Table of Contents

2024 budget insights: Beyond the numbers, what will it change for you and the nation?

The interim 2024 budget for the fiscal year 2024–25 was presented to the Lok Sabha on February 1 by Finance Minister Nirmala Sitharaman.

This 2024 budget serves as a preliminary financial framework for the country as the current government’s term is about to end, and the upcoming general elections are approaching.

It sets the stage for India’s financial direction until the comprehensive indias budget is detailed by the incoming government after the elections.

The goal of India’s 2024 budget is to support the country’s advanced and thriving economy. It focuses on establishing a strong foundation for comprehensive development, with an emphasis on modern infrastructure and sustainable growth.

This blog aims to simplify the key highlights and analyse the five sectors that are expected to have a significant impact.

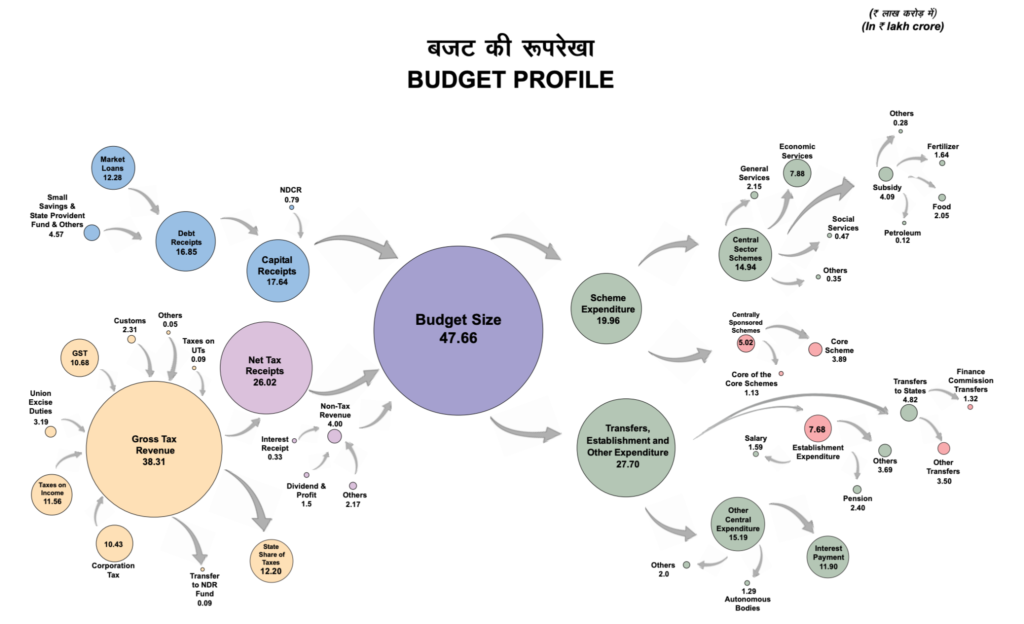

Big numbers from 2024 budget

Expenditure

The government plans a total expenditure of ₹47,65,768 crore, with a significant portion, ₹11,11,111 crore, allocated to capital expenditure, accounting for 3.4% of the GDP to boost infrastructure development and economic expansion. Additionally, the government has allocated ₹1.3 lakh crore towards fifty-year interest-free loans to states, enhancing their capital expenditure capabilities.

Source: India Budget

Deficit

With the aim of fiscal consolidation, the 2024 budget sets the fiscal deficit at 5.1% of GDP for FY25, with a strategic plan to reduce it to below 4.5% by FY26, reflecting the government’s intent to maintain fiscal discipline while supporting growth.

GDP

Nominal GDP growth is assumed at 10.5% for FY25, reflecting optimism about the economy’s potential for expansion.

Disinvestment

The 2024 budget sets a disinvestment target of ₹50,000 crore for FY25, adjusting the approach towards public sector enterprises to enhance efficiency and generate revenue.

Receipts

For the fiscal year 2024-25, estimated receipts, excluding borrowings, are projected to reach ₹30,80,274 crore, marking a 12% increase from the revised estimates of the previous year. This uptick is largely driven by tax revenue, which is also anticipated to rise by 12% compared to the revised figures for 2023-24.

Borrowing

The government plans to undertake gross and net market borrowings through dated securities of ₹14.13 lakh crore for the fiscal year beginning April 1, a decrease from ₹15.43 lakh crore in the current fiscal year. The net borrowings for the upcoming financial year are set at ₹11.75 lakh crore.

