Looking for insights on Persistent Systems share before you invest? Read the latest stock update, financial summary, and investment outlook, all in one place.

Persistent Systems, founded in 1990 and based in Pune, is a global technology company driving digital modernization and AI-powered innovation.It operates across the US, Europe, Asia-Pacific, and Africa, serving industries like banking, healthcare, and telecom. In 2025, the company strengthened its push into cloud engineering in India through vital partnerships with Flipkart Commerce Cloud, Google Cloud, and Microsoft, showing a stronger focus on AI and advanced technologies.

In this blog, we’ll look at the Persistent Systems share recent performance, important financial numbers, and the top reasons to invest in Persistent Systems today.

Stock Performance Overview

Persistent Systems share has stayed in focus on the stock market, trading close to its 52-week high and attracting strong investor interest. As of July 14, 2025 (live NSE data), the stock opened at ₹5,595.40, touched an intraday high of ₹5,597.90, and closed at ₹5,620.

| Metric | Value |

| Closing Price (July 14) | ₹5,620 |

| Opening Price | ₹5,550.00 |

| Day’s High | ₹5,605.00 |

| 52-Week High / Low | ₹6,788 / ₹4,148.95 |

Source:https://www.nseindia.com/get-quotes/equity?symbol=PERSISTENT&

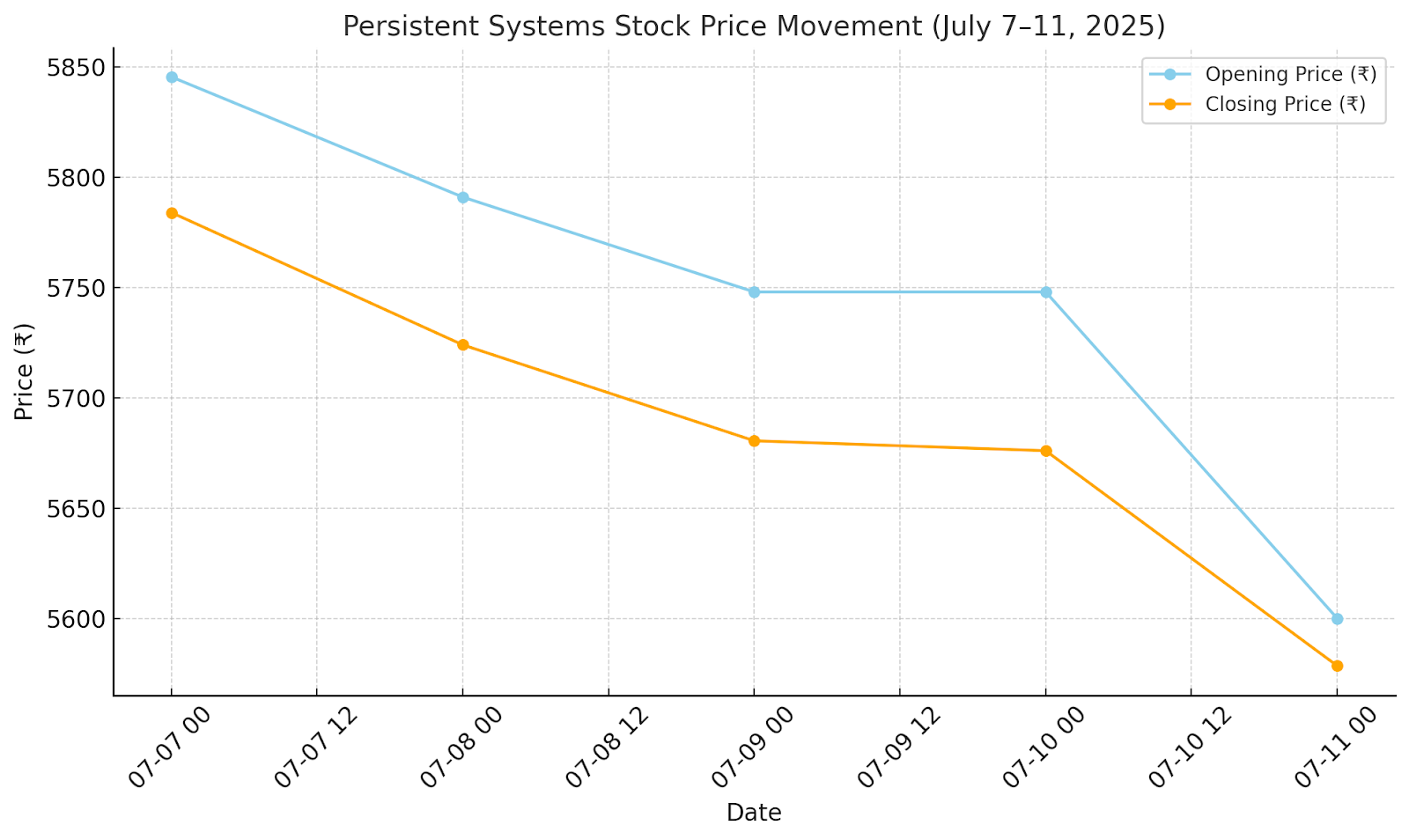

Looking at the past week, Persistent’s stock has seen a slight dip from ₹5,784 on July 7 to ₹5,578.50 on July 11, marking a weekly decline of around 3.5%.

| Date | Closing Price (₹) | Opening Price (₹) |

| July 11, 2025 | 5,578.50 | 5,600.00 |

| July 10, 2025 | 5,676.00 | 5,748.00 |

| July 9, 2025 | 5,680.50 | 5,748.00 |

| July 8, 2025 | 5,724.00 | 5,791.00 |

| July 7, 2025 | 5,784.00 | 5,845.50 |

Source:https://in.investing.com/equities/persistent-systems-historical-data

Financial & Business Highlights

Persistent Systems’ recent financials strengthen its case as a stock worth considering. The company has shown consistent growth, strong profitability, and solid returns, all signals investors look for in a reliable long-term pick.

Net profit grew to ₹1,400 crore in FY25, compared to ₹1,094 crore in FY24, showing healthy bottom-line expansion. Earnings Per Share (EPS) also increased from ₹70.10 to ₹89.84, signaling stronger earnings potential for shareholders.

Here’s a table showcasing the company’s key financial metrics:

| Metric | FY25 | FY24 |

| Revenue | ₹11,938 Cr | ₹9,822 Cr |

| Net Profit | ₹1,400 Cr | ₹1,094 Cr |

| EPS | ₹89.84 | ₹70.10 |

| Current Ratio | — | 2.36 |

| Debt to Equity | 0.00 | 0.04 |

| Dividend per Share | ₹35.00 | ₹42.00 |

| Dividend Yield | 0.63% | — |

| P/E Ratio | 61.85 | 57.39 |

| Market Cap | ₹87,270 Cr | — |

The balance sheet remains strong, with zero debt in FY25 and minimal debt in FY24. This adds financial stability and reduces risk, an important factor for investors in volatile markets.

