Table of Contents

The 2024 Lok Sabha elections may cause market volatility. Here are 5 key investment strategies to navigate the ups and downs.

Everyone is waiting for June 4—the day election results will come out with bated breath. It seems that now investors have lost calm, and fear is back.

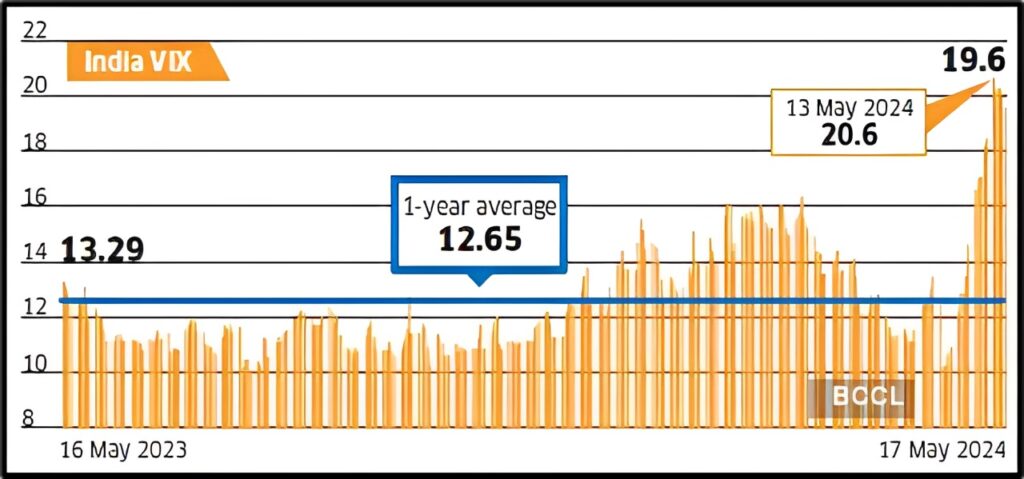

Lately, India VIX, an indicator that tracks volatility in the stock market, jumped from 10.15 on April 23 to 20.53 on May 18. This big spike shows how unsure and scared investors are.

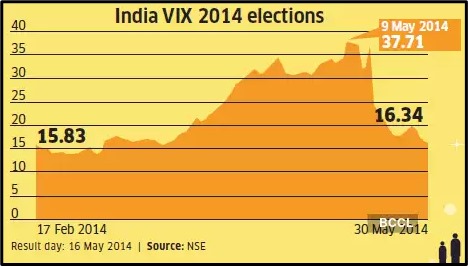

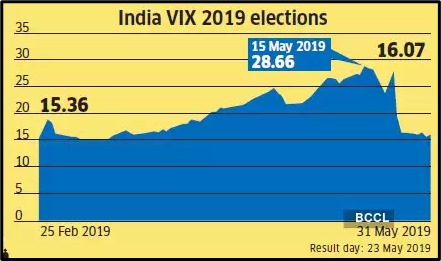

In the past, it has been evidenced that elections affect market behaviour in extremely volatile ways as people tend to be uncertain about how well the political transition will go.

Learning to take advantage of the volatility is particularly important for investors to protect and grow their portfolios during such times.

This article explores the dynamics of election-induced market fluctuations and offers strategies to weather these shocks effectively.

2024 Lok Sabha

2024 is set to be a pivotal year not only for the politics of India but also for the economic scene of India. India, the world’s largest democracy, is set to choose its political leaders once more with a vast electorate of over 900 million.

The election process commenced on April 19 and is scheduled to span 44 days, concluding on June 1. The eagerly awaited results will be declared on June 4.

The election will set the composition of the Lok Sabha and indirectly, shape the country’s economic policies. This major political event that takes place once every five years has a direct impact on most Indians as regards savings and investments.

- Different parties have different economic agendas that change job regulations, taxes, and government expenditures in the future.

- Elections can sway investor confidence positively or negatively, depending on the perceived business-friendliness of the potential governing party.

Due to election-related jitters, India VIX has spiked.

Source: The Economic Times

Historical data suggests that as the election results approach, we may continue to see high levels of volatility

Source: The Economic Times

Source: The Economic Times

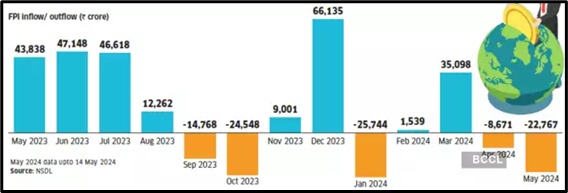

The heightened volatility is also causing foreign portfolio investors to exit Indian markets.

Source: The Economic Times

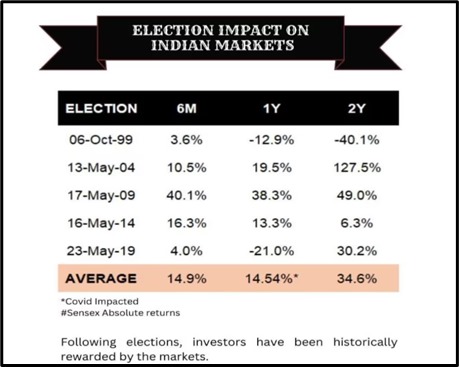

Though volatility is a concern, in the long term, markets tend to give good returns.

Source: Mint

So, what should investors do? Let’s see.

Key investment strategies

Long-term investment approach

Adopting a longer-term investment approach is one of the most effective ways to help you ride out the storms of market volatility. Short-term in nature, elections may cause temporary fluctuations in the market but do not typically change the long-term fundamentals of the economy.

What matters in the long run is how companies perform, economic expansion, and investor confidence. And so retail investors are cautioned against being swayed by short-term volatility rather they should concentrate on creating wealth for a long time ahead.

Adopt a multi-asset investment strategy

Market volatility can be tamed by diversification while keeping the portfolios balanced. Investors should allocate their money to various investments, such as shares, commodities, government securities, real estate, etc. Thus, this will help reduce the consequences of poor performance in any asset class. This multi-asset approach ensures that the overall portfolio remains balanced, even if specific segments of the market experience turbulence.

Sector rotation based on political promises

During election campaigns, it’s common for political parties to pledge initiatives that could influence various sectors, including healthcare, infrastructure, and technology. This presents an opportunity for investors to strategically shift their investments towards sectors likely to prosper under the policies of the victorious party.

Event-driven stock picks

Event-driven investing requires picking out stocks that are likely to be directly affected by specific events, such as elections. This strategy involves careful analysis and selection of companies that may experience significant price movements due to election outcomes. Companies having significant government contracts or those in heavily regulated industries, for instance, could witness their stock prices being shifted by changes in government policy.

Balanced investment approach

Considering the uncertain nature of election results, it’s wise to adopt a balanced investment strategy. One suggested approach is to invest 50% of your available capital at present and hold back the remaining 50% for adjustments after the election results are announced.

Conclusion

The 2024 general election in India is an important event that will shape the behaviour of the market. Although elections can be a source of volatility, there are also great opportunities for smart investors. By being historically responsive and adopting an inclusive investment approach to risk assessment, investors may reduce risks and monetise on market changes connected with political cycles.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024