Table of Contents

The interim budget gave us a teaser, but what comprehensive strategies and reforms can we expect from the Union Budget 2024 to boost various sectors?

As India is getting ready for the upcoming budget, excitement is in the air. This budget will be the first comprehensive one from the newly re-elected government, marking a pivotal moment.

The interim budget presented in February offered an initial outline of the government’s plans. Now, attention turns to the detailed strategies and reforms to be unveiled. Each sector is keenly waiting for initiatives that will foster development & ensure stability in the upcoming year. So what are the budget 2024 expectations? Let’s check.

Before getting into the budget 2024 expectations live, let’s have a recap of the interim budget.

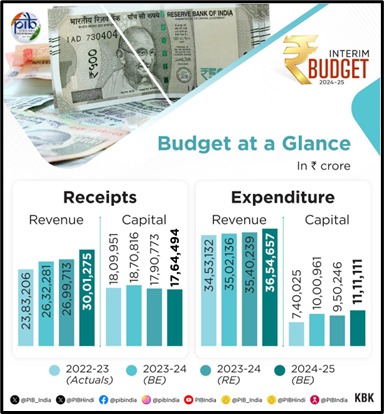

Interim budget highlights

Source: PIB

- Fiscal deficit target revised @5.8% of GDP, down from the previous 5.9%.

- Gross borrowing projected at ₹14.13 lakh crore; net borrowings at ₹11.75 lakh crore.

- Defence budget increased by 4%, now totalling ₹6.2 lakh crore.

- Tax structure remains unchanged.

- Tax incentives extended until March 2025 for investments made by sovereign wealth funds & pension funds, as well as for start-ups.

- Expected revenue receipts for 2024-25 projected at ₹30 lakh crore, up from ₹26.99 lakh crore.

- Capital expenditure boosted by 11%, now @₹11.11 lakh crore, representing 3.4% of GDP.

- 40k rail bogies to be upgraded to Vande Bharat standards for improved safety and comfort.

- Budget priorities:

- Poverty reduction

- Youth empowerment

- Agricultural support

- Women’s advancement

Budget 2024 date and time

Mark 23 July on your calendars! At 11 AM, Finance Minister Nirmala Sitharaman will begin the Union Budget in the Lok Sabha. President Droupadi Murmu has approved the parliamentary session. It will run from 22 July to 12 August. The session will discuss and approve financial strategies for the next year.

Union Budget 2024 expectations

Here’s a closer look at what to expect.

Personal income tax adjustments

Taxpayers eagerly await potential reliefs. Proposals include doubling the standard deduction under the concessional tax regime to ₹1 lakh and increasing the basic exemption limit to ₹3.5 lakh. These changes aim to boost disposable incomes, thus spurring consumer spending.

Reviving rural consumption

Rural India needs a substantial uplift. Enhanced wages through rural employment schemes and additional cash transfers to farmers could significantly drive rural consumption. Such measures are crucial to balancing economic growth with consumer demand.

Agricultural export policies

Current export restrictions on agricultural products like rice, wheat, and onions are being reconsidered. Easing these could enhance farmers’ incomes and stimulate broader economic growth. Agriculture, a vital sector, stands to benefit significantly from such policy changes.

Employment and job creation

Unemployment remains a key concern. Proposals for incentive schemes in labour-intensive sectors such as textiles and tourism aim to generate more jobs. Filling government vacancies and reinstating pension benefits could further stimulate economic activity.

