Table of Contents

File your taxes with confidence! Understand how your income is classified with this guide to the five heads of income.

Uncertain as to where your income fits? Salary? Other sources? House property? Or otherwise?

Knowing the different heads of income is crucial to filing tax returns in India. The Income Tax Act divides income into five heads. Each head has different rules and provisions, and by knowing this information, taxpayers can fulfil compliance and possibly derive tax advantage.

This article will delve into each head of income, computation of total income, and distinguish tax rates between the new and old tax regimes.

Five heads of income

For taxation purposes, you can classify your income into five heads:

- Income under the head salary

- Income from house property

- Profits and gains from business or profession

- Income under the head capital gains

- Income from other sources

Let us delve into each of these categories.

Income under the head salary

Under the salary head, all forms of money received in an employee-employer relationship are included:

- Basic pay,

- Allowances,

- Perquisites,

- Bonuses and commissions.

Employers should deduct tax at source (TDS) from salaries and furnish Form 16 summarising the total salary paid and TDS deducted.

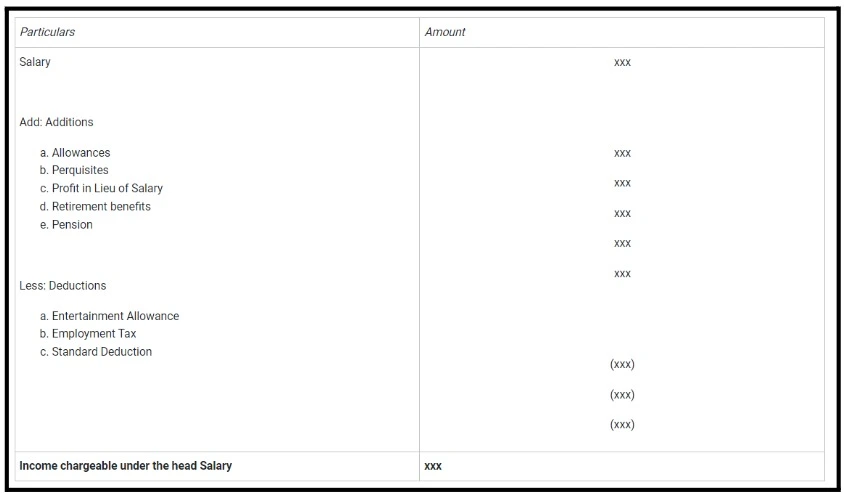

Some components of salary income are:

Basic pay – This is your core income.

Allowances – Think of these as bonuses to cover expenses, like housing (House Rent Allowance) or travel (Leave Travel Allowance).

Perks – These are extra goodies your employer might offer, like a company car or gym membership.

Retirement savings – This helps you build a nest egg for your golden years, like:

- Pension,

- Gratuity or

- Provident fund

Source: Income Tax Department

Deductions for employment tax, standard deduction and other eligible exemptions such as HRA/ LTA are made before calculating taxable salary.

Income from house property

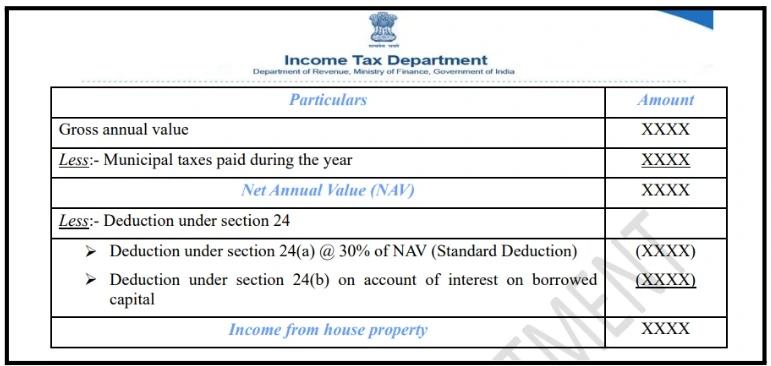

Income from house property refers to rental income earned through the property’s ownership. Even if it is not rented out, the annual value of any property can be estimated as generating notional income at times.

