Table of Contents

Budget 2025 is on the horizon and it is the right time to learn the price action of Nifty 50 index leading up to the budget.

With the Budget 2025 set to be unveiled shortly, all market players—whether individual traders or institutional entities—are eagerly trying to predict its contents and the potential effects on stock market trends.

Some experts are optimistic, anticipating substantial investments in infrastructure and possible tax relief. While others hold a more cautious stance, expressing concerns about the budget’s overall impact.The final verdict of whether the budget is accepted as good or bad by the market participants will be given by the price behavior of the stock markets. Let us look at how the price action of the Nifty 50 index has turned out right before the budget and where the price action is headed.

Nifty 50: Returns & Risk

As of January 28, 2024, the Nifty 50 has given the following returns:

| Time Horizon | % Returns |

| 1 week | -0.55% |

| Year-to-Date (since Jan 1, 2025) | -3.31% |

| 1 month | -2.91% |

| 6 months | -7.56% |

This shows that Nifty 50 has been struggling for some time now. As of January 28, 2025, Nifty 50 has lost 12.5% from its all-time high of 26,277 (made on September 27, 2024). Along with the anticipation of the budget 2025, there are many reasons behind this poor performance. Some of these reasons include:

- Foreign Institutional Investor (FII) selling – FII has been selling Indian equities since October 2024. They have sold stocks worth more than Rs. 2,50,000 crores since October 2024. But Domestic Institutional Investors (DIIs) are net buyers and have purchased equities worth Rs. 94,000 crores in the same period.

- Overvaluation – The stock markets have been rallying since 2020, which has raised concerns among investors that markets might be a bit overstretched. Market participants also believe that stocks that belong to some sectors might be overvalued.

- Sticky inflation – India’s inflation print is again becoming concerning as it was measured at 5.22% in December 2024. Market participants believe that RBI will delay rate cuts until the inflation is controlled. Higher interest rates are unfavourable for the stock market.

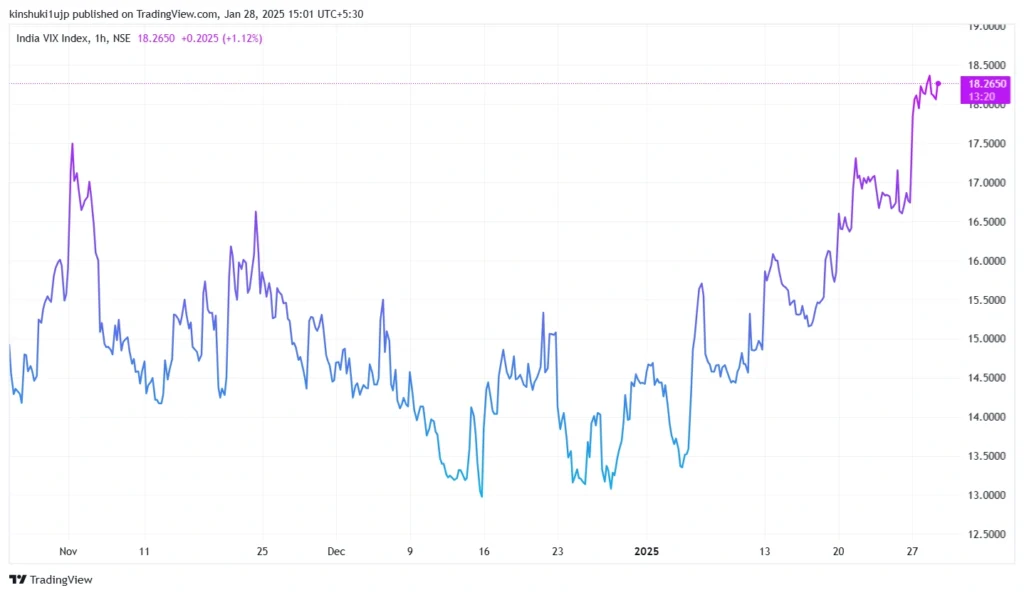

Due to these reasons, markets have become quite volatile. This can be witnessed by the Volatility Index (VIX), making a 3-month high of 18.2650 on January 28, 2025.

A rising VIX indicates market participants are more concerned about the future market direction and thus investing heavily in Nifty 50 put options to hedge against any possible downfall.

Source: Tradingview

Technical Analysis of Nifty 50

Source: Tradingview (Nifty 50, Weekly, with 100EMA, as on 28 Jan 2025)

The bigger picture for the Nifty 50 index shows it has been in a strong uptrend for the past few years. Let us now zoom in to see a clear picture of what is happening.

Source: Tradingview (Nifty 50, Daily, with 50 and 200 EMA, as on 28 Jan 2025)

On the daily chart of the Nifty 50, which shows the price data for the past year, it can be seen that the Nifty 50 has slipped below its 200-day exponential moving average (blue line), suggesting bearishness.

The 50-day exponential moving average (red line) is closing in on the 200EMA (blue line). Although they have not crossed yet, when the 50-day EMA passes below the 200-day EMA, it suggests the formation of the infamous Death crossover. Historically, death crossovers on daily charts have been followed by falling prices.

The Nifty 50 is also closing on its immediate support range of 22,500 – 22,700. Any meaningful buying and positive price reversals in this range can suggest the reversal of the down-trend.

Source: Tradingview (Nifty 50, Hourly, with 200 EMA, as on 28 Jan 2025)

If we zoom in a bit further and look at hourly, we can see that for the past month, the Nifty 50 has been in a clear downtrend. Nifty closed at 22,976 on January 28, 2025.

How to Gauge Future Price Action of Nifty 50?

Looking at the price action patterns of Nifty 50, we can conclude that the index is in a downward trend on shorter time frame charts. If the Nifty 50 index shows any significant reversal from its nearest support zone of 22,500 – 22,700 on daily charts, it can signify a reversal of trend. But investors should wait until there is a clear breakout above the 200 EMA on daily charts, as well as a clear formation of higher highs and higher lows on the hourly chart. Any such formation would indicate a possible end of the downtrend, and it would mean the markets have accepted the budget optimistically. Such a formation will be most likely followed by a rally, the extent of which will be decided by the outcome of the budget.

Source: Tradingview (Nifty 50, Daily, with 200 EMA, as on 28 Jan 2025)

If the Nifty 50 index breaks below its immediate support level of 22,500, it will head towards its next support in the range of 21,800 – 22,000, as suggested by price action. This will indicate a continuation of downtrend and this would also indicate that market participants are not happy with the budget.

Conclusion

The provisions of the budget will become the deciding factor for further price action patterns for Nifty 50 index. This analysis shows the outcomes with high probability in reality, markets might not act the same. Any trading decision has to be made after due diligence and with proper risk management. Remember that the markets can fluctuate a lot before and after the budget. This analysis is for educational purposes only and it is not investment advice.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Weekly Nifty 50 Trading Strategies and Technical Outlook - June 11, 2025

- Nifty 50 Trading Strategies and Technical Analysis - May 26, 2025

- Weekly Nifty 50 Technical Analysis: Key Trading Strategies - April 30, 2025