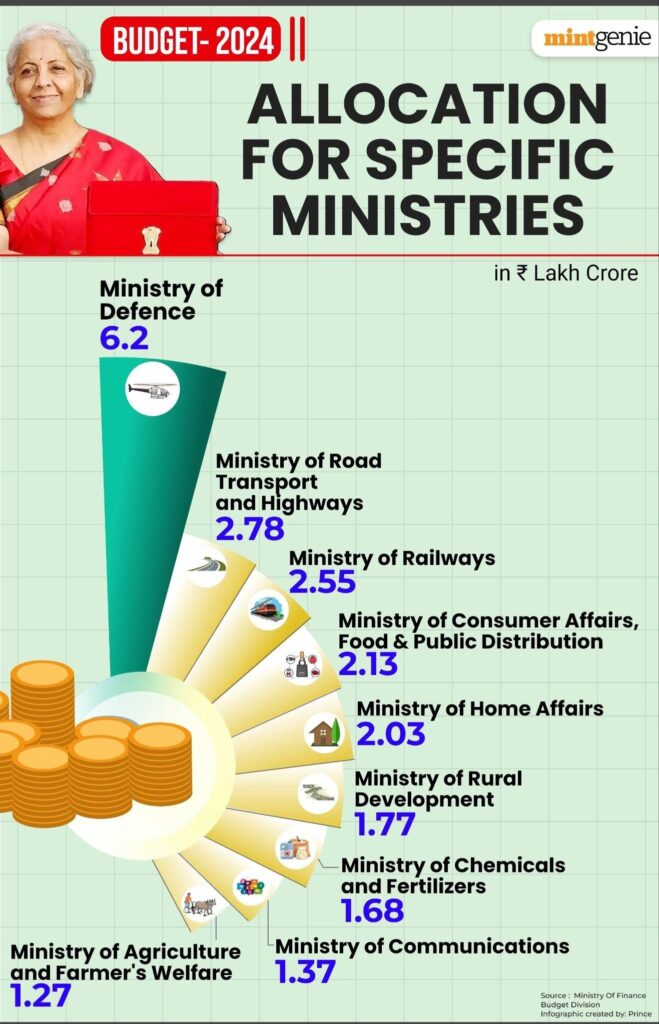

Ministry allocation

The indias budget significantly boosts funding for key ministries; top allocations include defence, road transport, and railways.

Source: Mint

Major announcements

- 2024 Budget will focus on four key areas for uplifting key societal sectors: the poor, women, youth, and farmers, known as ‘Garib’, ‘Mahilayen’, ‘Yuva’, and ‘Annadata’, respectively.

- No adjustments are made to the rates of direct and indirect taxes to maintain the stability of the fiscal system.

- The government has proposed to waive off pending income tax demands of up to ₹25,000 for requests made before the financial year 2010 and up to ₹10,000 for requests made between the financial years 2011 to 2015. Almost one crore taxpayers are anticipated to gain from the proposed measure.

- Setting direct tax collection targets at ₹21.99-lakh crore and indirect tax at ₹16.22-lakh crore.

- Tax breaks for start-ups and investments made by pension funds or sovereign wealth funds will be extended until March 31, 2025.

- Announcement of a white paper on the economy’s mismanagement before 2014.

- Special attention will be given to the eastern region of India, intending to make it a significant driver of the country’s growth.

- Establishment of a powerful commission to handle issues about population increase and demographic shifts.

- Launch of 2 crore additional homes under the PM Awas Yojana and initiatives for housing for middle-class sections.

- Encouragement of rooftop solar power generation to enable homes to produce 300 units or more of free electricity.

- An increase of 2 crores to 3 crore women is the new target for the Lakhpati Didi Scheme.

- Implementation of three major railway corridors to improve logistics efficiency and urban transformation initiatives including Metro and Namo Bharat.

- The government will establish a ₹1 lakh crore fund to offer 50-year interest-free loans aimed at motivating the private sector to enhance research and development in emerging sectors.

- Following the effective use of Nano urea, the adoption of Nano DAP(Diammonium phosphate) will be accelerated, aiming to reduce fertiliser imports and subsidies significantly.

- A new extensive program will be introduced to support the growth and development of the dairy sector.

Five key sectors impacted

Housing and construction

The 2024 budget has introduced a new scheme for middle-class housing to assist those who live in rented houses, slums, chawls, and unauthorised colonies. The scheme aims to facilitate homeownership, stimulate growth across the housing sector, and positively impact companies in the construction and home finance industries.

Railways

Significant investments in railway infrastructure through the introduction of new corridors and the upgrade of 40,000 bogies to Vande Bharat standards are set to benefit manufacturing companies involved in railway production, enhancing efficiency and connectivity.

Energy

The announcement of the rooftop solar scheme for one crore households highlights the shift towards renewable energy, expected to benefit companies in the power and renewable energy sectors by promoting sustainable energy solutions.

Tourism

The focus on developing tourism destinations and providing states with interest-free loans for tourism promotion is anticipated to revitalise the travel, tourism, and hospitality sectors, offering new opportunities for growth and development.

Microfinance

The expansion of the Lakhpati Didi Scheme aims to empower rural women, boosting the rural economy and increasing demand for microfinance services, positively impacting microfinance institutions.

Conclusion

The interim 2024 budget , presented by Finance Minister Nirmala Sitharaman, sets the stage for India’s economic growth and social welfare as we approach the elections.

It establishes a fiscal framework aimed at continuity and stability, reflecting the government’s commitment to development and prosperity, ensuring a smooth transition to the next term.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.