Table of Contents

Struggling to balance risk and reward in your portfolio? Discover an easy starting point for asset allocation that could make investing simpler.

The “100-age rule” is a well-known guideline among financial planners and advisors. This concept has sparked various opinions over the years. Wondering how your age might influence your financial decisions? Curious about the potential benefits & drawbacks of this method? Keep reading to explore the nuances and see if it fits your financial goals.

Basics of the 100-minus-age rule

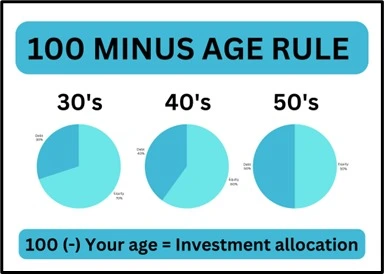

The 100 minus your age guideline is a widely recognised concept in personal finance. The idea is subtracting your age from hundred, you determine the percentage of your portfolio to allocate to growth-oriented assets. The remainder should be directed towards more conservative options like bonds or fixed deposits.

Suppose you’re 30 years old with ₹10 lakhs to allocate. This principle suggests placing 70% (100-30) into growth assets and 30% into conservative ones. As you age, this mix shifts. At 50, it would be a balanced 50-50 split.

This approach is beneficial as it adjusts risk with age. Yet, this is not a universal solution. Take account of your personal risk accepting capacity, end target & market situation.

Importance of age in investing

Age significantly influences your investment choices. And, the age rule provides a simple way to allocate assets based on how old you are.

In your 30’s, priorities might be towards purposes like buying a house & saving for later years. This approach suggests balancing growth with stability, such as @65% in stocks at age 35.

Entering your 40s and 50s decades, financial security is the name of the game. The guideline recommends a gradual shift towards safer assets. At 50, you might have an even split between stocks and bonds.

In your 60s, preserving wealth is key. The 100-age rule advises a higher allocation to low-risk options. For a 65-year-old, this means 35% in stocks and the rest in safer avenues.

Benefits of the 100 minus age rule in investing

Simple and straightforward

- The “100 minus age” approach is easy to grasp. Just subtract your age from 100 to determine the percentage for equities.

- This straightforward method is perfect for beginners, offering a clear starting point without complexity.

Tailored risk management

- Younger population can afford to take on more risk by investing more in stocks, as they have a longer time horizon.

- As you are ageing, this strategy shifts your investments towards safer assets, aligning with the need for stability and regular income.

Foundation for financial guidance

- This guideline serves as a starting point for discussions with financial advisors, providing a basic framework to explore risk tolerance and asset distribution.

- Advisors can then refine their recommendations, making adjustments that suit your specific financial objectives.

Dynamic and adaptable

- The strategy evolves with your life stages, ensuring your investments stay relevant over time.

- Regularly updating your asset mix based on this rule keeps it aligned with your changing financial needs.

Limitations and considerations

Personal risk tolerance

The strategy takes everyone’s risk taking capacity is the same at a given age, which is far from true. Some might embrace high-risk investments due to a solid financial foundation, while others might prefer safer choices because of existing responsibilities or a cautious outlook.

Different financial goals

Financial objectives are diverse. One person in their 30s might be focused on funding a child’s education, while another might aim to build a retirement fund. This guideline doesn’t account for these varied goals, leading to potential misalignments in investment strategies.

Variable market conditions

The guideline assumes stable markets, but conditions are always changing. Economic cycles, geopolitical events, and other factors can greatly impact investments. Strictly following this approach might result in significant losses during downturns or missed opportunities in an upswing.

Income needs in retirement

As retirement nears, generating income from investments becomes crucial. The “100-age” method doesn’t specifically address this need, possibly leaving retirees without sufficient income streams.

Financial obligations

Mortgages, loans, and family duties significantly affect one’s capacity to invest and risk-taking ability. This approach doesn’t consider these commitments, which can heavily influence financial strategies.

Should you consider the 100-age rule?

The “100-age rule” rule offers a quick formula for deciding how much of your portfolio should be in stocks. As noted above, the simplicity comes with drawbacks.

Tailored approach can make a huge difference. Different goals need different approaches. Saving for a house in three years? A conservative strategy works. Planning for retirement in 20 years? You can afford more equities. One-size-fits-all just doesn’t cut it here.

So, keep in mind the 100-age rule is a starting point. Don’t rely on it alone. Dive into personal financial planning for better results.

Conclusion

The investment thumb rule works as a handy guideline for those starting out. Yet, it’s merely a beginning. Recognising its limitations is crucial. Your financial goals, risk appetite, and market dynamics must shape your investment strategy.

Investing needs more depth. Consulting with a financial advisor offers a personalised and dynamic plan tailored to your unique needs. Don’t just stick to formulas; understand your financial landscape for better decision-making.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025