Table of Contents

Step into a lifetime of togetherness with these captivating and cost-effective wedding budget hacks.

Did you know that every year, India witnesses about 10 million weddings, each with its own unique set of wedding budget hacks?

This makes the wedding industry worth a huge $50 billion industry. In our blog, we will explore the nuances of financial planning for such grand occasions and unveil some captivating facts about this extravagant cultural tradition.

Source: Money Trap

Financial planning for a wedding

Let’s explore how to financially plan for a wedding, considering investment options that can help in accumulating the required funds.

We will take the example of a typical wedding in a metro city, where wedding budget hacks can significantly reduce costs for a one-day event ranging from ₹25 lakhs to ₹50 lakhs, covering various expenses.

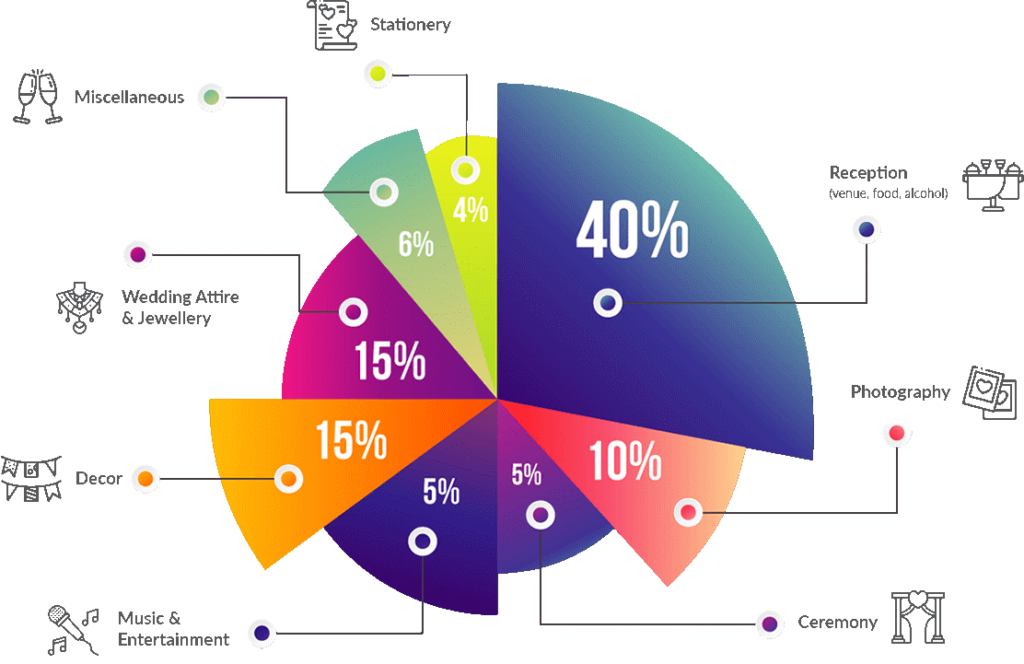

In general, when considering wedding budget hacks, the major chunk of wedding expenses goes towards the reception, accounting for 40% of the budget, reflecting the cost of the venue and food.

Following that, both wedding attire & jewellery and decor command 15% each.

Music and entertainment, photography, ceremony, stationery, and miscellaneous items make up the rest of the expenses, each playing its role in bringing the wedding day to life.

Source: Money Trap

To illustrate, suppose we set a saving goal of ₹20 lakhs for a future wedding. Let’s explore the options of saving and investing to reach the target.

Investment options

Fixed Deposits (FDs):

Fixed Deposits are a safe and straightforward way to save for a wedding. You deposit a lump sum with a bank for a fixed tenure and earn higher interest than a savings account.

This is an ideal choice for those preferring low-risk investments and have a lump sum amount to start with.

Mutual Funds:

Mutual Funds offer potentially higher returns and are managed by professionals. You can opt for the fund that best meets your financial goals and risk appetite.

For example, equity mutual funds are suitable for longer-term goals and can offer higher returns but come with increased market risk. Debt mutual funds, on the other hand, are more stable in the medium term.

Recurring Deposits (RDs):

RDs are ideal for those who prefer saving in small, regular amounts. You deposit a fixed sum every month, which matures at the end of a predetermined period.

