September 12th, Friday,

The Indian stock markets opened on a strong footing this Friday, September 12, 2025, buoyed by positive global cues, a steady domestic macro environment, and robust moves in large-cap technology and automobile stocks. Both benchmark indices—BSE Sensex and NSE Nifty50—extended their recent winning streak, reflecting renewed optimism among investors.

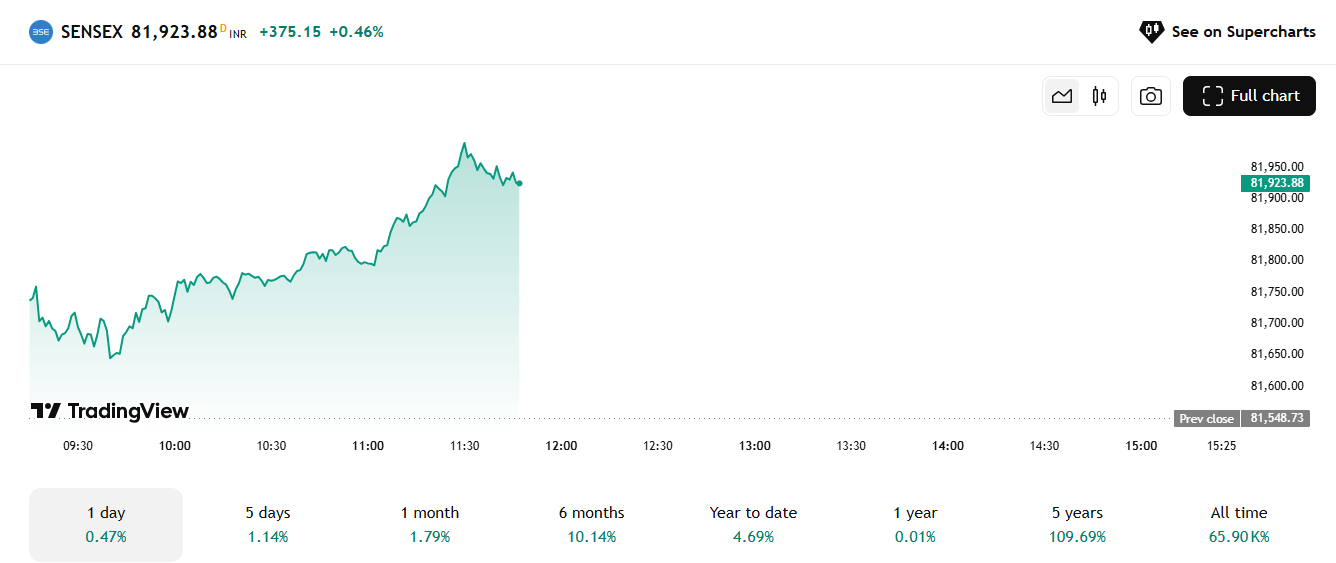

BSE Sensex opened at 81,758.95, up 210 points from the previous close of 81,548.73, and traded higher through the morning session, holding above the 81,700 mark and touching an intraday high of 81,948.45 by midday. This marks a rise of about 0.5% in early trading.

