4,440crore. OPM margin improved in the recent quarter.

Stock is trading near its all-time high. Also having a PE ratio of 54.5 above its median PE of 28.4

HAL : Aerospace Giant Secures Landmark Contract

Hindustan Aeronautics Ltd (HAL) recently scored a big victory by bagging a ₹62,370 crore contract for 97 Tejas Mk-1A light combat fighter aircraft, of which 68 will be fighters and 29 twin-seat trainers, from the Ministry of Defence. This is the second major contract for the state-owned aerospace giant and will enhance the combat capabilities of the Indian Air Force considerably in the next six years.

The contract delivery will commence in 2027-28 and be completed over six years. The aircraft will feature 64% indigenous content with 67 additional items incorporated compared to previous LCA Mk-1A variants, including advanced systems like the Uttam AESA radar, Swayam Raksha Kavach electronic warfare suite, and control surface actuators

HAL’s strong financial metrics support its market leadership position. The company boasts a market capitalization of approximately ₹3.15 lakh crore, earnings per share of ₹124.27, return on equity close to 24%, and operates with zero debt. WiWith a P/E ratio of 38 and a dividend yield of 0.85%, HAL stands out among defence peers for its financial strength.

However, it’s not all good news. The government is now looking at restructuring HAL to make it more efficient, even as the company sits on a record order book of ₹2.7 lakh crore. The main issue is that HAL has been slow to deliver planes, which raises serious concerns. This is especially critical for the Indian Air Force, which is already struggling with a shrinking fleet, operating with only about 30 fighter squadrons when it should have 42.

Conclusion : Investment Thesis

Government policy assistance, rising defence expenditure, and geopolitical tensions create a strong investment case for defence firms. Defence production hit an all-time high of ₹1.51 lakh crore in FY 2024-25, up 18% year-on-year. Exports reached a record ₹23,622 crore, marking significant long-term industry growth.

The drone and anti-drone systems market presents particularly attractive opportunities. India’s counter-drone market is expected to grow at 28% annually over the next five years, with the addressable market estimated at ₹120 billion. The broader defence electronics market is projected to grow from $1.9 billion in 2021 to $7 billion by 2030, growing at 15.7% annually.

But investors must watch out for execution risks. Defence projects have long gestation periods, compounded complexity of deliverables, and strict performance clauses. Businesses are hit with supply chain disruption, cost volatility, and stiff competition from the entry of private and global players into India’s defence electronics space.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025