It has three sub-classifications:

- Property that is self-occupied

- Property deemed let out

- Property let out

A self-occupied property has a nil annual value.

Owning multiple homes? Here’s the tax twist:

Only two self-occupied properties get that tax break. The rest are considered “rented out or deemed let out property”, even if you live there.

For actual rentals, you will pay tax on rental income minus any municipal taxes you paid and a flat 30% standard deduction for repairs and maintenance, irrespective of actual expenditure.

Deductions available under this head also include interest on borrowed capital.

Source: Income Tax Department

Profits & gains from business/profession

This head covers income from any business, profession, or trade. It includes all earnings or losses that come from any business or trade which was carried out by the taxpayer during the year.

Taxpayers can write off the costs incurred in generating the income, including the rent, salaries, depreciation, and utilities (known as deductions).

Calculating income under this head can be complex. In addition – doctors, lawyers, and architects, who are professionals, fall under this category, and they are allowed to deduct expenses such as office rent, professional expenses, and other operational costs.

Taxpayers should maintain accurate records and accounts that substantiate their entitled claims and, in the end, guarantee their compliance with the Income Tax Act.

Income under head capital gains

When you sell investments – like property, stocks, or bonds for more than you bought them for, you earn a profit. This profit is called a capital gain.

Capital gains come in two types:

- Short-term and

- Long-term

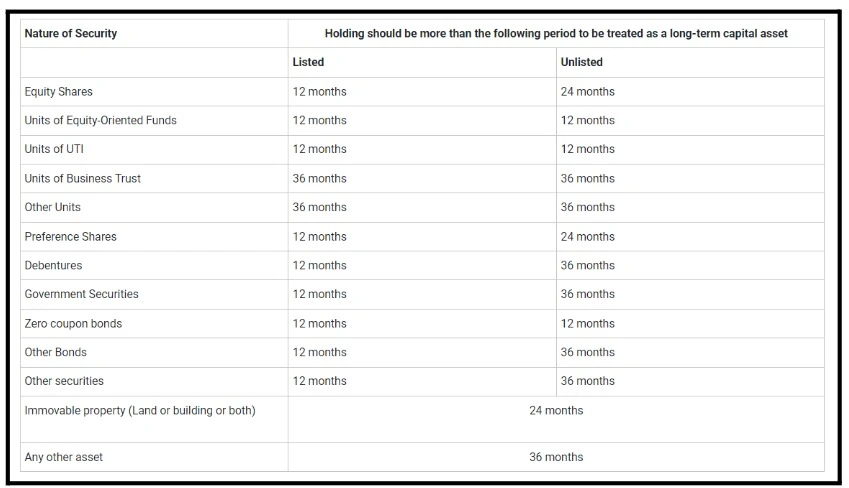

Short-term capital gains (STCG): These are gains from assets you held for a shorter period. For stocks and mutual funds – the holding period is less than one year. For other assets, it is typically less than three years.

Long-term capital gains (LTCG): These are gains from assets you held for a longer period. For stocks and mutual funds, the holding period is more than one year. For other assets, it is typically more than three years.

Source: Income Tax Department

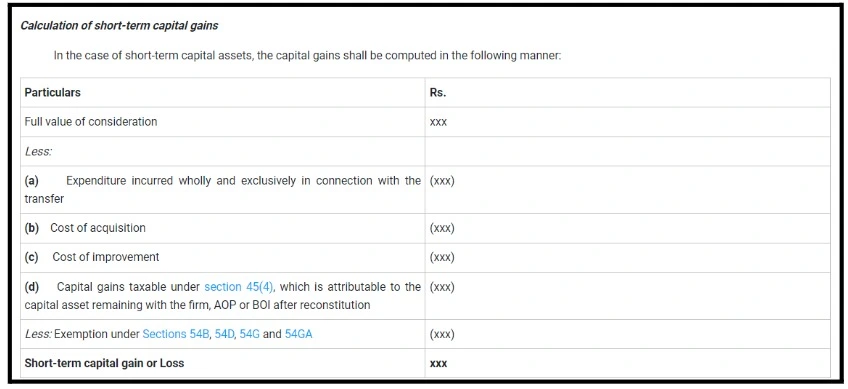

Here’s how short-term capital gains are calculated.

