Table of Contents

The financial health of any nation is vital in today’s complex economic system. Similarly to companies that depend on balance sheets to evaluate their financial stability, governments employ balance sheets to summarise their economic situations and direct policy moving forward. However, what composes a government’s balance sheet, and why does it matter?

Consider a financial statement that lets you know the state of a nation’s economy, from its investment in infrastructure down to the burden of public debt. It can affect your tax payments or the quality of public services you may receive, if any. This article will explore the intricacies of the government’s balance sheet by discussing its contents and the importance of balancing the payments.

What is a government balance sheet?

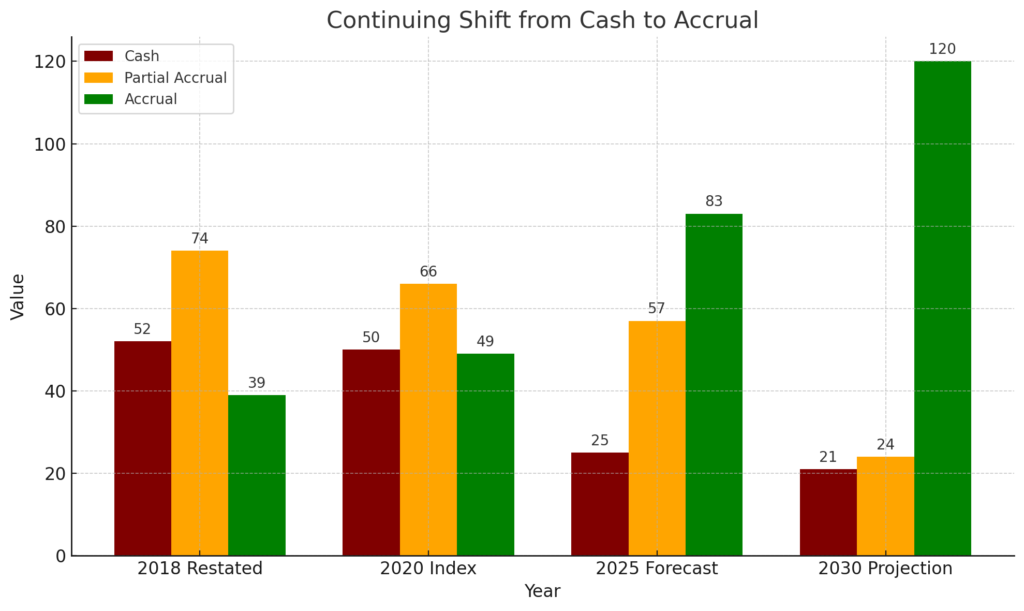

Government balance sheets enable governments and citizens to understand the fiscal effects of government policies in the short-run and long-run. They also help to show how choices made today will influence fairness between generations. However important they are, government balance sheets are nonexistent in most developing nations. According to a survey done in 2021, only 30% of the world’s 165 jurisdictions report on an accrual basis. By 2025, 50% of the world’s jurisdictions will report on an accrual basis, as indicated by the trend.

Governments, as well as development partners, usually depend on estimates of assets and liabilities when there is no balance sheet. Additionally, even where there are countries that produce balance sheets for their governments, this information is not being used to make financial decisions, and it is still limited thus far. The debate over shifting from cash-based to accrual accounting has been going on for the past two decades but remains inconclusive at best.

Components of a government balance sheet

Assets

The tangible assets owned by the government include infrastructure, land and buildings while other financial assets range from investments to foreign exchange reserves. These assets are vital in providing public goods and services as well as maintaining stable economic growth.

Liabilities

Government liabilities principally involve national debts both internal and external together with other responsibilities such as pensions or accounts payable. The effective control of such obligations is important in keeping fiscal soundness while borrowing too much should be avoided.

Net worth

Total assets minus total liabilities equal net worth. A positive net worth reveals a surplus, whereas a negative net worth denotes a deficiency. By monitoring net worth, it is possible to examine the long-run sustainability of government finances.