Source: Tradingview

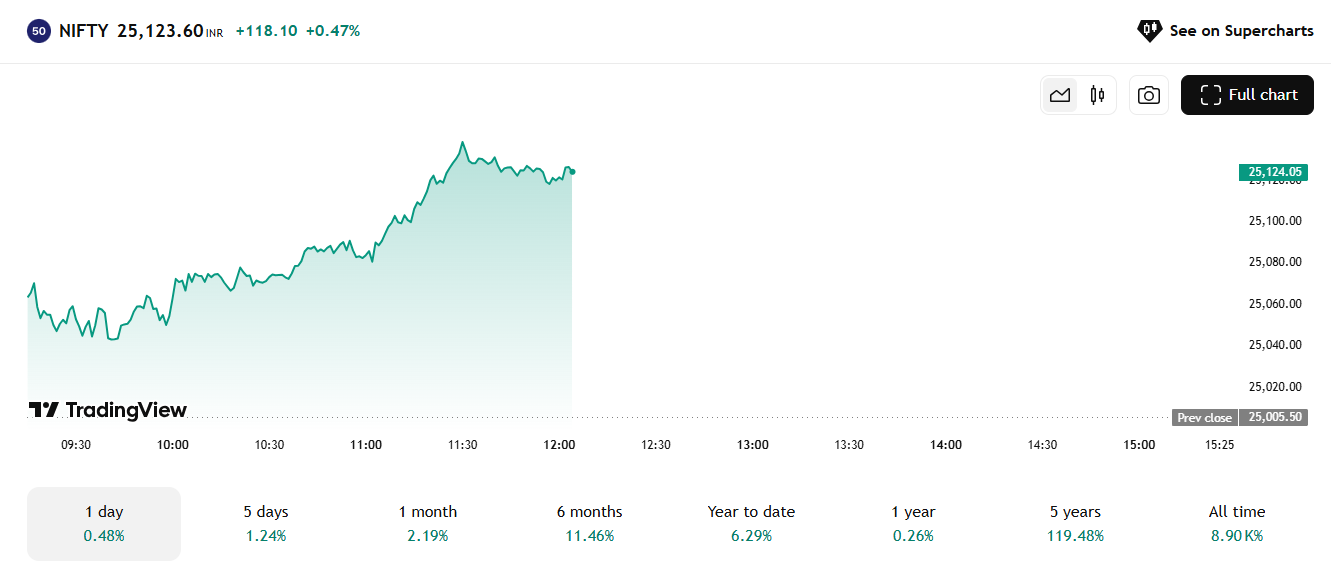

Source: Tradingview

Nifty50 began the session at 25,074.45 (pre-open) and moved up to 25,125.50, registering a solid 120-point gain, or 0.48% higher than yesterday’s close of 25,006.

Source: Tradingview

Nifty MidCap index also advanced 0.46%, gaining around 200 points. The Nifty SmallCap index also rose by 0.33%, up approximately 50 points, mirroring the frontliners in optimism.

Nifty IT Index was the sectoral star, up by 0.74% as heavyweight technology firms, including Infosys, TCS, Tech Mahindra, and HCL Tech, witnessed significant buying.

The Indian rupee opened higher at 88.39 per US dollar, firming up slightly from Thursday’s 88.44, benefiting from strong FII inflows and a narrower current account deficit. The relatively stable currency supported positive sentiment in the equity markets.

Talking about IPOs, Urban Company’s IPO continued to grab headlines, with the issue being subscribed nine times by morning, led by strong retail and NII participation.

Now, what are the key reasons behind this steady upward trend?

Reasons Behind Today’s Market Direction

- Global Tech Rally & US Market Strength

Indian IT stocks mirrored Wall Street’s record highs, as investors bet on continued strength in US technology firms supported by AI and digital transformation themes. A dovish outlook from the US Fed, hinting at possible rate cuts, further bolstered global risk appetite and channelled flows into emerging markets, including India. - Domestic Macros and FII Flows

A robust macroeconomic backdrop in India—marked by steady GDP growth projections, controlled inflation, and stable government finances—continues to underpin equity performance. Foreign Institutional Investors (FIIs) extended their buying streak, encouraged by the narrowing current account deficit and strong government-led capex, pouring fresh liquidity into the market. - Corporate Earnings & Buybacks

Major announcements such as Infosys’s record share buyback and infrastructure order wins for companies like BEL and L&T lifted investor sentiment in specific sectors. Healthy earnings in the automobile and banking sectors contributed to the sectoral outperformance, driving up the headline indices.

Now, let’s also have a look at the top 3 gainers and top 3 losers of today, till 12:20 pm?

| Stock Name | Previous Close (₹) | Open (₹) | Last Traded Price (₹) | % Change |

| Themis Medicare Ltd (THEMISMED) | 101.77 | 103.39 | 122.12 | 20.00% |

| Consolidated Construction (CCCL) | 18.57 | 19.40 | 21.82 | 17.50% |

| Lambodhara Textiles Ltd (LAMBODHARA) | 127.24 | 129.79 | 146.90 | 15.45% |

Source: NSE

And, top 3 losers:

| Stock Name | Previous Close (₹) | Open (₹) | Last Traded Price (₹) | % Change |

| Tainwala Polycontainers Ltd (TPHQ) | 0.73 | 0.73 | 0.69 | -5.48% |

| Paradeep Phosphates Ltd (PARADEEP) | 181.03 | 182.14 | 171.60 | -5.21% |

| PVP Ventures Ltd (PVP) | 32.04 | 32.04 | 30.43 | -5.02% |

Source: NSE

Indian stocks advanced for the eighth consecutive session today, supported by gains in IT, auto, and banking names and underpinned by solid macro fundamentals and positive global cues. With mid- and small-caps joining the rally and the rupee holding firm, the market mood remains upbeat, although any correction in the coming days could present fresh buying opportunities for disciplined investors.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025