Source: Income Tax Department

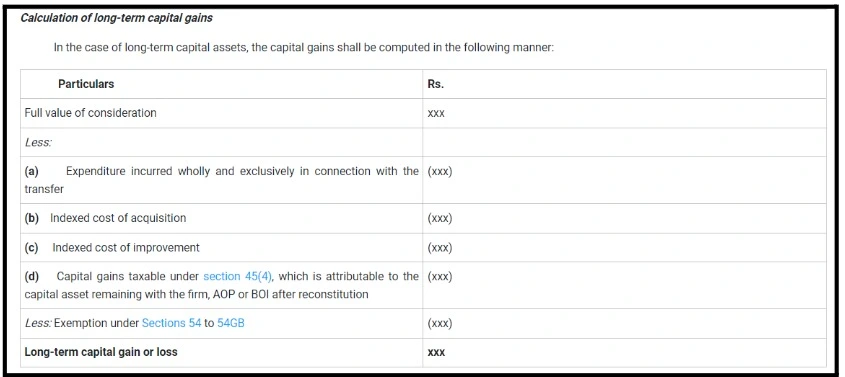

This is how long-term capital gains are calculated:

Source: Income Tax Department

The table shows the tax rate for different capital assets:

| Asset | Holding period | Short-term tax rate | Long-term tax rate |

| Immovable property | 24 months | Slab rates | 20% after indexation |

| Other capital assets | 36 months | Slab rates | 20% after indexation |

| Unlisted equity shares | 24 months | Slab rates | 20% after indexation |

| Listed equity shares or equity-oriented mutual funds | 12 months | 15% | 10% (₹1 lakh is exempt) |

| Debt funds – Purchased after 1st April 2023 | Not Applicable | Slab rates | Slab rates |

Source: Income Tax Department

Deductions under Sections 54, 54EC, 54F, etc., are available to reduce taxable capital gains.

Income from other sources

The incomes which are not covered by the rest of the four categories are charged under this head (residuary head).

Income under this head include:

Interest income – From fixed deposits, savings accounts, bonds, etc.

Dividend income – Dividends received from domestic companies and mutual funds.

Gifts – Money received as gifts above a specified limit from non-relatives.

Lottery winnings – Income from lottery, gambling, and other windfalls. Expenses deductions are allowed in such cases except for gambling wins, which must be paid at the 30% fixed rate without any deductions.

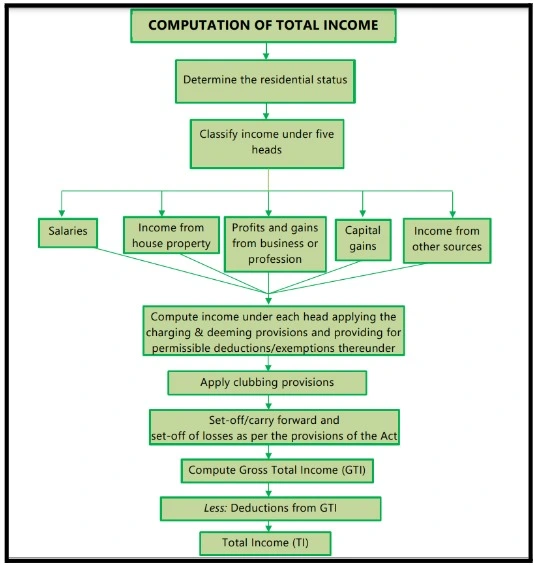

Computation of total income

To determine your total taxable income, you first combine your income from all five categories and then apply the relevant deductions and exemptions.

The process involves:

1. Calculate income under each head: Determine taxable income under each head after applying respective deductions.

2. Aggregate the income: To calculate your Gross Total Income (GTI), simply add up all your income from different sources.