While the dividend per share dropped slightly from FY24 to FY25, the company continues to deliver consistent shareholder returns alongside growth. The rise in P/E ratio also moved up, reflecting growing investor confidence and aligns with the Persistent Systems growth outlook 2025,

Risks, Opportunities & Key Catalysts

Persistent Systems offers a strong mix of growth potential and near-term triggers, making it a stock to watch closely, especially for traders looking at India’s tech sector. Here are the key factors to consider:

- The stock is about 2.7 times more volatile than the Nifty index. For short-term traders, this means more chances to act on price movements around company news or market trends. It also suggests that the stock reacts quickly to performance updates, both good and bad.

- In the beginning of this year, the company entered into a major partnership with Flipkart Commerce Cloud, all focused on advanced AI and Persistent Systems cloud transformation services. This partnership not only builds its credibility but also highlights its growing role in IT service expansion and next-gen digital transformation.

- The company was named Google Cloud’s Infrastructure Modernization Partner of the Year for Asia Pacific, after completing a complex migration project for a leading e-commerce player. The project moved 6,000+ microservices and 100+ petabytes of data with zero downtime and a 30% reduction in cloud costs, a clear indicator of Persistent’s technical leadership.

- Persistent also acquired select assets from Soho Dragon Solutions India to strengthen its BFSI capabilities, showing its intent to grow both organically and inorganically across key sectors.

- The company is aiming to improve margins by 200–300 basis points by FY27 through better cost control and operational efficiencies. If it delivers, this could be a strong driver of positive market sentiment.

- Analysts at JPMorgan have maintained Buy or Overweight ratings, with target price of ₹7,200 per share, reflecting strong institutional belief in Persistent’s long-term value.

Conclusion

Persistent Systems share is staying in the spotlight with strong financials, no debt, and a growing focus on AI and cloud. A slight dip this week hasn’t shaken its solid foundation. With big partnerships, expansion moves, and margin goals ahead, it continues to draw interest in the tech space. The stock’s higher volatility offers both risk and opportunity, making it one to watch closely in the coming weeks. The analysis hints at further potential, but staying updated is a must. If you’re following market movers like this, a trusted trading platform can help you track trends, spot signals, and take better investment calls.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025