Table of Contents

Filing your ITR is not just a responsibility; it is an opportunity! Know how filing ITR can benefit you.

Tax return time can be confusing! You might wonder, “Do I even need to file if I don’t make that much?”

Filing your income tax return or ITR is a crucial aspect of being a responsible citizen in India. Every Indian citizen is legally bound to pay taxes and strictly follow the tax laws in the country.

Though it may initially present as a daunting endeavour, knowing the ITR procedure permits individuals to play a part in national development while reaping various personal advantages.

This article seeks to cover what ITR is, its significance, who needs to file it, specified deadlines, and the types of ITRs accessible.

What is an ITR?

Income tax return (ITR)- this refers to a legal form that is supposed to be submitted to the Income Tax Department stating certain incomes. This includes your total income for a 12-month period starting 1 April and ending 31 March.

Source: Income Tax Department

The income could be from sources like:

- Salary

- Profits and gains from business/profession

- House property

- Capital gains

- Other sources

On this form- you will also indicate the total amount of taxes already paid and any deductions and exemptions available to you. Taking advantage of these can greatly reduce how much you are taxed, ensuring you are spending less money or even getting a refund!

In the end, the ITR assists the government in calculating the total tax you are supposed to pay.

Importance of ITR

ITR filing is not just important for legal requirements. There are other benefits:

Claim tax refunds: What if more tax is deducted from your income? ITR filing is a form that enables you to claim your refunds and use the extra money more effectively.

Financial proof: ITR shows that you have a certain amount of income and a good history of filing your taxes. This document will be very helpful when you need to take loans, mortgages, and some insurance products. ITR is the way that financial institutions will allow you to borrow money because it helps in assessing your creditworthiness and the capacity to repay the money.

Carry forward losses: Did you incur business losses/capital losses in a particular year? An ITR can allow you to carry forward those losses and offset them against your income in subsequent years, potentially reducing your tax burden.

Apart from these benefits – you can easily apply for business loans with ITR.

Who has to file it?

In India – you typically need to file an ITR if your total income for the financial year is more than a certain limit – called the basic exemption limit. This limit depends on which tax regime you choose: old or new.

Old tax regime:

The basic exemption limit for AY 2024-25 or FY 2023-24 is:

| Age Group | Income Threshold (₹) |

| Below 60 years | 2.5 lakh |

| Above 60 years but below 80 years | 3.0 lakh |

| Above 80 years | 5.0 lakh |

Source: The Economic Times

New tax regime:

The basic exemption limit for all taxpayers is ₹3 lakhs.

A person is also required to file an income tax return if:

- Bank deposits exceed ₹50 lakhs,

- Professional income exceeds ₹10 lakhs,

- Electricity bill exceeds ₹1 lakh, or

- TDS is deducted from your income, and you want a refund.

Due dates – ITR

You must file your ITR by 31 July. If you are unable to file by 31 July, then before 31 December, you need to file a belated or late return.

| Category of Taxpayer | Due Date for Tax Filing |

| Individual (books of accounts not required to be audited) | 31st July 2024 |

| Businesses (Requiring Audit) | 31st October 2024 |

| Businesses requiring transfer pricing reports (in case of international/specified domestic transactions) | 30th November 2024 |

| Revised return | 31st December 2024 |

| Belated/late return | 31st December 2024 |

Source: Income Tax Department

Remember missing the deadline can result in a penalty.

The penalty is as follows:

| Due Date of ITR Filing | Income below ₹5 lakh | Income above ₹5 lakh |

| Before 31st July | Nil | Nil |

| Between 1st August to 31st December | ₹1,000 | ₹5,000 |

Source: Income Tax Department

Types of ITR

There are 7 ITR forms. The last three forms are for companies. Let us see the 4 ITR forms that are for individuals.

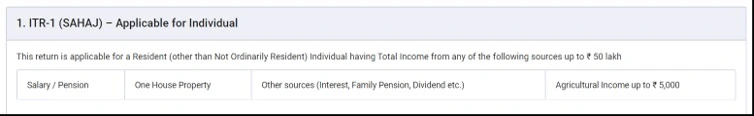

ITR 1 – SAHAJ

This ITR is for resident individuals whose total income is less than ₹50 lakhs and comes from the following sources:

- Salary or pension

- Other sources such as dividends, interest, etc.

- Only one house property

- Agricultural income (up to ₹5000)

Source: Income Tax Department

ITR 2

This ITR can be filed by people whose sources of income are:

- Salary/pension

- House property

- Foreign income

- Capital gains

- Other sources like dividends, interest, etc.

ITR-2 is not for people with profits and gains of business/profession. And you can still use ITR-2 if your total income exceeds ₹50 lakh.

Source: Income Tax Department

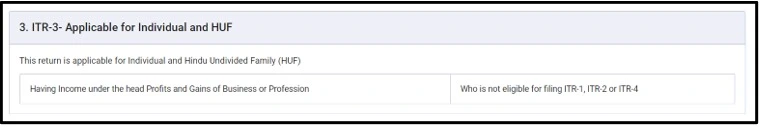

ITR 3

If you are an individual whose sources of income are:

- Business or profession

- Salary/pension

- House property

- Other sources or

- Capital gains – then you can file ITR-3.

For this ITR – you must have income from a business/profession.

Source: Income Tax Department

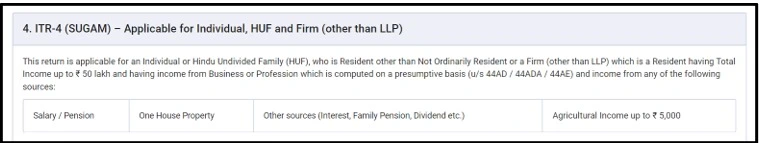

ITR 4 or SUGAM

If your total income includes income from:

- Business/profession,

- Salary or retirement benefits like pension

- One house property and

- Other sources – then you can file ITR 4.

However, to file this form, your total income in a financial year should not exceed ₹50 lakhs. Additionally, if you have income from capital gains, you cannot file this return.

Source: Income Tax Department

Conclusion

Filing your ITR is not only a legal duty; in essence, it is also a valuable habit that helps bring our country even further into the development phase and stimulates numerous personal advantages. Using this guide and planning a little bit in advance, you can tackle the tax season with ease.

Don’t be afraid to be in charge of your money and learn about what a well-informed taxpayer can do to you!

Good luck with your tax filing!

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024