Simplification of tax structures

India’s tax regime is often viewed as complex. Streamlining capital gains tax and GST could attract more investments and simplify business operations. Such changes are necessary to increase India’s attractiveness as a commercial destination.

| Tax rates for people under 60 years of age | |||

| Old tax regime | New tax regime | ||

| Income tax slab (₹) | Income tax rate | Income tax slab (₹) | Income tax rate |

| Up to 2,50,000 | Nil | Up to 3,00,000 | Nil |

| 2,50,001 – 5,00,000 | 5% above 2,50,000 | 3,00,001 – 6,00,000 | 5% above 3,00,000 |

| 5,00,001 – 10,00,000 | 12,500 + 20% above 5,00,000 | 6,00,001 – 9,00,000 | 15,000 + 10% above 6,00,000 |

| Above 10,00,000 | 1,12,500 + 30% above 10,00,000 | 9,00,001 – 12,00,000 | 45,000 + 15% above 9,00,000 |

| 12,00,001 – 15,00,000 | 90,000 + 20% above 12,00,000 | ||

| Above 15,00,000 | 1,50,000 + 30% above 15,00,000 | ||

Source: Income Tax Department

Benefits for senior citizens

Ageing people are quite concerned about the rising costs of healthcare. Increasing the deduction limits for medical expenses and mediclaim premiums would offer significant relief. This adjustment is both necessary and timely.

Balancing fiscal consolidation with welfare spending

Despite high public debt, the budget must strike a balance between fiscal consolidation and necessary welfare spending. The focus might be on infrastructure development, job creation, and stabilising the food supply chain. Managing this balance is crucial for sustainable economic growth.

Sectoral expectations

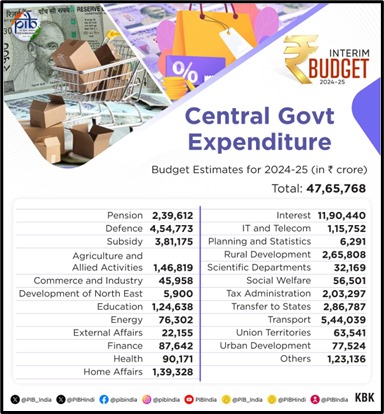

Source: PIB

Manufacturing sector

Manufacturers are looking forward to incentives that boost labour-intensive industries. The goal is to make India a global leader in manufacturing toys, textiles, apparel, and even commercial aircraft. Such measures could not only create jobs but also enhance India’s position in international markets.

Urban and rural housing

Urban areas are hoping for a focus on slum redevelopment to improve living conditions. Lowering regulatory costs, like registration fees, can make housing more affordable. Future reforms might include automatic approvals and ensuring access to clean drinking water.

Service sector expansion

The service sector expects an increase in Global Capability Centres (GCCs), Global Technology Centres (GTCs), and Global Engineering Centres (GECs). These expansions could create numerous jobs and drive economic growth. Tourism is also likely to receive attention due to its potential for generating employment.

Modernising agriculture

Better infrastructure, such as effective irrigation systems and refrigerated storage, is what farmers are searching for. Incentives are required to increase domestic production of necessities such as fruits, vegetables, legumes, and edible oil. Expanding dairy cooperatives and fisheries, reducing machinery costs, and improving seed availability are also key expectations.

Infrastructure development

Infrastructure is expected to be a major focus, especially in expanding the rail network in East and North-East India. Adding over 5,000 kilometres of new rail tracks annually could significantly enhance connectivity and regional economic growth.

Insurance sector strengthening

The insurance sector hopes for policies that provide coverage for unorganised workers. This covers possible plans for drivers of trucks, taxis, and three-wheelers. Such initiatives could offer essential financial security to those without formal insurance.

Real estate sector demands

The real estate industry seeks an increase in the interest deduction limit on housing loans from ₹2 lakh to ₹5 lakh. Another important demand is to shorten the holding period for long-term capital gains tax. These changes could invigorate the housing market and attract more investment.

Conclusion

Budget 2024 expectations are set to bring significant transformations across multiple sectors. By addressing diverse demands, from tax reforms to infrastructure projects, it seeks to harmonise growth with fiscal stability. Each policy announcement will play a crucial role in shaping the nation’s financial future, marking a pivotal moment for India.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Best 5 Indian Stocks & Trending Picks to Watch Now - August 19, 2025

- Need a tax plan for ₹15 lakhs salary? - August 2, 2024

- Budget 2024 Expectations: India’s Wishlist - July 15, 2024