Big moves by Reliance, green energy and AI initiatives. How does it impact its stock performance? Read the blog to find out more.

Reliance Industries Limited (RIL) is India’s largest and most diversified private company, operating across energy, petrochemicals, retail, telecom, entertainment, and textiles. As of 2024, it is a Fortune 500 company and the biggest in India by revenue and market value. In FY2025, Reliance posted a record revenue of ₹1,071,174 crore (about $125.3 billion).

Let’s take a look at the performance of Reliance Industries stock and how its strategic focus particularly the Reliance Industries solar energy projects in 2025 is shaping its long-term investment outlook.

Reliance’s Green Energy Push: Solar Modules and Beyond

Committed to a target of achieving net-zero carbon status by 2035, Reliance green energy segment is gaining traction. It is now being closely watched by analysts as a potential long-term value driver. One of the most notable developments is its commercial entry into the solar PV space:

- Production Kick-off: The 10GW solar PV cell and module factory at Jamnagar has begun production from 2024 onwards. The company plans to scale this to 20GW by 2026.

- Earnings Visibility: As per Nuvama, this solar business could contribute ₹3,800 crore to net profit around 6% of Reliance’s projected consolidated PAT for FY25.

- Building a Full Ecosystem: Reliance isn’t just making solar panels. It’s developing gigafactories for battery storage, hydrogen electrolyzers, and power electronics. A pilot project for sodium-ion cells is expected in 2025, with lithium-ion production lined up for 2026.

- Policy and Market Support: With the Indian government pushing for 500 GW of non-fossil capacity by 2030, and with PLI incentives in place, Reliance is well-positioned to benefit from both rising demand and supportive regulation.

This clean energy push is not just aligned with future sustainability trends, it also presents a scalable, margin-positive opportunity. The solar module production segment, in particular, is now being seen as a key catalyst in shaping Reliance’s growth trajectory over the next few years.

How Jio is Entering the AI Race in India

Apart from its clean energy focus, Jio Platforms, the digital and telecom arm of Reliance Industries’ is taking a major step into artificial intelligence with the launch of the Open Telecom AI Platform. This move marks a prominent milestone in the Jio AI expansion, aimed at transforming telecom networks through AI and tap into a new growth lever for Reliance.

- Systematic Partnership and Launch: At Mobile World Congress 2025, Jio announced a major partnership with AMD, Cisco, and Nokia to launch the Open Telecom AI Platform. The goal is to deliver AI-powered solutions for telecom operators driving smarter, more automated networks.

- AI-Driven Architecture: The platform will integrate agentic AI, Large Language Models (LLMs), domain-specific Small Language Models (SLMs), and traditional non-generative AI techniques. It’s built with an LLM-agnostic architecture and open APIs, ensuring adaptability and easy deployment across various telecom environments.

- Efficiency, Security, and Monetization Focus: By embedding AI throughout network layers, the platform aims to improve operational efficiency, enhance security, and enable intelligent automation. It is also expected to lower the total cost of ownership (TCO) and unlock new revenue streams for service providers.

- Jio as First Customer: Jio will be the first to deploy this platform internally transforming its own network into a self-optimizing, customer-aware ecosystem. Group CEO Mathew Oommen highlighted that this goes beyond standard automation, aiming to build AI-driven, autonomous networks that enhance user experiences and create new service models.

- Ecosystem Collaboration: The platform leverages AMD’s high-performance CPUs and GPUs, Cisco’s analytics and cybersecurity, and Nokia’s broadband infrastructure creating a powerful foundation for AI adoption across the telecom space.

For Reliance Industries, this AI initiative adds another high-potential vertical alongside green energy. It strengthens the company’s digital footprint and supports its long-term investment case by aligning with global trends in AI and automation.,

Q4 FY25 Performance and Increased Target Price

Reliance Industries’s recent efforts into green energy and artificial intelligence is beginning to show up in its financial performance and stock movements, In Q4 FY2025, the company reported consolidated net profit of ₹22,611 crore and revenue from operations of ₹2,61,388 crore, showing strong year-on-year growth.

The company’s consumer businesses and Oil to Chemicals (O2C) division performed well, while digital services and new energy segments also contributed meaningfully, reflecting early momentum in its transformation strategy.

Confidence in this direction is reflected in recent target price revisions. CLSA and Nuvama and has raised its target price for RELI (Reliance Industries Ltd) ranging from ₹1,650 to ₹1,801. A clear sign of potential seen in the solar module business and the AI rollout via Jio. According to their estimates, the solar segment alone could contribute around ₹3,800 crore in net profit, roughly 6% of Reliance’s consolidated PAT for FY25.