This option is excellent for steady, disciplined saving over time.

Sovereign Gold Bonds:

Given the cultural significance of gold in Indian weddings, investing in sovereign gold bonds can be a strategic choice.

Such bonds provide benefits similar to gold without the need for physical possession, reducing risks like theft.

The bonds are also seen as a hedge against inflation and can be a part of a diversified investment portfolio.

Wedding loans:

For those who may not have enough time to save the desired amount, wedding budget hacks suggest that wedding loans are an option.

These loans can cover major wedding expenses and are repayable in instalments.

The rates and terms differ as per the borrower’s credit profile and the lender’s policy.

Planning Approach

Early Planning

Start planning as soon as possible. The sooner the better, because it gives sufficient time for money to grow.

Diverse Portfolio:

Consider a mix of investment options to balance risk and return. Diversifying across FDs, mutual funds, and Gold ETFs can provide both stability and growth.

Regular Savings:

Adopt a disciplined approach to savings, whether through SIPs in mutual funds or RDs.

Risk Assessment:

Understand your risk appetite and choose investment options accordingly.

Higher-risk options like equity funds may offer better returns but require a longer investment horizon and tolerance for market fluctuations.

Goal Setting

Keep your target amount in mind and regularly review your investments to ensure you are on track to meet your wedding budget hacks goals.

Importance of Saving for Wedding

Coping with rising wedding costs

Indian weddings are known for their splendour and multiple events, leading to escalating costs over time. This includes spending on venues, catering, decorations, and attire.

Having savings allows you to be self-reliant. This independence means you can make your own wedding choices without depending heavily on family support or loans, thanks to wedding budget hacks.

Achieving financial independence

Apologies for the oversight. Here’s the revised sentence with the focus keyword included:

Utilizing wedding budget hacks and having savings allows you to be self-reliant. This independence means you can make your own wedding choices without depending heavily on family support or loans.

It empowers you to realise your dream wedding without financial limitations.

Promoting long-term financial health

Saving for your wedding is a part of broader financial planning.

It fosters financial discipline and good saving practices, which help in the long run. This approach encourages goal setting and achieving financial stability for your future.

Steering clear of debt

Without sufficient savings, you may have to borrow money for wedding expenses.

This debt can lead to financial stress due to repayment obligations. Saving in advance helps you avoid this burden and ensures post-wedding financial ease.

Ensuring post-wedding financial stability

A solid wedding budget hacks, savings, and investment plan not only funds your wedding but also sets the stage for financial security afterward.

It allows you to start your married life with a safety net, giving you peace of mind and the ability to concentrate on other life goals.

Saving Money for Getting Married

Send digital invitations

Instead of printing expensive invitation cards, opt for digital invitations. Besides being cost-effective, it is also a convenient way to inform your guests.

You can even arrange a live stream of the wedding for missing guests.

Choose an off-season wedding

To reduce expenses, explore getting married during the off-season.

In India, weddings during winter (November to January) tend to be costly because of high demand. A great alternative is to plan your special day in spring or summer.

These seasons often offer more affordable options due to lower demand, and you can still enjoy a beautiful setting for your celebration.

Consider getting a wedding planner

Hiring a wedding planner might initially seem like an extra expense when you’re aiming to reduce costs. However, their extensive knowledge and vendor connections often result in savings.

They secure competitive rates and help you manage your budget effectively. Everyone may not be aware of the typical costs, potential issues, or when they might be overpaying.

A planner helps in these challenges, preventing costly errors that could otherwise exceed your budget.

Conclusion

In short, smart money moves can make your big wedding dreams come true without the big bills. Start saving early, mix up your investments, and keep an eye on your cash.

Think ahead, make wise choices like online invites and picking a less busy wedding season, and maybe get a planner to help you out.

By adopting these measures, you can ensure a splendid wedding celebration that is both financially responsible and memorable.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- How I Doubled My Portfolio: Investment Story Beyond Stock Recommendations in India - June 24, 2025

- Values-Based Budgeting: What It Is & Why It Works - June 24, 2025

- Gold Investment 2025: Is Gold Still a Safe Haven? - June 16, 2025