Balance of payments (BOP)

Balance of payments (BOP) is an exhaustive financial statement that records all economic transactions between the nations and the rest of the world for a given period. It’s made up of three key sections; they are:

- Current account – What is the current account of India? The current account of India records the flow of goods and services between the countries. It consists of visible (goods) and invisible (services) trade and unilateral transfers such as gifts or donations made to foreign residents.

- Capital account – What is a capital account? The capital account of India is closely related to asset purchases, taxes, and foreign exchange reserves, which are also monitored by fiscal authorities to manage current account deficits and surpluses alongside current accounts.

- Financial account – What is a financial account? The financial account in BOP keeps records of investments between countries, such as real estate, business ventures and foreign direct investments. It shows who owns what in terms of domestic assets versus foreigners owning local assets.

You can calculate the BOP by adding the current account, the capital account and the financial account in the BOP together with the balancing item. The result obtained will be zero.

The financial health of any nation relies on each of these accounts.

BoP contributes to financial health by providing insights into the economic interplays between this country and others in other parts of the globe. Here is how it relates to financial health:

- Economic stability: A balanced BoP signifies a stable economy, but an ongoing deficit may be indicative of economic challenges that could ultimately lead to currency devaluation, inflationary pressures as well as confidence erosion among investors.

- Foreign exchange reserves: Reserve assets under the financial account serve to stabilise currencies, control inflation rates and maintain confidence within the domestic market system. A strong reserve position can protect against international shocks to an economy.

- Investment flows: The capital and financial accounts show where investments are coming in or leaving a country –an indication of investor confidence and economic prospects. This can increase investment with surplus positions on these accounts, implying sound financial principles.

On 24 June, the Reserve Bank of India announced that India had recorded a current account surplus of $5.7 billion or 0.6% of gross domestic product (GDP) in the March quarter.

The previous year’s corresponding period was represented by the current account deficit which accounted for $1.3 billion or 0.2% of GDP while it was $8.7 billion or 1% of GDP in the last quarter ending December 2023.

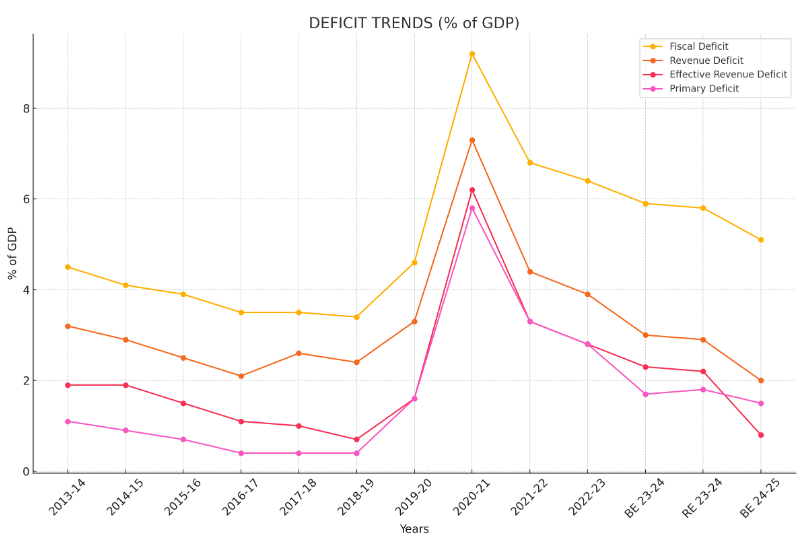

Source: Budget at a Glance 2024-2025

Trend analysis

Currently, the government of India does not produce a comprehensive balance sheet like that of public companies or some other governments. Instead, it mainly uses cash-based accounting that records transactions when there is an exchange of money as opposed to when economic value is generated or obligations are incurred. This can be observed in its budget documents that have receipts and payment accounts but lack a complete balance sheet reflecting assets and liabilities on an accrual basis.

However, in terms of transparency and presenting a true picture of the financial standing of the government, efforts were made through debates and consultations towards movement into an accrual-based accounting system For example, the Comptroller and Auditor General (CAG) of India has given various committees’ reports which suggests shift to accrual accounting for improving fiscal control as well as accountability.