3. Apply deductions: Deduct eligible deductions (Sections 80C to 80U) to derive at the Total Income (TI).

Source: ICAI

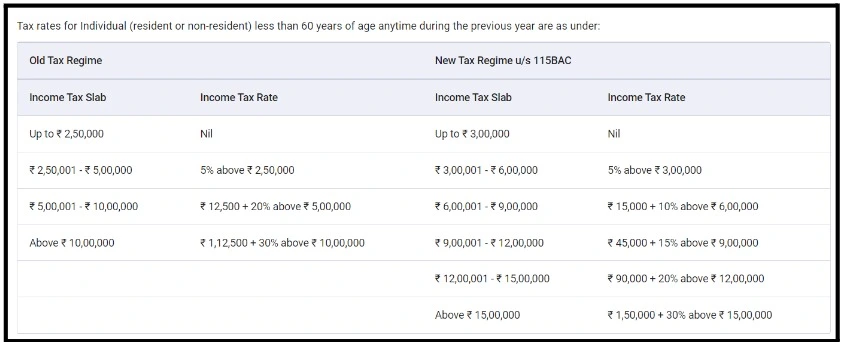

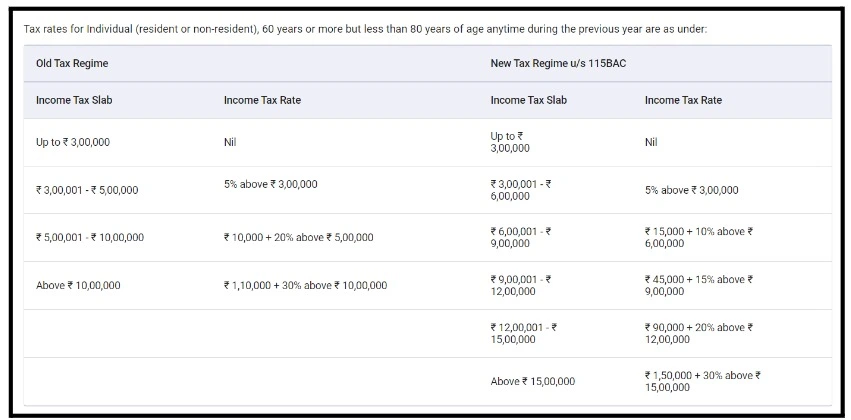

The tax rate under the old and new regimes

India essentially has dual tax regimes:

- One is the old regime, which is the one with deductions and exemptions and

- The second one is the new regime with lower tax rates but no deductions or exemptions.

Taxpayers can pick the regime that works best for them.

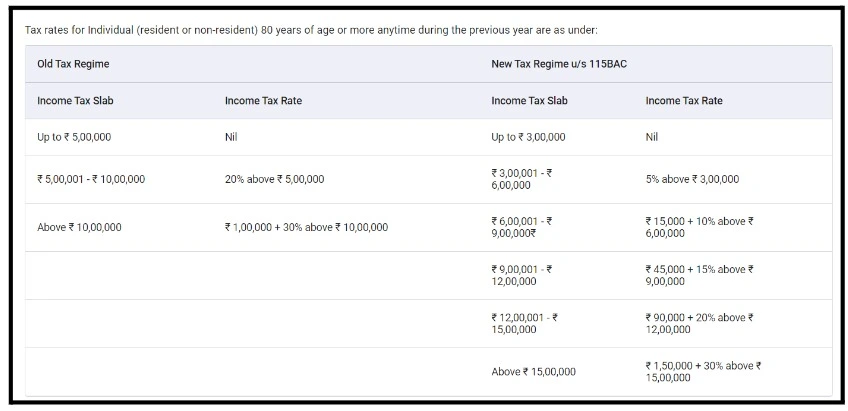

Here are the tax slabs for AY 2024-25 under both the old and new regimes.

Source: Income Tax Department

Conclusion

For proper tax planning and compliance, you must master the five heads of income. Every head has particular and distinguishing rules and deductions that can either make or break the situation with your taxable income.

By understanding these heads and also the computation process, you can gain the ability to effectively manage your financial assets and limit your tax burdens in both the old and new regimes.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024