Before getting to the weekly stock trends, here’s a quick look of the company’s Q4 FY25 key financials:

| Metric | Q4 FY25 (₹ crore) |

| Revenue from Ops | 2,61,388 |

| Gross Revenue | 2,88,138 |

| EBITDA | 48,737 |

| Profit After Tax | 22,611 |

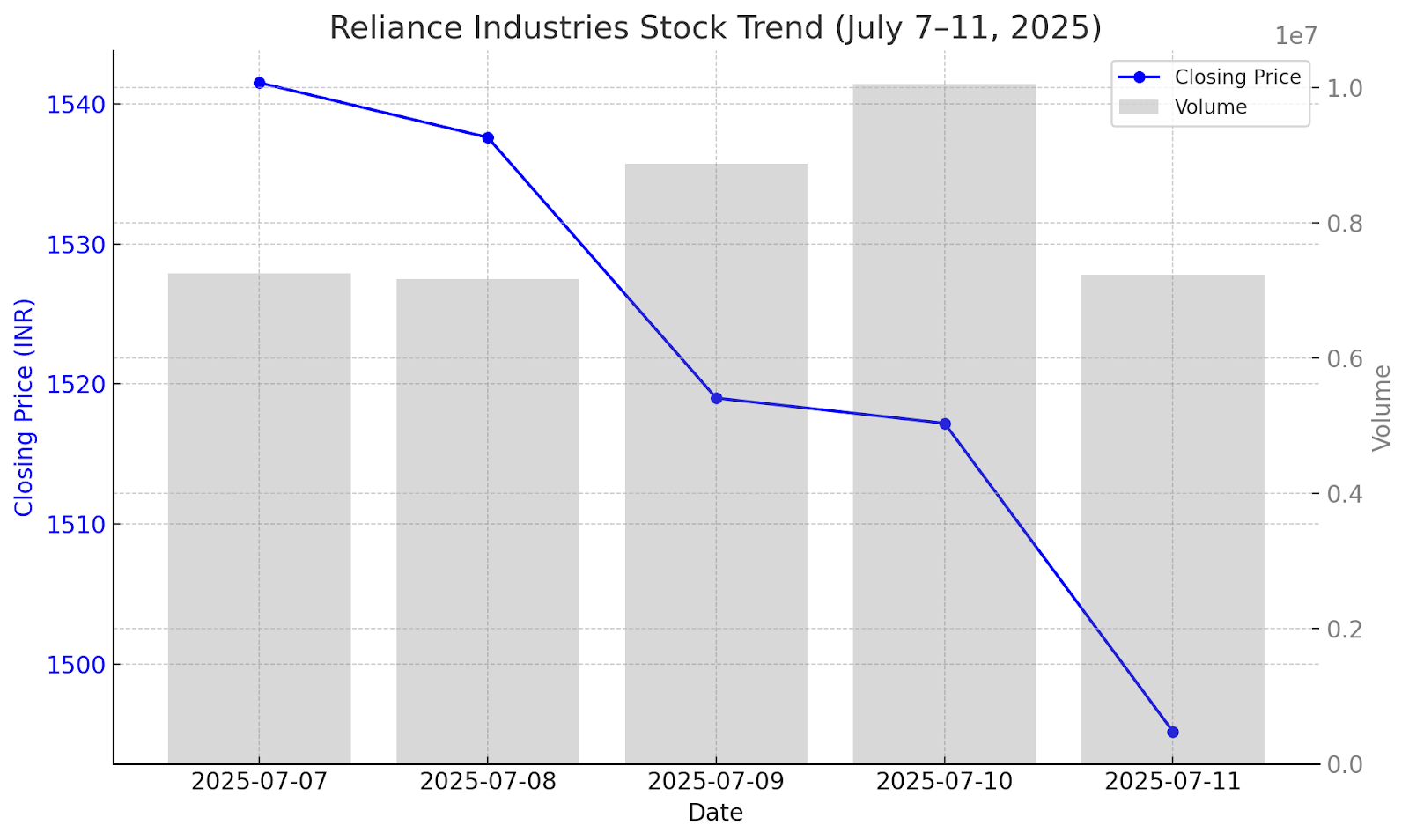

Reliance’s stock saw some short-term pressure following reports of IPO delays for Reliance Jio and Reliance Retail, leading to profit booking and a slight pullback from recent highs.

Over the long-term, Reliance Industries has delivered a 9.4% CAGR return over 3 years and a 10.0% CAGR return over 5 years as of 14 July 2025, showcasing its consistent performance.

| Date | Open | High | Low | Close | Change (%) | Volume |

| 11-Jul-25 | 1,512.00 | 1,515.00 | 1,490.30 | 1,495.20 | -1.45 | 7,234,991 |

| 10-Jul-25 | 1,519.70 | 1,524.70 | 1,507.50 | 1,517.20 | -0.11 | 10,047,129 |

| 09-Jul-25 | 1,536.70 | 1,551.00 | 1,510.10 | 1,519.00 | -1.21 | 8,870,000 |

| 08-Jul-25 | 1,536.00 | 1,544.90 | 1,530.20 | 1,537.60 | -0.25 | 7,170,000 |

| 07-Jul-25 | 1,526.60 | 1,544.80 | 1,525.00 | 1,541.50 | +0.93 | 7,250,000 |

The stock opened strong during the week, supported by earnings optimism and growing interest in its clean energy and AI strategies. However, by July 11, it settled at ₹1,495.20, around 3% below its weekly high.

Conclusion

Reliance Industries is strengthening its foothold in green energy and AI (via Jio), and with Nuvama raising its target post solar module launch, investor interest is clearly growing. With strong Q4 numbers and clear action in solar and AI, the company is adding new layers to its business. These moves make Reliance Industries stock stand worth tracking closely.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025