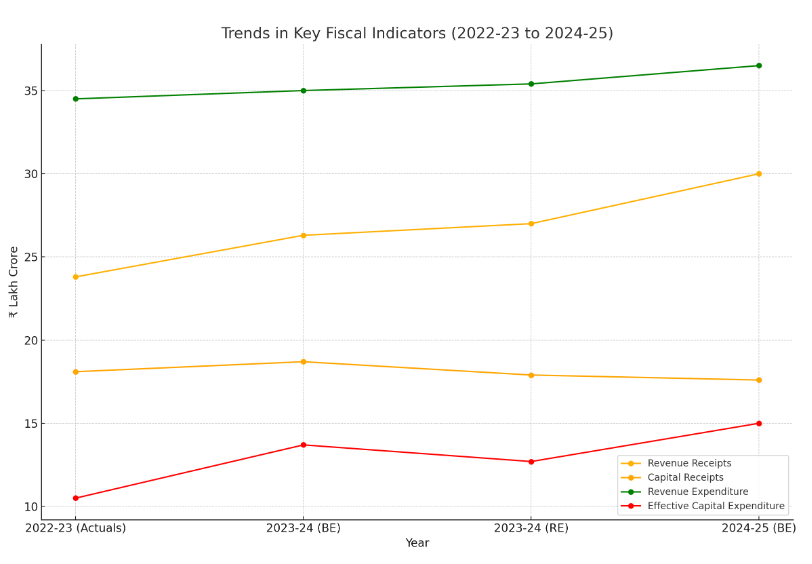

This is the Receipts and Expenditures of the Indian budget for the past few years:

Source: Key Features of Budget 2024-2025

Significance of a healthy government balance sheet

The significance of a healthy government balance sheet is the stability of the economy, trust from investors and the provision of public services. Here’s why it matters:

Impact on economic stability and growth

A solid balance sheet allows for a steady response to economic shocks, ensuring stable growth and financial activities. Efficient debt management reduces borrowing costs, creating more resources for investments that fuel economic growth.

Additionally, an effective balance sheet enhances confidence among business people and consumers in the government’s economic management, leading to increased investment and consumption.

Importance for investors and international stakeholders

Effective oversight of the balance sheet ensures steady economic expansion and the ability to respond to sudden changes in economic conditions. Good debt management lowers borrowing costs, freeing up funds for productive investments that stimulate growth.

Additionally, an efficient balance sheet boosts economic confidence among entrepreneurs and consumers, increasing their trust in the government’s financial control and encouraging higher levels of investment and purchasing.

Influence on public services and infrastructure development

Adequate resources for health services, education, and social programs enhance citizens’ quality of life and promote social stability. Investment in infrastructure boosts productivity, reduces costs, and attracts private investments, driving economic growth.

Additionally, a strong balance sheet supports strategic, long-term development plans and ambitious projects that require sustained funding, ensuring continued progress and stability.

Challenges in managing the government balance sheet

Government balance sheet management has its challenges. Let’s explore some of these:

- Complexity and scale: Government balance sheets cover many diverse assets, liabilities, and programs, making them vast and intricate. It can be overwhelming to keep track of these components in different agencies and departments.

- Data accuracy and timeliness: It is essential to ensure accurate data entry while updating it in time. Financial assessments and policy decisions can be distorted by inconsistencies.

- Contingent liabilities: Governments often provide guarantees or backstop certain entities (e.g., banks, public corporations). This poses a challenge when assessing or dealing with such contingent liabilities.

- Political pressures: Asset management may be influenced by political considerations as well as liability assumptions. Striking a balance between fiscal responsibility and political imperatives is difficult.

- Dynamic economic environment: Changes in economic conditions directly affect the values of assets and liabilities. Agility is therefore required for acceptance of such changes.

Conclusion

A well-managed government balance sheet is indispensable for fostering sustainable economic growth, ensuring social stability, and maintaining the trust of investors and citizens alike. As nations strive towards greater fiscal transparency and accountability, the importance of a comprehensive and accurate government balance sheet cannot be overstated.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025